- United States

- /

- Banks

- /

- NasdaqGS:UBSI

Should Investors Reconsider United Bankshares After Recent Drop in Share Price?

Reviewed by Bailey Pemberton

If you’re watching United Bankshares and trying to figure out your next move, you’re not alone. The stock recently closed at $35.53, and while it’s dipped about 4.5% over the past week and a bit more in the last month, the longer-term story is a bit more stable. Over the last year, United Bankshares is down only 0.5%, and if you zoom out even further, the stock is actually up an impressive 79.6% over five years. These numbers point to both short-term headwinds and underlying long-term resilience, which might tempt value-minded investors to take a closer look.

Some of that recent weakness could be related to ongoing shifts in the regional banking sector and fluctuating investor sentiment toward financial stocks in the current interest rate environment. Nothing dramatic has surfaced, but the mood has arguably turned slightly more cautious in recent weeks.

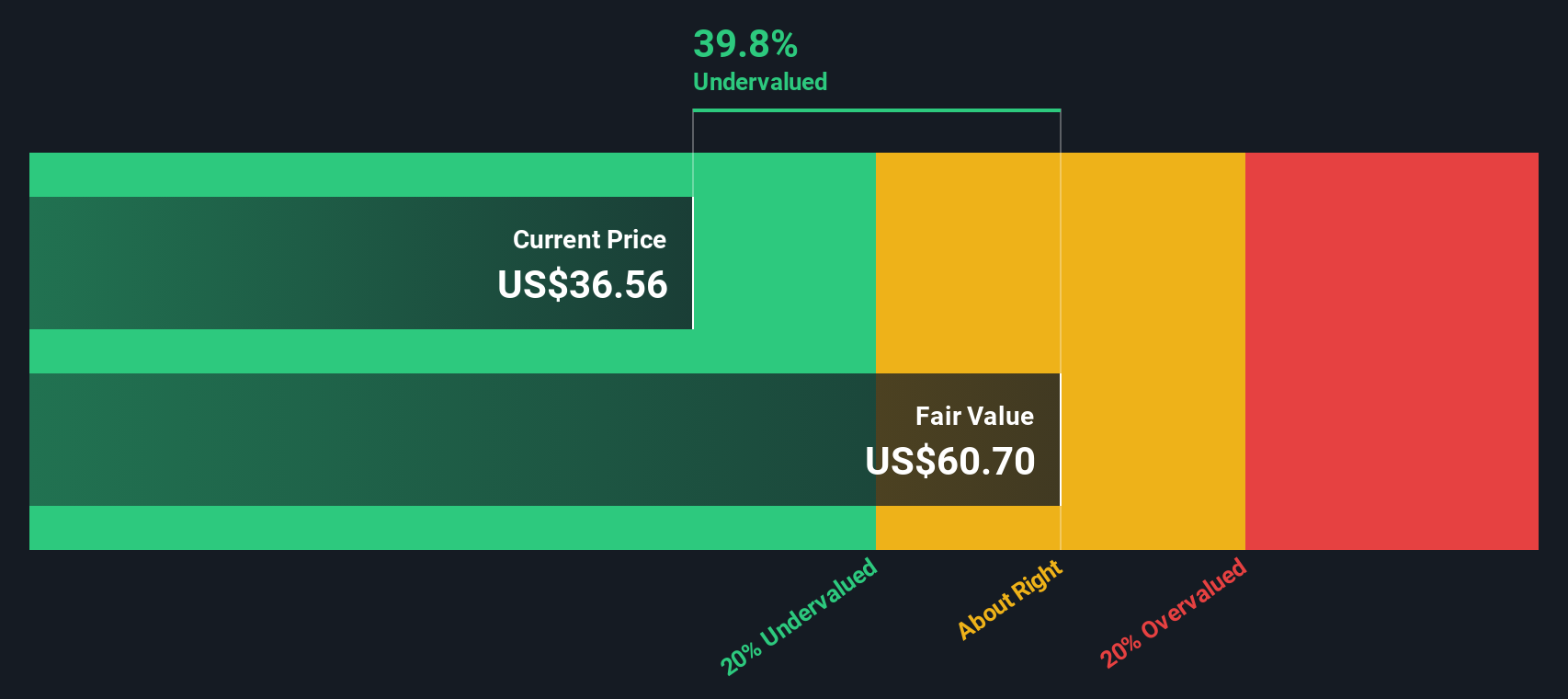

When it comes to valuation, United Bankshares scores a 2 out of 6 based on major value checks. In other words, it’s currently considered undervalued in only two key areas, so it’s not a screaming bargain, but there could be more to the story depending on how you measure value. Next, we’ll dive into the details behind those six valuation angles and see how United Bankshares stacks up. If you’re really looking for the most telling insight, stick around for the approach at the end that just might offer a bigger-picture answer.

United Bankshares scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: United Bankshares Excess Returns Analysis

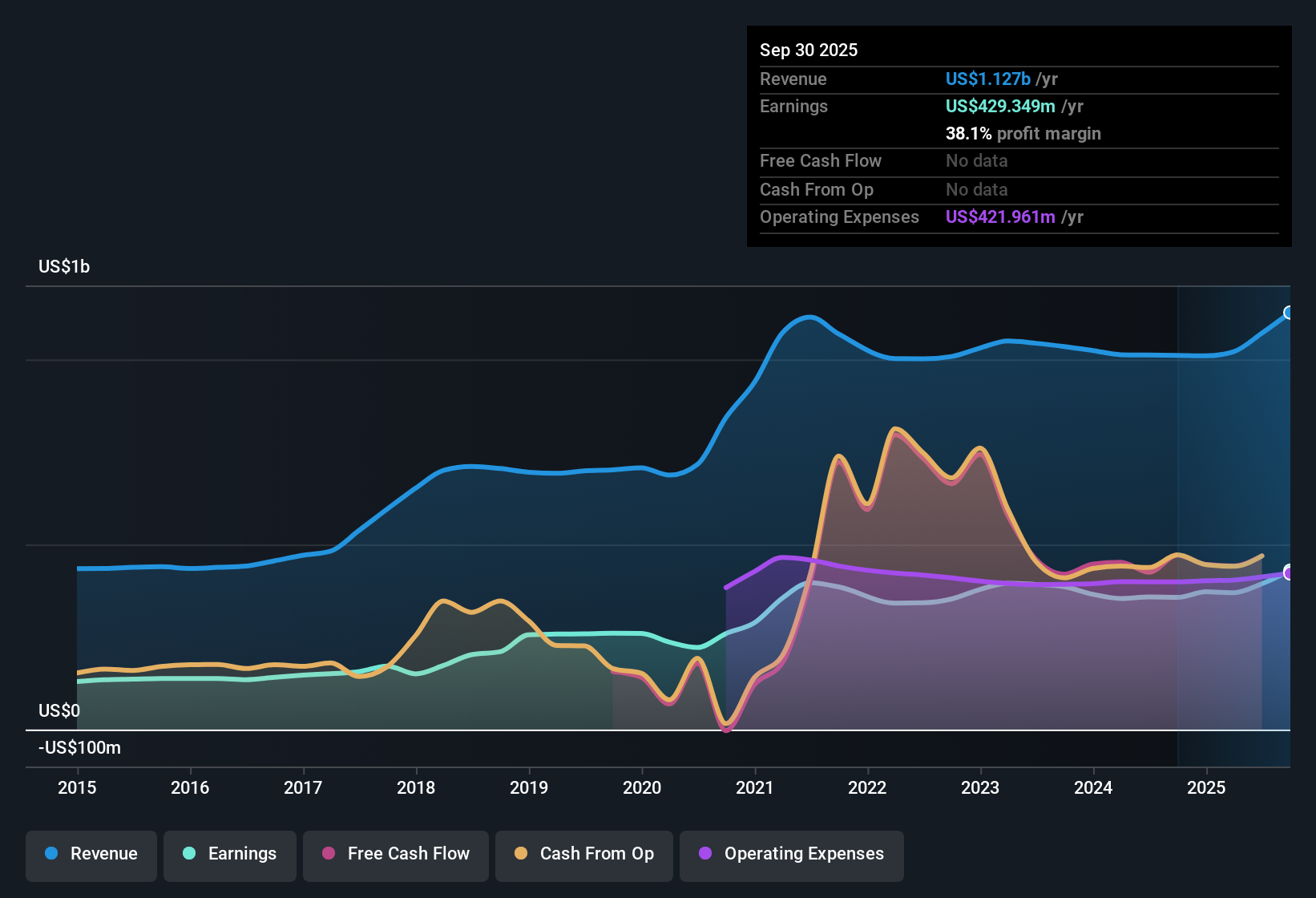

The Excess Returns valuation model focuses on how efficiently a company uses its equity to generate profits above the minimum return expected by investors. In other words, it examines whether United Bankshares is creating value by earning returns on shareholders’ money that exceed its cost of equity.

For United Bankshares, the current Book Value per share stands at $37.89, while analysts estimate a stable Book Value of $39.88 per share in the coming years. The company’s stable earnings per share (EPS) are projected to be $3.31, calculated using weighted future Return on Equity estimates from six analysts. On average, the Return on Equity is 8.3%. The implied cost of equity is $2.70 per share. This means United Bankshares produces an Excess Return of $0.61 per share, which is a clear sign it is adding value for shareholders after accounting for risk.

Using this methodology, the model calculates United Bankshares’ intrinsic value at $56.27 per share. With shares currently trading at $35.53, the analysis suggests the stock is 36.9% undervalued compared to its excess returns potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests United Bankshares is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Bankshares Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation measure for profitable companies like United Bankshares because it directly compares the company’s current share price to its per-share earnings. This metric gives investors a quick sense of how much they are paying for a dollar of earnings, which makes it especially useful when evaluating banks with steady profits.

Growth expectations and risk are central to what’s considered a “normal” or “fair” PE ratio. Companies with stronger anticipated growth or lower perceived risks typically command higher multiples. Those with slower growth or more uncertainty tend to have lower PE ratios. For United Bankshares, the current PE ratio is 12.75x. This is slightly above both the industry average of 11.32x and the peer average of 11.57x. This suggests the market may view United as modestly higher quality or offering more growth potential than its immediate competitors.

Simply Wall St’s proprietary “Fair Ratio” model refines this comparison further by taking into account United Bankshares’ earnings growth outlook, profit margins, risk profile, industry, and market capitalization. Instead of relying solely on peers or broad industry averages, the Fair Ratio aims to reflect what investors should reasonably pay for these specific company attributes. In the case of United Bankshares, the Fair PE Ratio is calculated at 12.72x, which is almost identical to the current PE ratio of 12.75x. This suggests the stock’s price closely matches its underlying fundamentals at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Bankshares Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind a company's numbers. It connects your perspective on United Bankshares’ business, future prospects, and risks directly to a financial forecast and a fair value estimate. Narratives bring context to the data, helping you see not just what the numbers are, but what they mean to you as an investor.

With Simply Wall St’s Narratives tool, available to millions of investors on our Community page, you can easily build or follow these living stories. Each Narrative lays out expected future revenue, earnings, and margins, then automatically updates as new news or earnings come in. The tool lets you quickly compare your Fair Value to the current Price, making it simple to decide whether now is the right time to buy, hold, or sell.

For United Bankshares, one investor’s Narrative might see a fair value as high as $60. Another, more cautious view might see it as low as $30, depending on their outlook for future growth. Narratives keep decision-making dynamic, letting you act with more confidence as your view of the company evolves.

Do you think there's more to the story for United Bankshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives