- United States

- /

- Banks

- /

- NasdaqGS:SRCE

Undiscovered Gems In The US Market Backed By Strong Fundamentals

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has shown a significant 32% increase over the last year, with earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks with strong fundamentals can uncover potential opportunities for investors seeking stability and growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Northeast Bank (NasdaqGM:NBN)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market capitalization of $807.91 million.

Operations: Northeast Bank generates revenue primarily from its banking segment, totaling $157.67 million. The bank's market capitalization is approximately $807.91 million.

Northeast Bank, with assets totaling US$3.9 billion and equity of US$392.6 million, demonstrates robust financial health through its primarily low-risk funding structure, where 88% of liabilities are customer deposits. The bank's net loans stand at US$3.5 billion against deposits of US$3.1 billion, indicating a strong lending position complemented by a net interest margin of 5.2%. With an appropriate bad loan ratio at 1%, Northeast Bank showcases high-quality earnings growth of 17.8% over the past year, outperforming industry standards and trading significantly below estimated fair value by 43%.

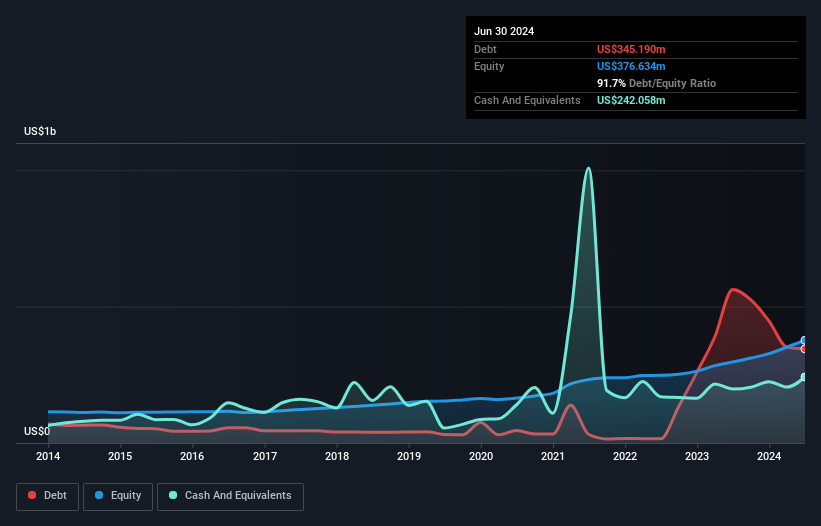

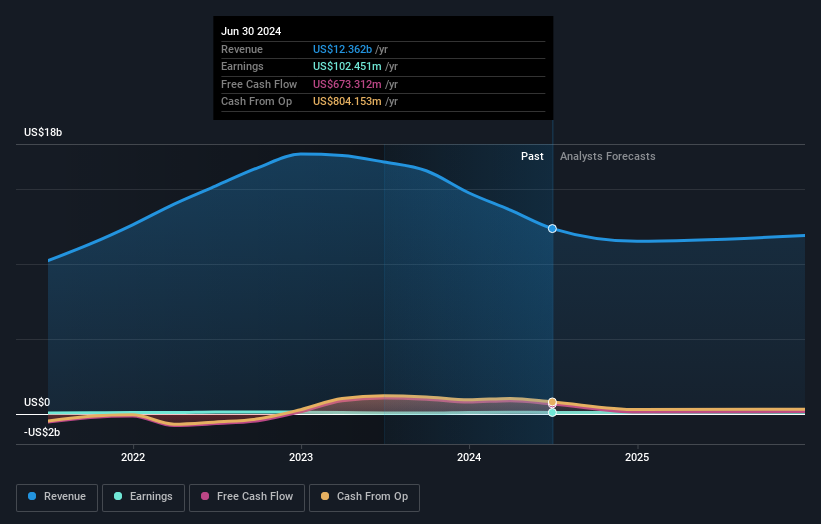

Andersons (NasdaqGS:ANDE)

Simply Wall St Value Rating: ★★★★★★

Overview: The Andersons, Inc. is a diversified company involved in the trade, renewables, and nutrient and industrial sectors across multiple countries including the United States, Canada, Mexico, Egypt, and Switzerland with a market cap of approximately $1.61 billion.

Operations: The company's primary revenue streams are from its trade segment, generating $7.61 billion, followed by renewables at $2.88 billion, and nutrient and industrial at $852.05 million.

Andersons is making strategic moves in the agribusiness and renewable energy sectors, with investments like the $70 million Port of Houston facility aimed at improving grain operations. Despite a decrease in sales to US$2.62 billion from US$3.64 billion year-over-year for Q3 2024, net income rose to US$27.37 million from US$9.71 million, showcasing improved efficiency and profitability. The company's price-to-earnings ratio stands at 13.6x, below the market average of 19.6x, indicating potential value for investors amidst challenges such as grain market oversupply and ethanol price volatility that could impact future growth projections.

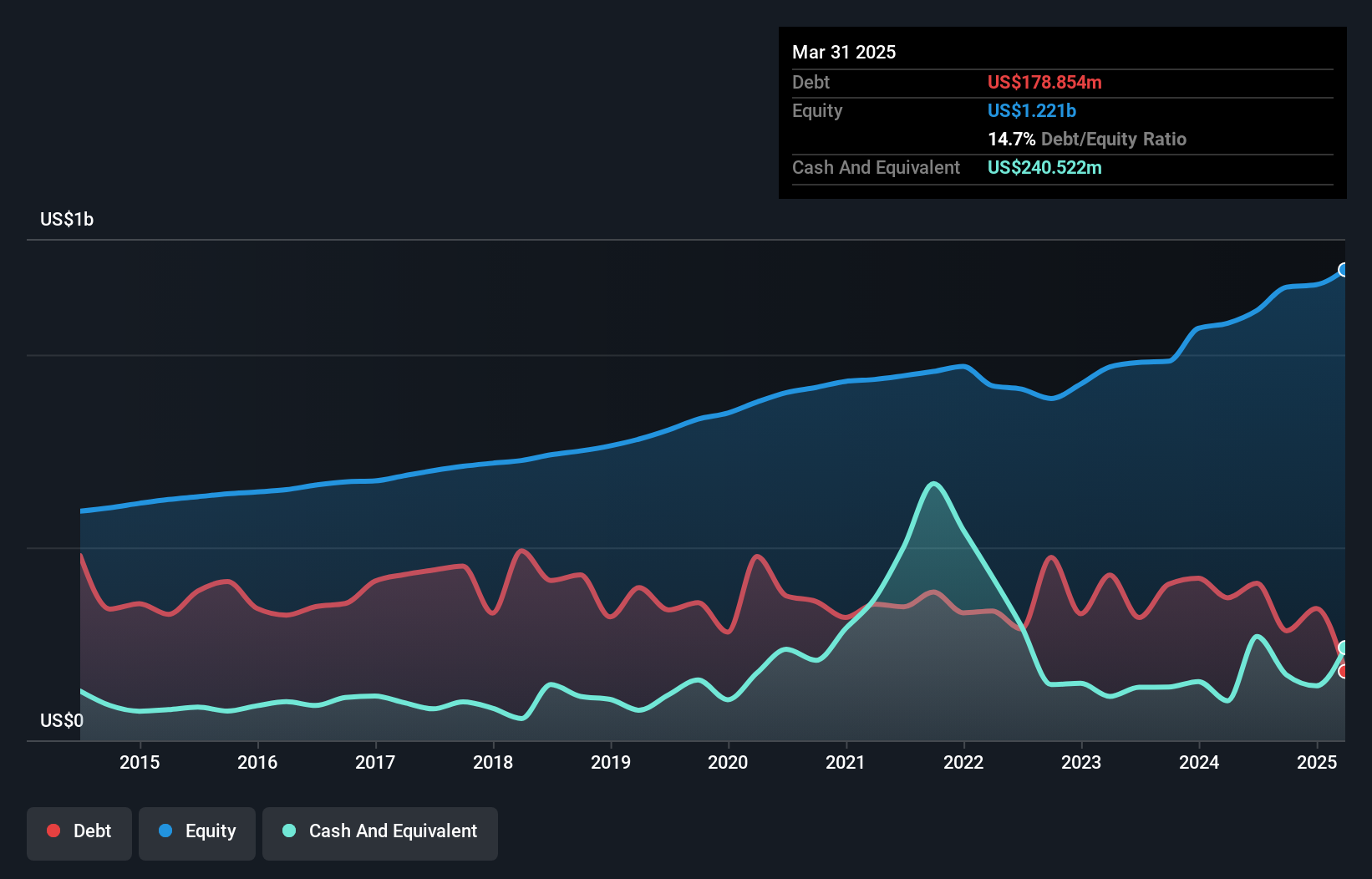

1st Source (NasdaqGS:SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to individuals and businesses, with a market cap of approximately $1.59 billion.

Operations: 1st Source generates revenue primarily from its commercial banking segment, which contributed $369.01 million. The company has a market cap of approximately $1.59 billion.

1st Source, with assets totaling US$8.8 billion and equity of US$1.2 billion, stands out for its robust financial health and quality earnings. The bank's total deposits amount to US$7.1 billion, supporting a loan portfolio of US$6.5 billion while maintaining a net interest margin of 3.5%. Impressively, it manages non-performing loans at just 0.5% with a substantial allowance for bad loans at 495%. Despite the forecasted average earnings decline of 1.3% annually over the next three years, recent earnings growth exceeded industry norms by hitting 1.6%, showcasing resilience in challenging times.

Summing It All Up

- Click through to start exploring the rest of the 228 US Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives