Narratives are currently in beta

Key Takeaways

- Strategic investments in agribusiness and renewables are expected to enhance revenue growth and improve net margins through synergies and efficiency improvements.

- Focus on reducing ethanol carbon intensity and strong fiscal discipline positions Andersons for long-term growth and improved earnings.

- Challenges in revenue growth, grain market pressures, renewable margins, and uncertain ethanol dynamics could hinder Andersons' earnings and growth opportunities.

Catalysts

About Andersons- Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

- The recent investment in Skyland Grain LLC, which is expected to contribute $30 million to $40 million in annual EBITDA, doubles the size of Andersons' retail farm centers and provides potential synergies in their wholesale ag fertilizer and specialty liquids businesses, likely impacting future earnings positively.

- The $70 million investment in the Port of Houston facility aims to enhance grain operation efficiency and enter the export market for soybean meal, expected to generate $15 million to $20 million in EBITDA annually by 2026, potentially increasing net margins and revenue.

- Continued improvements in the Renewables segment, with a focus on increasing export demand and higher blend rates for ethanol, along with a favorable margin environment supported by efficient production and abundant corn harvests, are likely to drive revenue growth and improve net margins.

- Efforts to lower the carbon intensity (CI) of their ethanol products through regenerative agriculture investments and carbon sequestration projects anticipate bolstering long-term growth by leveraging regulatory incentives, potentially enhancing net margins and earnings.

- Andersons' strong balance sheet and commitment to disciplined capital spending provide significant capacity for future growth investments that align with strategic goals, supporting an anticipated run-rate EBITDA target of $475 million by 2026, which should positively impact earnings.

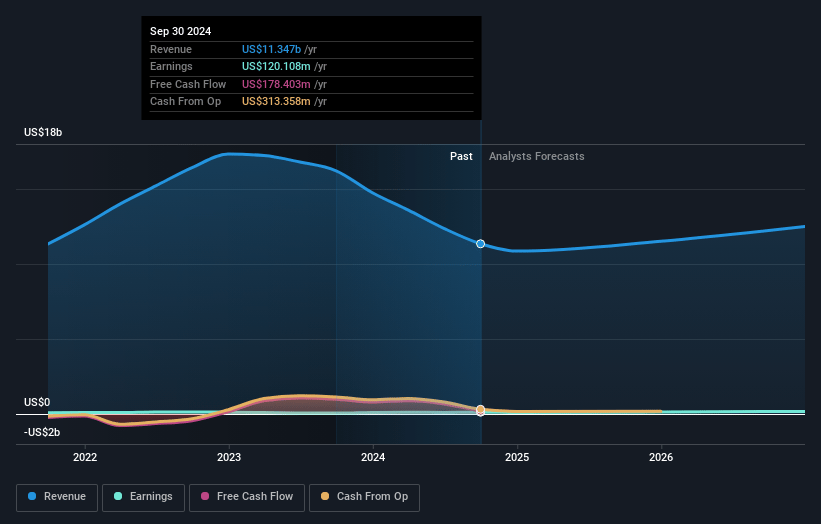

Andersons Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Andersons's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 1.5% in 3 years time.

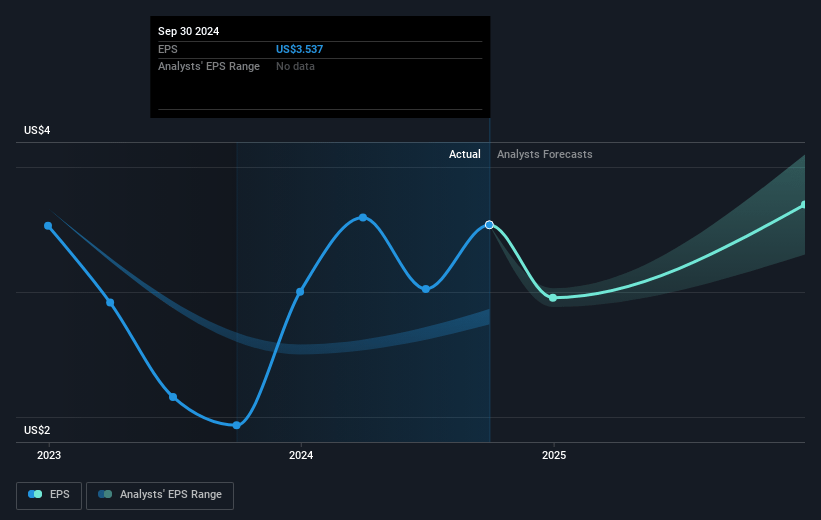

- Analysts expect earnings to reach $188.3 million (and earnings per share of $3.92) by about January 2028, up from $120.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 11.6x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 27.1x.

- Analysts expect the number of shares outstanding to grow by 12.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Andersons Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth target of achieving a $475 million run rate EBITDA has been delayed by one year from its original target, indicating potential challenges in achieving revenue and earnings growth as initially anticipated.

- The grain market is currently oversupplied with lower commodity prices and less volatility, impacting merchandising businesses and potentially compressing margins and overall revenues.

- Investment in renewable diesel feedstock volumes faces lower margins due to unfavorable industry fundamentals, which could suppress profitability in the renewables segment.

- The Nutrient and Industrial business experienced a pre-tax loss during the quarter, and margins in base nutrients have reset to more normalized levels, which may hinder margin recovery and earnings growth.

- Continued volatility in ethanol prices and market dynamics, along with uncertainty in policy developments around the Inflation Reduction Act and sustainable aviation fuel, could impede the company's ability to leverage its renewable energy assets for future earnings and growth opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.5 for Andersons based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.9 billion, earnings will come to $188.3 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 6.3%.

- Given the current share price of $41.06, the analyst's price target of $62.5 is 34.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives