- United States

- /

- Machinery

- /

- NYSE:KMT

3 Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements amid tariff uncertainties and recent gains in major indices, investors are keenly observing how these factors might influence their portfolios. In such a dynamic environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.17% | ★★★★★★ |

| Atlantic Union Bankshares (NYSE:AUB) | 5.14% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.26% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.64% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.90% | ★★★★★★ |

| Heritage Commerce (NasdaqGS:HTBK) | 5.71% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.02% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.92% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.54% | ★★★★★★ |

| German American Bancorp (NasdaqGS:GABC) | 3.14% | ★★★★★☆ |

Click here to see the full list of 153 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

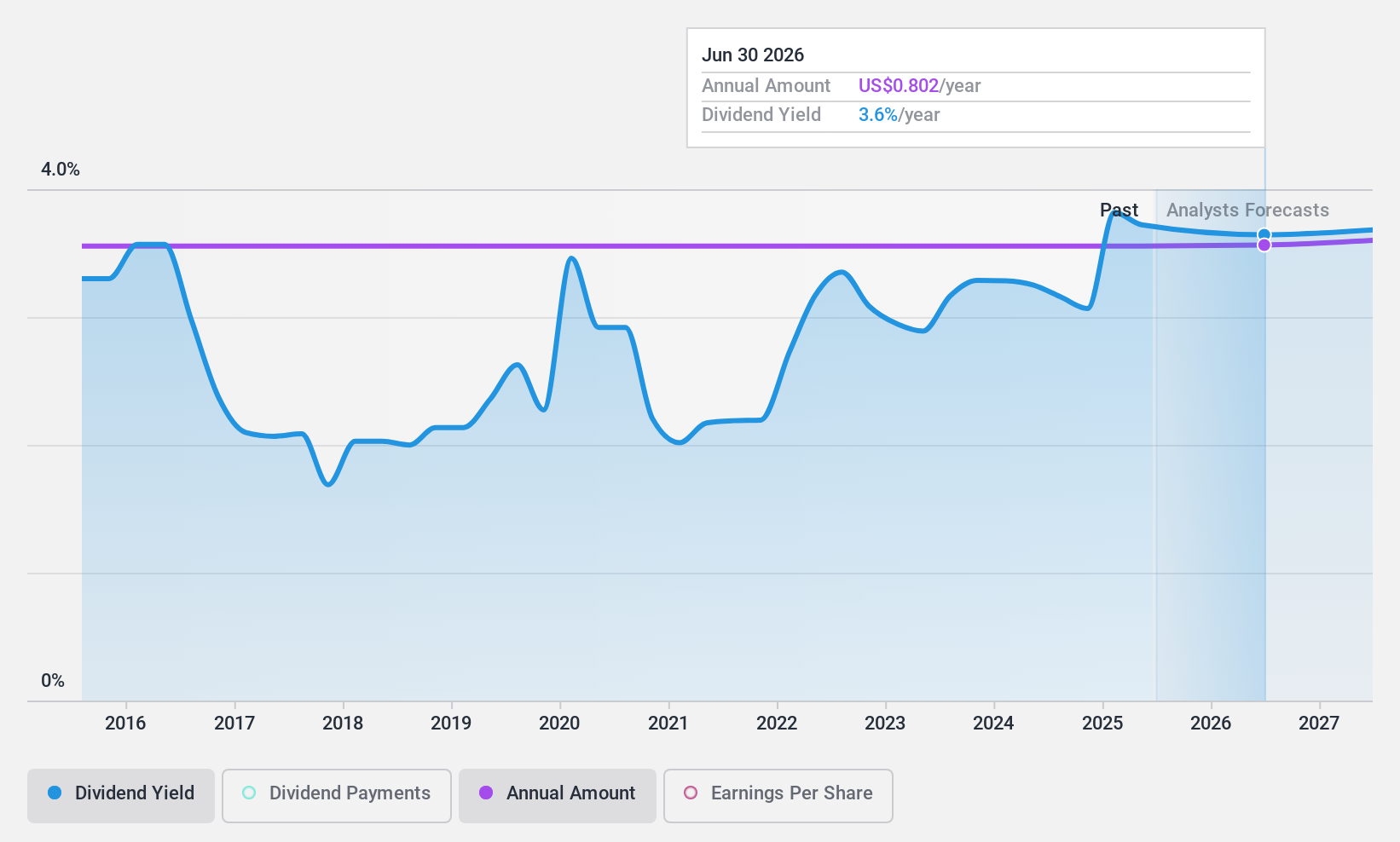

Penns Woods Bancorp (NasdaqGS:PWOD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Penns Woods Bancorp, Inc. is the bank holding company for Jersey Shore State Bank, offering commercial and retail banking services across various customer segments in the United States, with a market cap of $210.57 million.

Operations: The primary revenue segment for Penns Woods Bancorp, Inc. is Community Banking, generating $68.38 million.

Dividend Yield: 4.6%

Penns Woods Bancorp offers a stable dividend yield of 4.58%, with payments reliably growing over the past decade. The company's payout ratio of 54.4% suggests dividends are well-covered by earnings, although its yield is slightly below the top quartile in the US market. Recent financial results show significant growth, with Q1 net income rising to US$7.37 million from US$3.81 million a year ago, supporting ongoing dividend sustainability despite some uncertainty about future coverage beyond three years.

- Navigate through the intricacies of Penns Woods Bancorp with our comprehensive dividend report here.

- Our valuation report here indicates Penns Woods Bancorp may be undervalued.

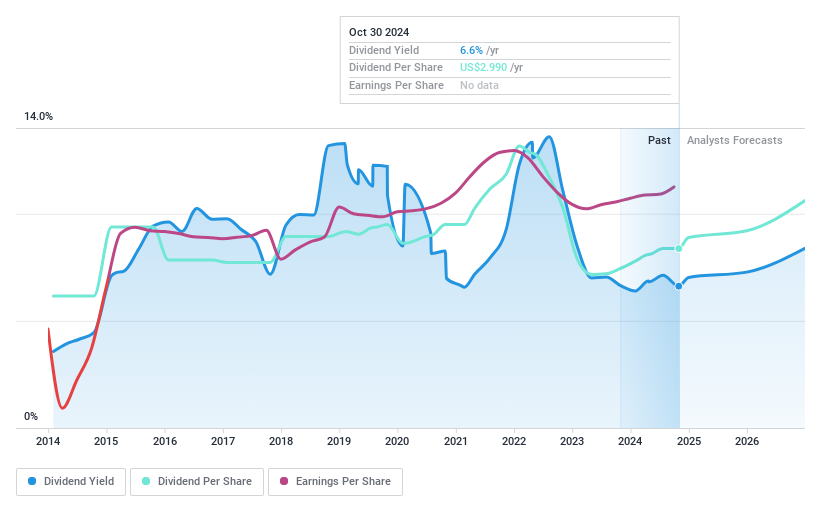

Artisan Partners Asset Management (NYSE:APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of approximately $2.90 billion.

Operations: Artisan Partners Asset Management Inc. generates its revenue primarily from the Investment Management Industry, totaling $1.11 billion.

Dividend Yield: 9.4%

Artisan Partners Asset Management provides a high dividend yield of 9.36%, ranking in the top 25% among US dividend payers, with dividends covered by earnings and cash flows at payout ratios of 81.5% and 75.9%, respectively. Despite recent growth in earnings, its dividend history has been volatile over the past decade, raising concerns about reliability. Recent executive changes include Jason Gottlieb's appointment as CEO, potentially impacting future strategic direction.

- Dive into the specifics of Artisan Partners Asset Management here with our thorough dividend report.

- The valuation report we've compiled suggests that Artisan Partners Asset Management's current price could be quite moderate.

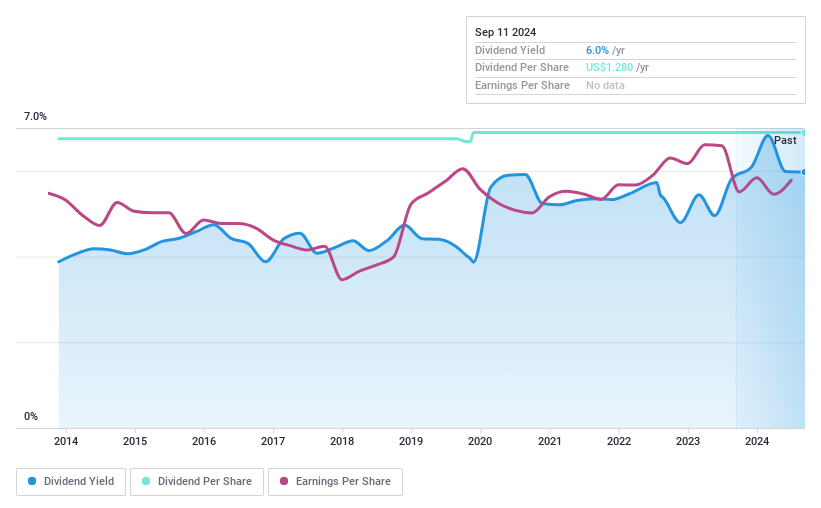

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. develops and applies tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications globally, with a market cap of approximately $1.48 billion.

Operations: Kennametal Inc.'s revenue is derived from two main segments: Metal Cutting, which generated approximately $1.26 billion, and Infrastructure, which contributed about $767.31 million.

Dividend Yield: 4.1%

Kennametal offers a stable dividend yield of 4.06%, though it falls short compared to the top US dividend payers. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 65.2% and 31.6%, respectively, indicating sustainability. Despite a recent decline in earnings, Kennametal has consistently increased its dividends over the past decade. A legal dispute involving trade secrets could pose future financial risks, potentially affecting dividend stability.

- Take a closer look at Kennametal's potential here in our dividend report.

- Our expertly prepared valuation report Kennametal implies its share price may be lower than expected.

Make It Happen

- Unlock our comprehensive list of 153 Top US Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives