- United States

- /

- Banks

- /

- NasdaqGS:PCB

Top Dividend Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the U.S. stock market faces turbulence with new tariffs set to take effect and major indices experiencing significant declines, investors are increasingly focused on economic indicators and policy impacts. In such uncertain times, dividend stocks can offer a measure of stability by providing consistent income streams, making them an attractive option for those looking to navigate volatile market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.46% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.99% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.52% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.99% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.70% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.16% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.55% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.14% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

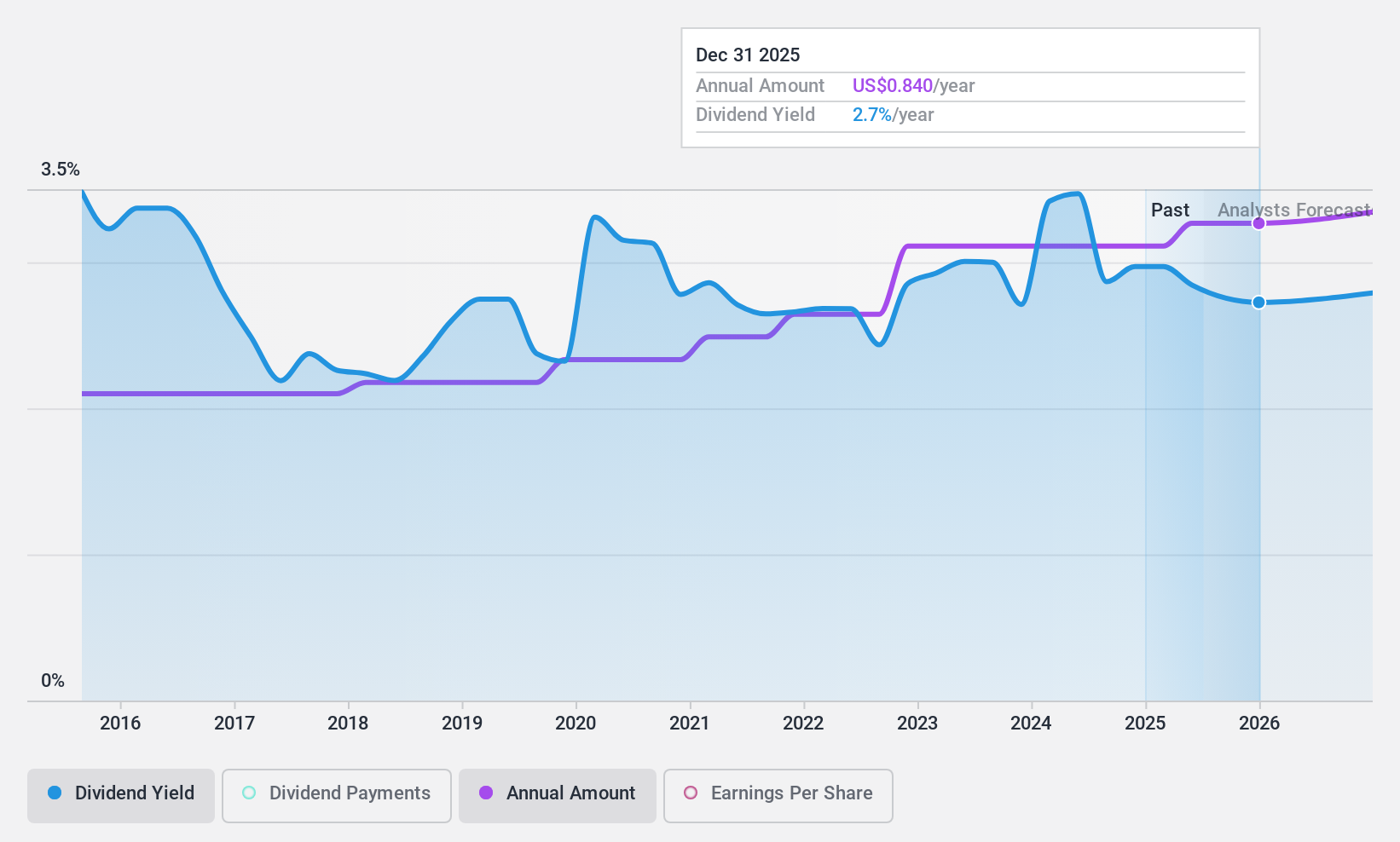

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civista Bancshares, Inc., with a market cap of $324.36 million, operates as the financial holding company for Civista Bank, offering community banking services.

Operations: Civista Bancshares, Inc. generates revenue primarily through its banking segment, which amounts to $149.09 million.

Dividend Yield: 3.3%

Civista Bancshares recently increased its quarterly dividend to $0.17 per share, reflecting a steady growth in dividends over the past decade. Despite a lower yield of 3.26% compared to top-tier US dividend payers, Civista's payouts are well-covered by earnings with a current payout ratio of 31.8%. The company reported stable earnings for Q4 2024 and maintains strong prospects for future profit growth, supporting sustainable dividend payments moving forward.

- Click here and access our complete dividend analysis report to understand the dynamics of Civista Bancshares.

- According our valuation report, there's an indication that Civista Bancshares' share price might be on the cheaper side.

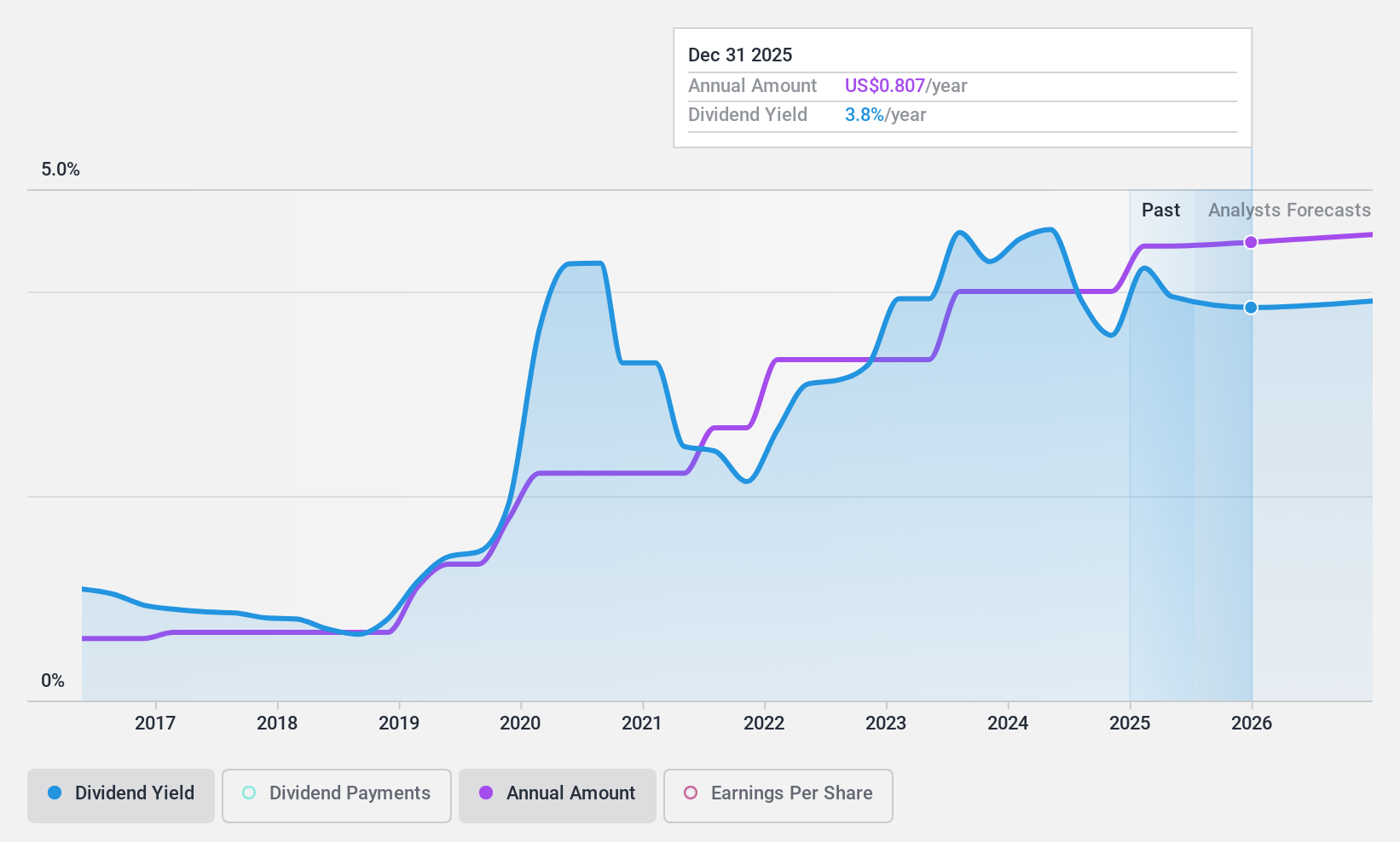

Middlefield Banc (NasdaqCM:MBCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Middlefield Banc Corp., with a market cap of $216.38 million, operates as the bank holding company for The Middlefield Banking Company, offering a range of commercial banking services to small and medium-sized businesses, professionals, small business owners, and retail customers in northeastern and central Ohio.

Operations: Middlefield Banc Corp. generates its revenue primarily from banking services, amounting to $65.89 million.

Dividend Yield: 3%

Middlefield Banc recently raised its quarterly dividend to $0.21 per share, marking a 5% increase from the previous quarter. The company's dividends have been stable and growing over the past decade, supported by a payout ratio of 41.6%, ensuring coverage by earnings. While its yield of 3.02% is below top-tier US dividend payers, Middlefield’s dividends remain reliable with earnings forecasted to grow at nearly 5% annually, reinforcing future sustainability.

- Dive into the specifics of Middlefield Banc here with our thorough dividend report.

- The analysis detailed in our Middlefield Banc valuation report hints at an inflated share price compared to its estimated value.

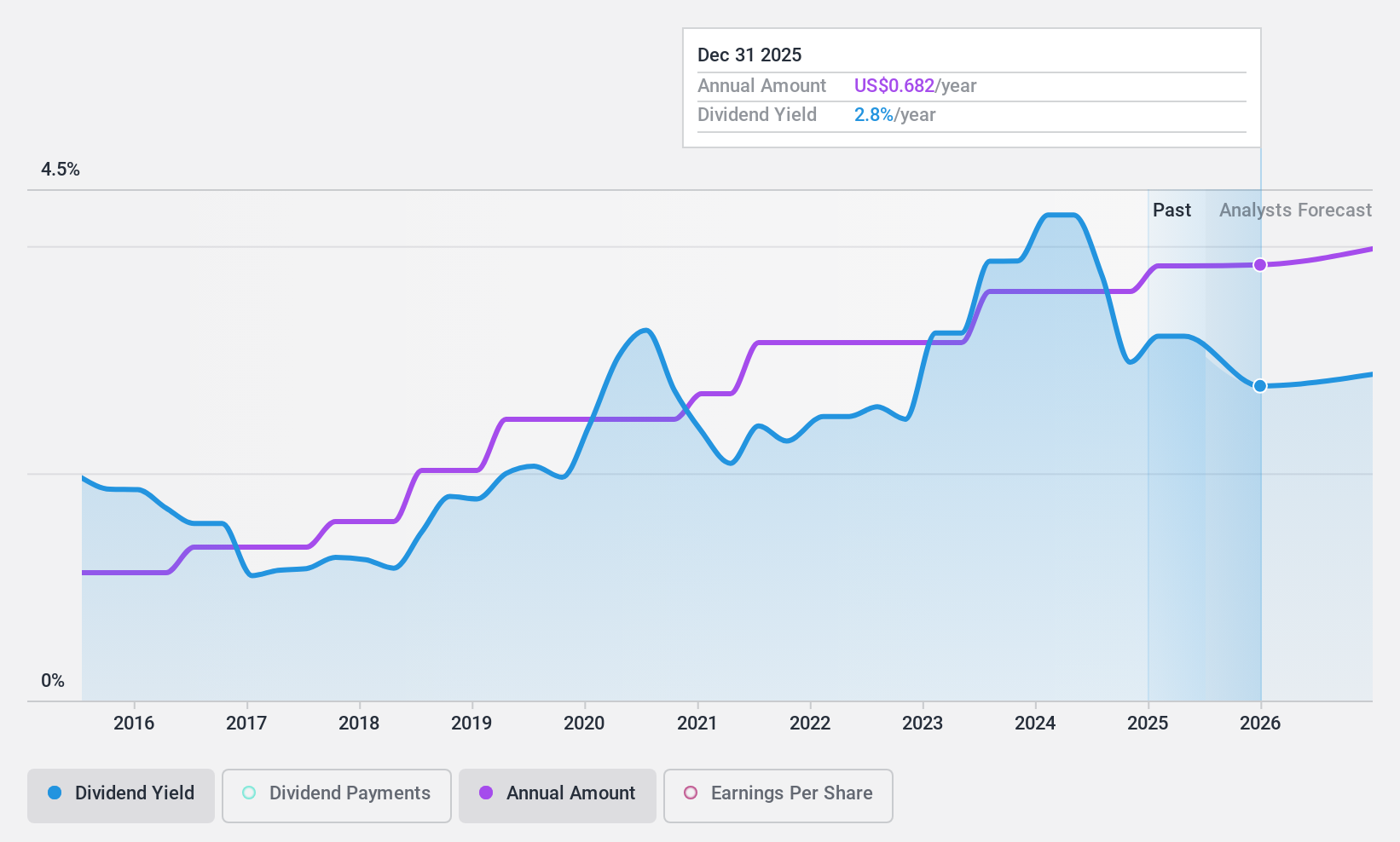

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small to medium-sized businesses, individuals, and professionals in Southern California, with a market cap of $282.20 million.

Operations: PCB Bancorp generates revenue primarily from its banking industry segment, amounting to $96.31 million.

Dividend Yield: 4.1%

PCB Bancorp's dividend payments have been stable and growing over the past decade, with a current yield of 4.12%, slightly below the top US dividend payers. The company's payout ratio of 41.1% indicates dividends are well covered by earnings, with future coverage expected to improve to 33%. Recent financial results show increased net income and earnings per share, supporting ongoing dividend reliability. PCB declared a quarterly cash dividend of $0.20 per share for February 2025 payment.

- Take a closer look at PCB Bancorp's potential here in our dividend report.

- Our valuation report unveils the possibility PCB Bancorp's shares may be trading at a discount.

Where To Now?

- Embark on your investment journey to our 143 Top US Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCB

PCB Bancorp

Operates as the bank holding company for PCB Bank that provides various banking products and services to small and middle market businesses and individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives