- United States

- /

- Banks

- /

- NasdaqGM:OVBC

Top 3 US Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market pulls back from recent record highs, investors are navigating a landscape marked by persistent inflationary pressures and potential shifts in Federal Reserve policy. In such an environment, dividend stocks can offer a stable income stream and may provide some cushion against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.86% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.43% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.49% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.63% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.40% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.52% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.71% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

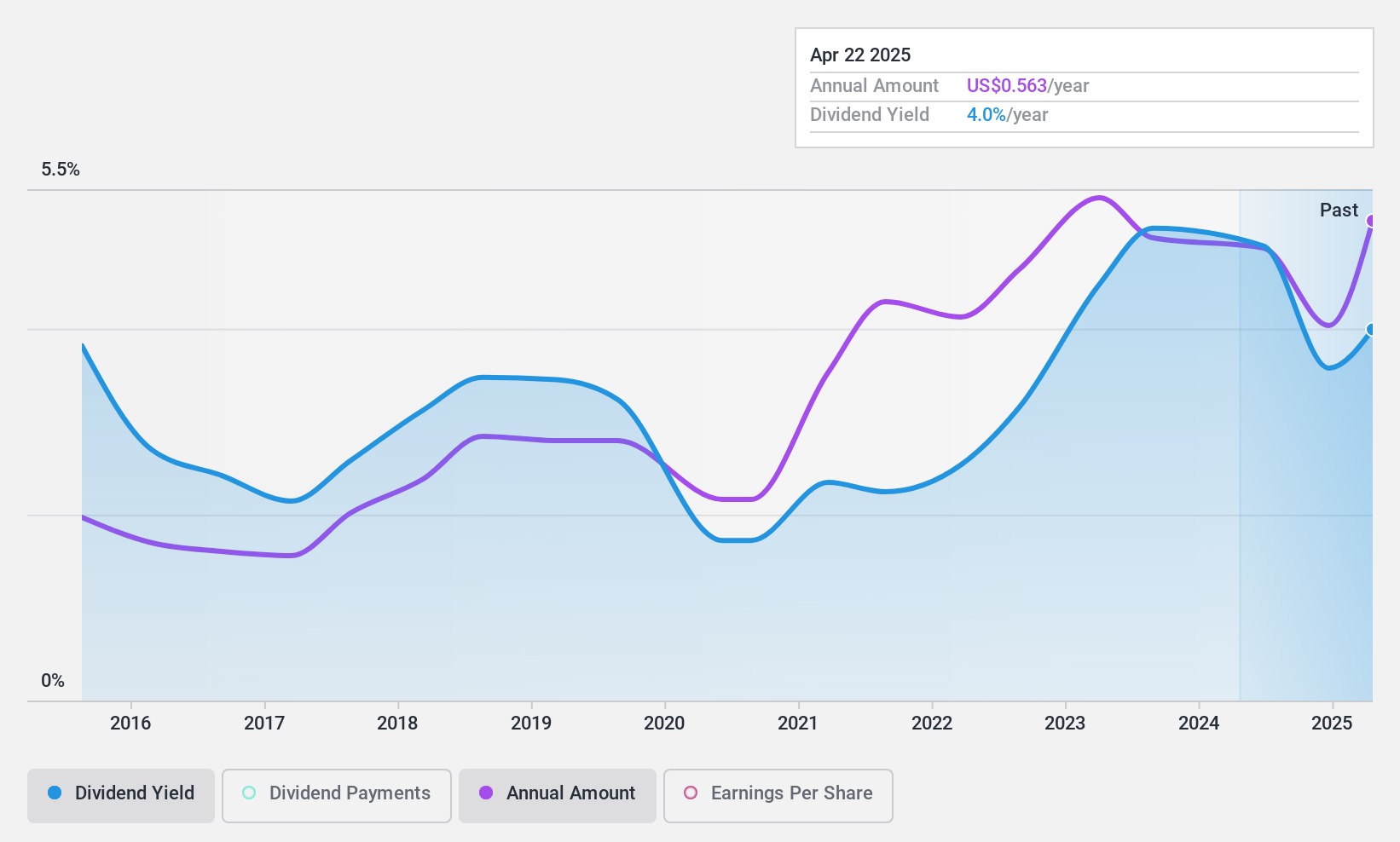

Ohio Valley Banc (NasdaqGM:OVBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ohio Valley Banc Corp. is a bank holding company for The Ohio Valley Bank Company, offering commercial and consumer banking products and services, with a market cap of $124.37 million.

Operations: Ohio Valley Banc Corp. generates revenue through its primary segments of Banking, which accounts for $54.00 million, and Consumer Finance, contributing $3.34 million.

Dividend Yield: 3.3%

Ohio Valley Banc offers a stable dividend history with consistent growth over the past decade and a current yield of 3.25%, though it falls short compared to top-tier US dividend payers. Its dividends are well-covered by earnings, evidenced by a low payout ratio of 35.7%. Recent financials show increased net interest income and net income for Q3 2024, despite some charge-offs, supporting its ability to maintain reliable dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Ohio Valley Banc.

- The valuation report we've compiled suggests that Ohio Valley Banc's current price could be quite moderate.

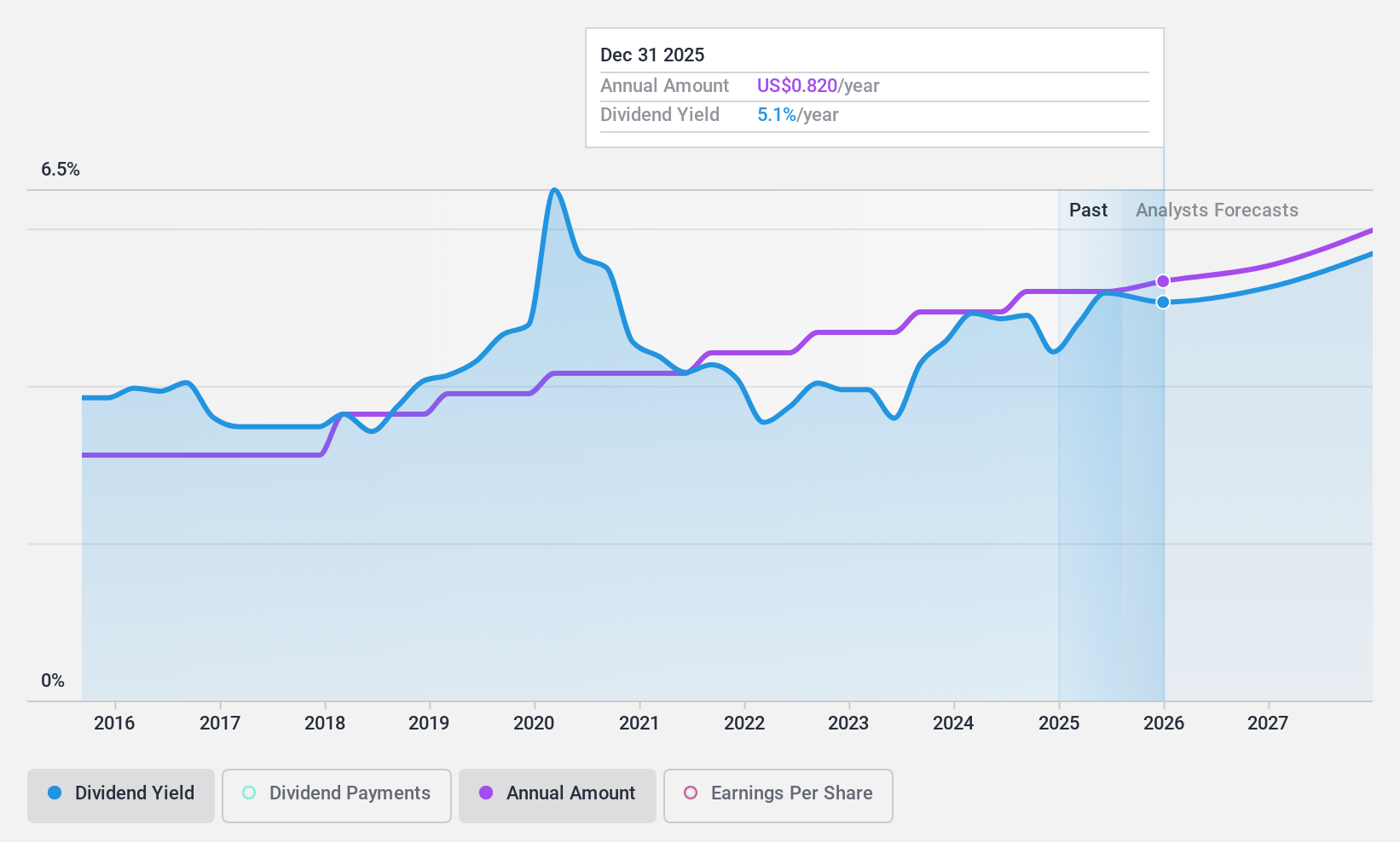

Silvercrest Asset Management Group (NasdaqGM:SAMG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Silvercrest Asset Management Group Inc. is a wealth management firm offering financial advisory and family office services in the United States, with a market cap of $247.35 million.

Operations: Silvercrest Asset Management Group Inc. generates revenue primarily from its investment management industry segment, which amounts to $120.23 million.

Dividend Yield: 4.2%

Silvercrest Asset Management Group's dividend payments have been reliable and stable over the past decade, with a recent quarterly dividend of US$0.20 per share. However, the high payout ratio of 98.5% indicates dividends are not well-covered by earnings, despite being covered by cash flows at a 61.5% cash payout ratio. Recent financials show declining net income for Q3 2024 compared to last year, highlighting potential challenges in sustaining current dividend levels without improved profitability.

- Delve into the full analysis dividend report here for a deeper understanding of Silvercrest Asset Management Group.

- Our valuation report here indicates Silvercrest Asset Management Group may be undervalued.

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based services both in Israel and internationally, with a market cap of approximately $619.14 million.

Operations: Magic Software Enterprises Ltd. generates revenue through its proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services.

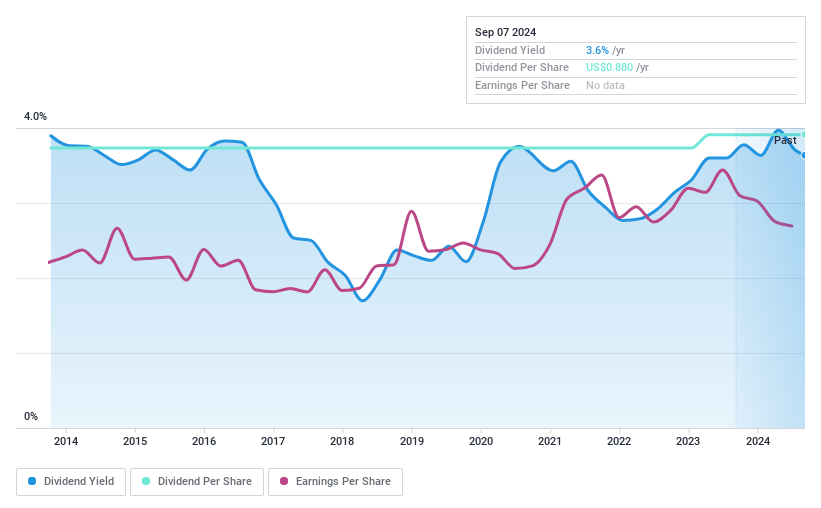

Dividend Yield: 3.6%

Magic Software Enterprises offers a dividend yield of 3.58%, which is lower than the top US dividend payers. The company's dividends are covered by earnings and cash flows, with payout ratios of 62.2% and 45.2%, respectively, but have been volatile over the past decade. Recent financials show increased Q3 sales to US$142.97 million, though net income for nine months decreased slightly to US$26.26 million, impacting overall dividend reliability despite raised revenue guidance for 2024.

- Navigate through the intricacies of Magic Software Enterprises with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Magic Software Enterprises is trading behind its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 135 Top US Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OVBC

Ohio Valley Banc

Operates as the bank holding company for The Ohio Valley Bank Company that provides commercial and consumer banking products and services.

Flawless balance sheet, good value and pays a dividend.