- United States

- /

- Banks

- /

- NasdaqGS:OSBC

Old Second Bancorp (OSBC): Reaffirmed Strong Buy Spurs Fresh Look at Valuation After Revenue Beat and EPS Miss

Reviewed by Simply Wall St

Old Second Bancorp (OSBC) is back in focus after Raymond James reiterated its Strong Buy rating following the bank’s appearance at the Small Cap Bank Summit and a quarter where revenue topped expectations despite an earnings per share miss.

See our latest analysis for Old Second Bancorp.

The renewed Strong Buy call comes as Old Second’s share price has quietly built momentum, with a robust 30 day share price return of 11.23 percent feeding into a 5 year total shareholder return of 122.81 percent. This suggests investors see improving growth prospects despite the recent earnings per share miss.

If this kind of steady bank story has you thinking about what else might be overlooked, now is a good time to explore fast growing stocks with high insider ownership for other compelling ideas.

With shares near record highs yet still trading at a steep discount to some intrinsic value estimates, is Old Second Bancorp a quietly undervalued compounder, or has the recent rally already priced in the next leg of growth?

Most Popular Narrative: 5.7% Undervalued

With Old Second Bancorp last closing at $20.51 versus a narrative fair value of $21.75, the gap is modest but still points to upside.

The recent Evergreen Bank acquisition is performing ahead of expectations, providing higher than expected profitability and a more favorable asset mix, which is expected to drive incremental revenue growth, strengthen net interest margin, and enhance ROA as integration is completed.

Want to see how one deal and a revamped margin profile could justify a richer future earnings multiple than many peers? The narrative outlines the potential growth runway, the shift in profitability, and the valuation bridge that ties these elements together. Curious which assumptions would need to hold for that upside to materialize? Read on to see the framework behind this fair value assessment.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on Illinois staying resilient and Old Second keeping pace digitally, as any local downturn or tech lag could swiftly challenge the thesis.

Find out about the key risks to this Old Second Bancorp narrative.

Another View: Multiples Tell a Tougher Story

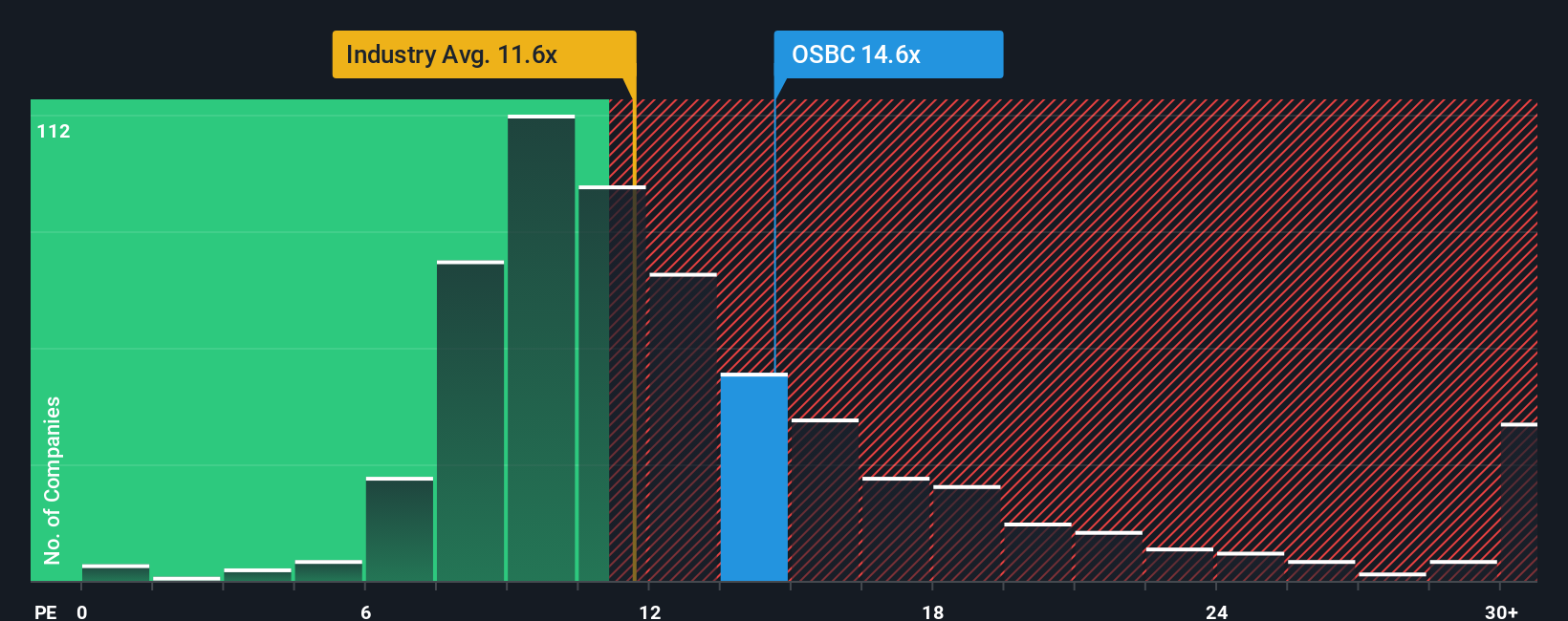

Look past the modest 5.7 percent discount to fair value and the picture gets trickier. On a price to earnings basis, Old Second trades at 15.3 times earnings, materially richer than both peers at 11.4 times and the 14.5 times fair ratio the market could move toward.

That premium means even solid execution might only justify today’s price, while any stumble could see the valuation compress quickly, leaving less room for error than the narrative suggests. Is this a quality premium worth paying, or a margin of safety that has already disappeared?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old Second Bancorp Narrative

If you see the numbers differently or would rather dig into the details yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Old Second Bancorp research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next smart move? Use the Simply Wall Street Screener to uncover focused opportunities that could sharpen your edge before the market catches on.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that aim to balance stability with meaningful cash returns.

- Capitalize on innovation by scanning these 26 AI penny stocks that are pushing the boundaries of automation, data, and intelligent software.

- Position yourself ahead of the crowd with these 80 cryptocurrency and blockchain stocks poised to benefit from growth in digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSBC

Old Second Bancorp

Operates as the bank holding company for Old Second National Bank that provides community banking services in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)