- United States

- /

- Hospitality

- /

- NasdaqGS:CBRL

Avoid Cracker Barrel Old Country Store And Explore One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

In the quest for reliable income from dividend stocks in the United States, where average yields hover around 1.7%, investors often face a mix of opportunities and risks. A key factor in evaluating these stocks is the stability of their dividends. Companies like Cracker Barrel Old Country Store, which have experienced significant dividend cuts, highlight the importance of assessing not just the yield but also the consistency and reliability of dividend payments over time. This article will explore why such instability can be a red flag for investors seeking dependable dividend investments.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.36% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.31% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.97% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.15% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.87% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.83% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.75% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 5.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 6.19% | ★★★★★☆ |

| East West Bancorp (NasdaqGS:EWBC) | 3.03% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

National Bankshares (NasdaqCM:NKSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bankshares, Inc., with a market cap of approximately $179.70 million, serves as the bank holding company for the National Bank of Blacksburg, offering retail and commercial banking products and services to individuals, businesses, non-profits, and local governments.

Operations: The firm offers retail and commercial banking solutions to a diverse clientele including individuals, businesses, non-profits, and local governments.

Dividend Yield: 5%

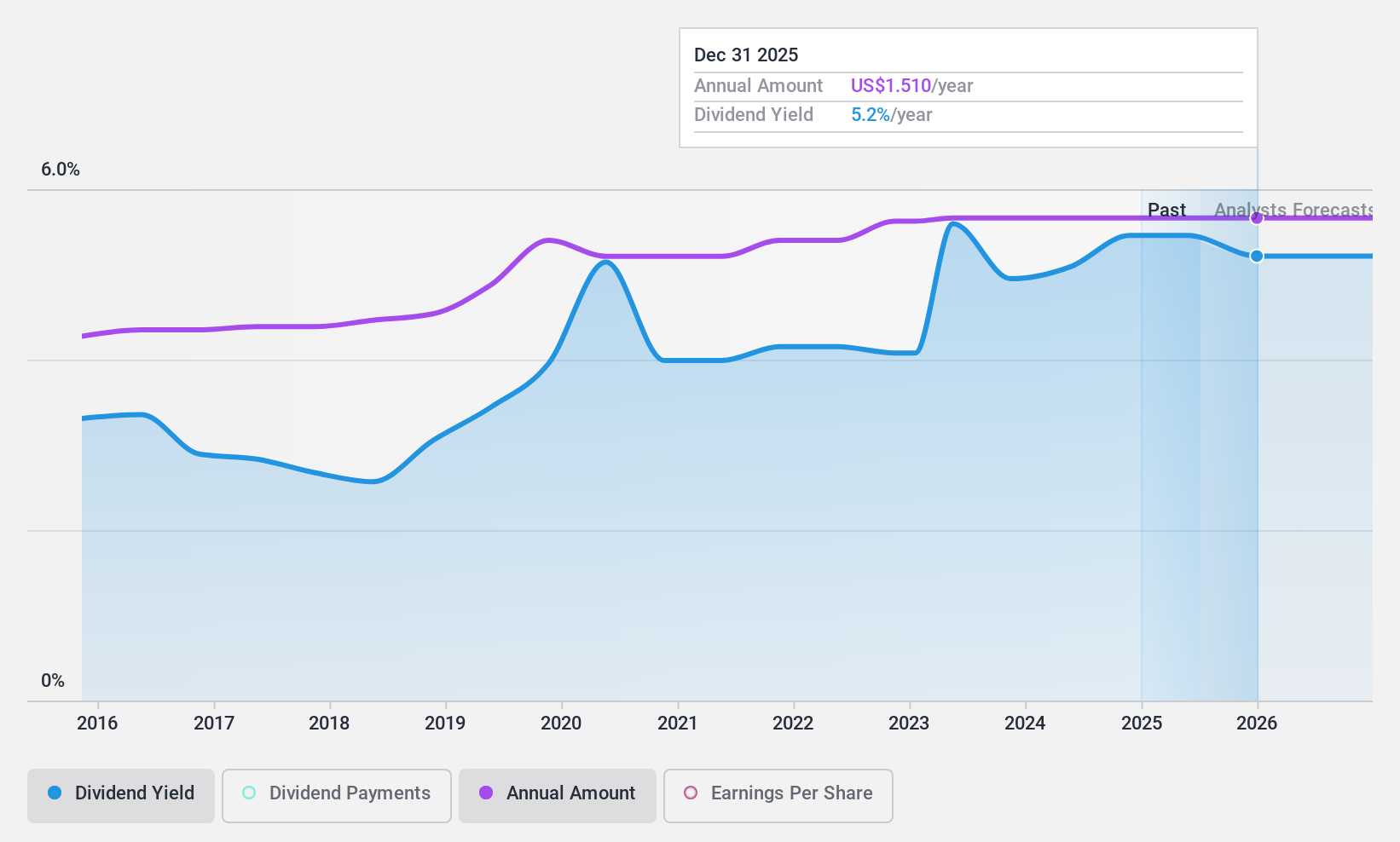

National Bankshares is currently valued at 61.5% below our fair value estimate, offering a potentially attractive entry point for dividend investors. Despite a decline in profit margins from 43.1% to 29.5% over the past year, the company has maintained stable and reliable dividends for the last decade, with payments increasing annually. Its dividend yield stands at 4.95%, higher than the top quartile of US market payers at 4.74%. Additionally, with a payout ratio of 66.7%, its dividends are well-covered by earnings, contrasting sharply with companies that have experienced significant cuts in their dividends due to coverage issues.

- Click here and access our complete dividend analysis report to understand the dynamics of National Bankshares.

- The valuation report we've compiled suggests that National Bankshares' current price could be inflated.

One To Reconsider

Cracker Barrel Old Country Store (NasdaqGS:CBRL)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Cracker Barrel Old Country Store, Inc. operates a chain of combined restaurant and gift stores under the Cracker Barrel Old Country Store brand across the United States, with a market capitalization of approximately $875.66 million.

Operations: The company generates its revenue primarily from its restaurant operations, totaling approximately $3.41 billion.

Dividend Yield: 2.5%

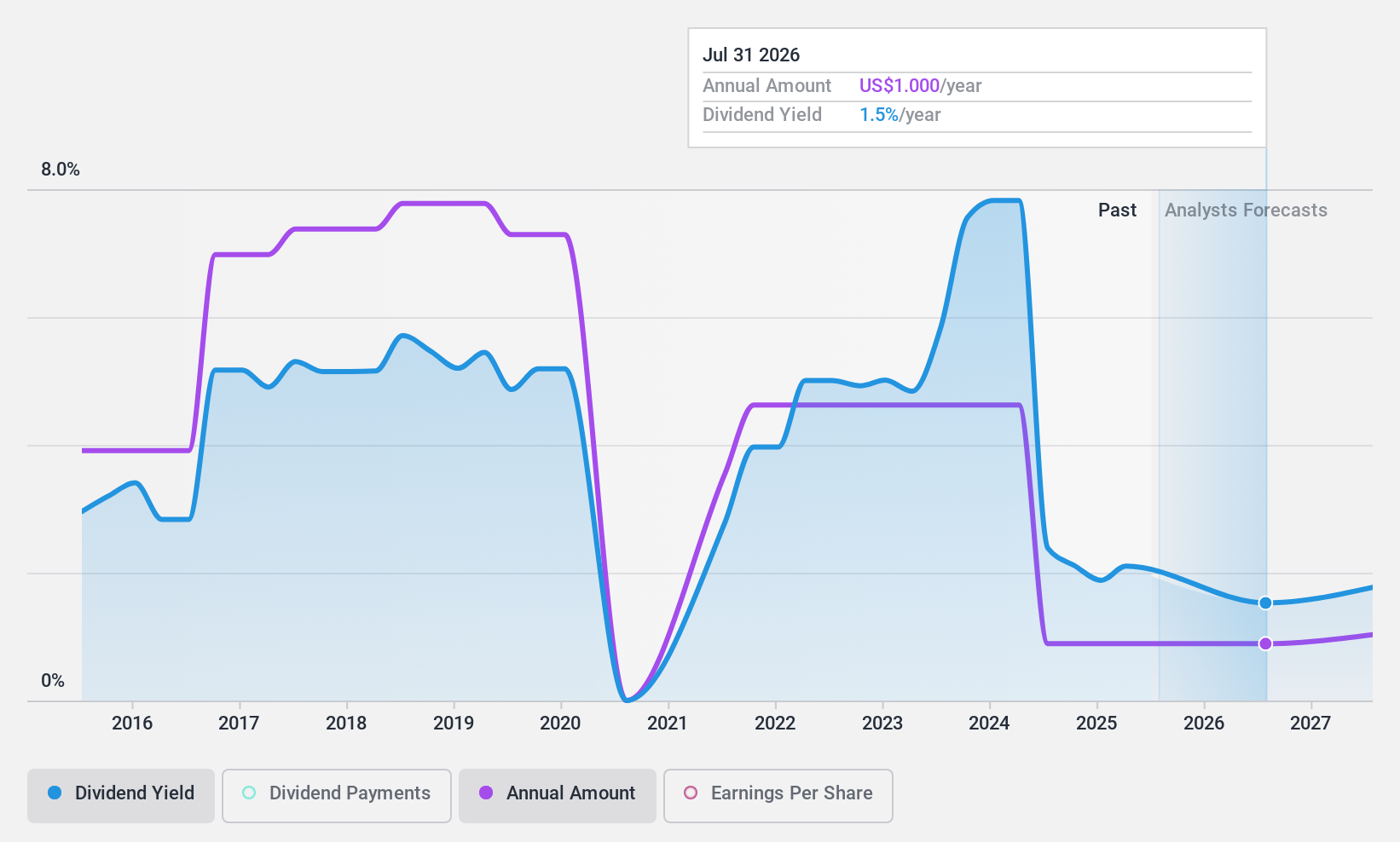

Cracker Barrel Old Country Store has demonstrated unstable dividend payments, with a significant reduction announced on May 16, 2024. Despite a low cash payout ratio suggesting adequate coverage by cash flows, the high payout ratio of 191.4% indicates dividends are not well supported by earnings. Recent financials show declining profits, with net income dropping significantly in the third quarter of 2024 compared to the previous year. Additionally, amidst operational changes and menu revamps aimed at efficiency and customer satisfaction, financial stability concerning dividends remains questionable.

Seize The Opportunity

- Click here to access our complete index of 205 Top Dividend Stocks.

- Are you invested in any of these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBRL

Cracker Barrel Old Country Store

Develops and operates the Cracker Barrel Old Country Store concept in the United States.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives