- United States

- /

- Banks

- /

- NasdaqGM:FDBC

3 US Dividend Stocks To Consider With Up To 4.8% Yield

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations amidst a wave of earnings reports, investors are closely monitoring economic indicators that could influence Federal Reserve interest rate decisions. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking consistent returns in uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.60% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.75% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.07% | ★★★★★★ |

| Polaris (NYSE:PII) | 4.69% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.07% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.74% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.80% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 149 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

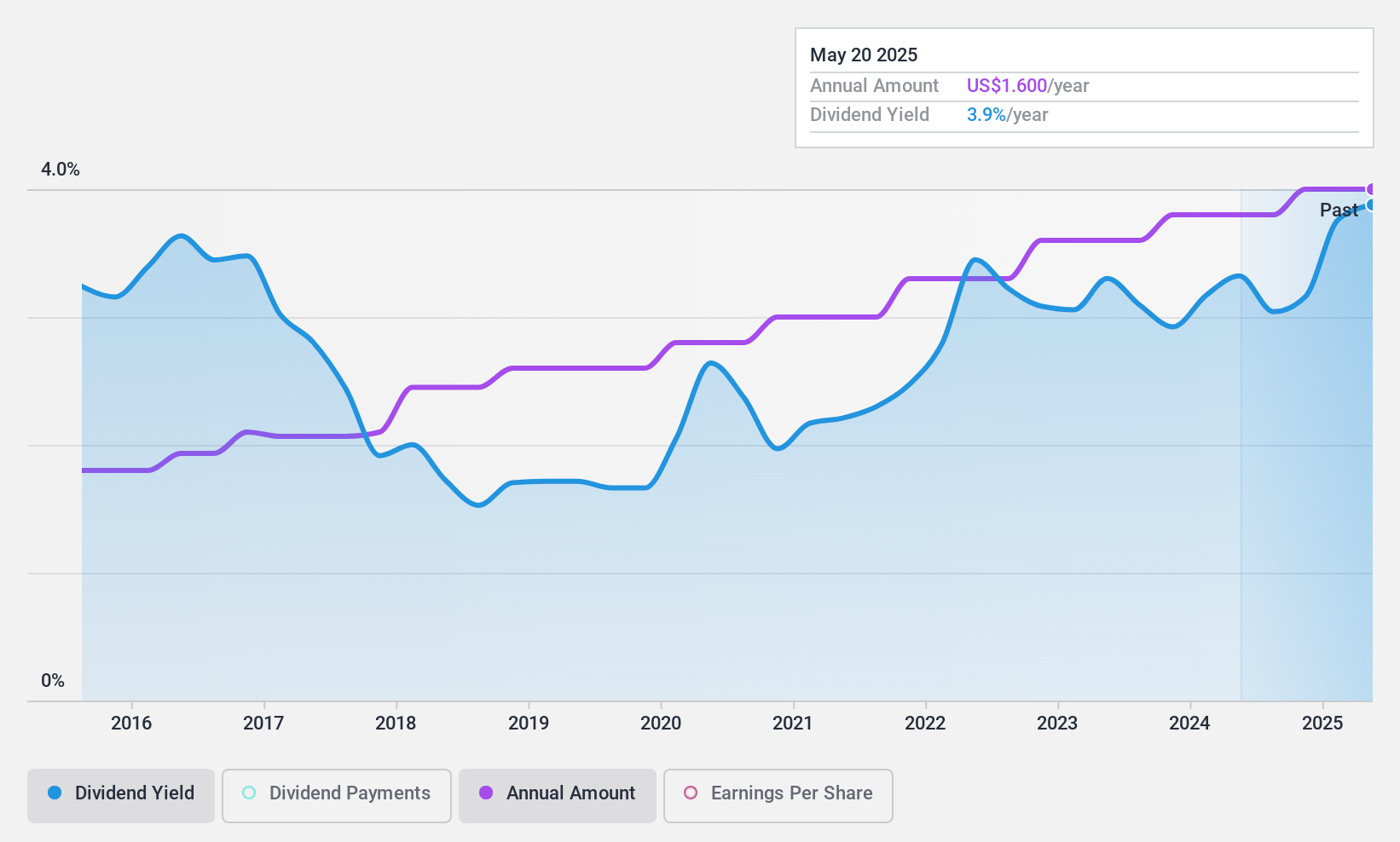

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering banking, trust, and financial services to individuals, small businesses, and corporate customers with a market cap of $253.42 million.

Operations: Fidelity D & D Bancorp, Inc. generates revenue of $71.24 million from its banking, trust, and financial services provided to a diverse clientele including individuals, small businesses, and corporate customers.

Dividend Yield: 3.5%

Fidelity D & D Bancorp offers a stable and reliable dividend, with payments increasing over the past decade. The recent 5% increase in quarterly dividends to $0.40 per share underscores this trend. Despite trading at a significant discount to its estimated fair value, the dividend yield of 3.53% is below top-tier levels in the US market. Earnings coverage appears reasonable with a payout ratio of 56.4%, though recent earnings have shown slight declines, which may warrant monitoring for future sustainability.

- Unlock comprehensive insights into our analysis of Fidelity D & D Bancorp stock in this dividend report.

- Our valuation report here indicates Fidelity D & D Bancorp may be overvalued.

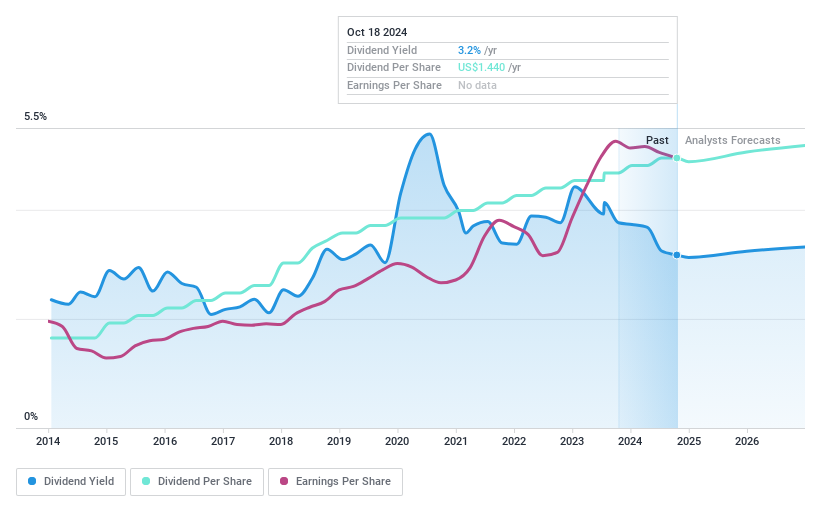

Mercantile Bank (NasdaqGS:MBWM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercantile Bank Corporation is the bank holding company for Mercantile Bank of Michigan, offering commercial and retail banking services to small- to medium-sized businesses and individuals in the United States, with a market cap of $701.53 million.

Operations: Mercantile Bank Corporation generates revenue from its banking segment, totaling $222.19 million.

Dividend Yield: 3.2%

Mercantile Bank provides a reliable dividend yield of 3.24%, supported by a low payout ratio of 28.2%, indicating sustainability despite forecasted earnings declines. Dividends have been stable and growing over the past decade, enhancing their appeal to income-focused investors. Recent board expansions may influence future governance positively, although the dividend yield remains below top-tier US market levels. The stock trades at a substantial discount to its estimated fair value, suggesting potential undervaluation relative to peers.

- Click here to discover the nuances of Mercantile Bank with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Mercantile Bank is priced lower than what may be justified by its financials.

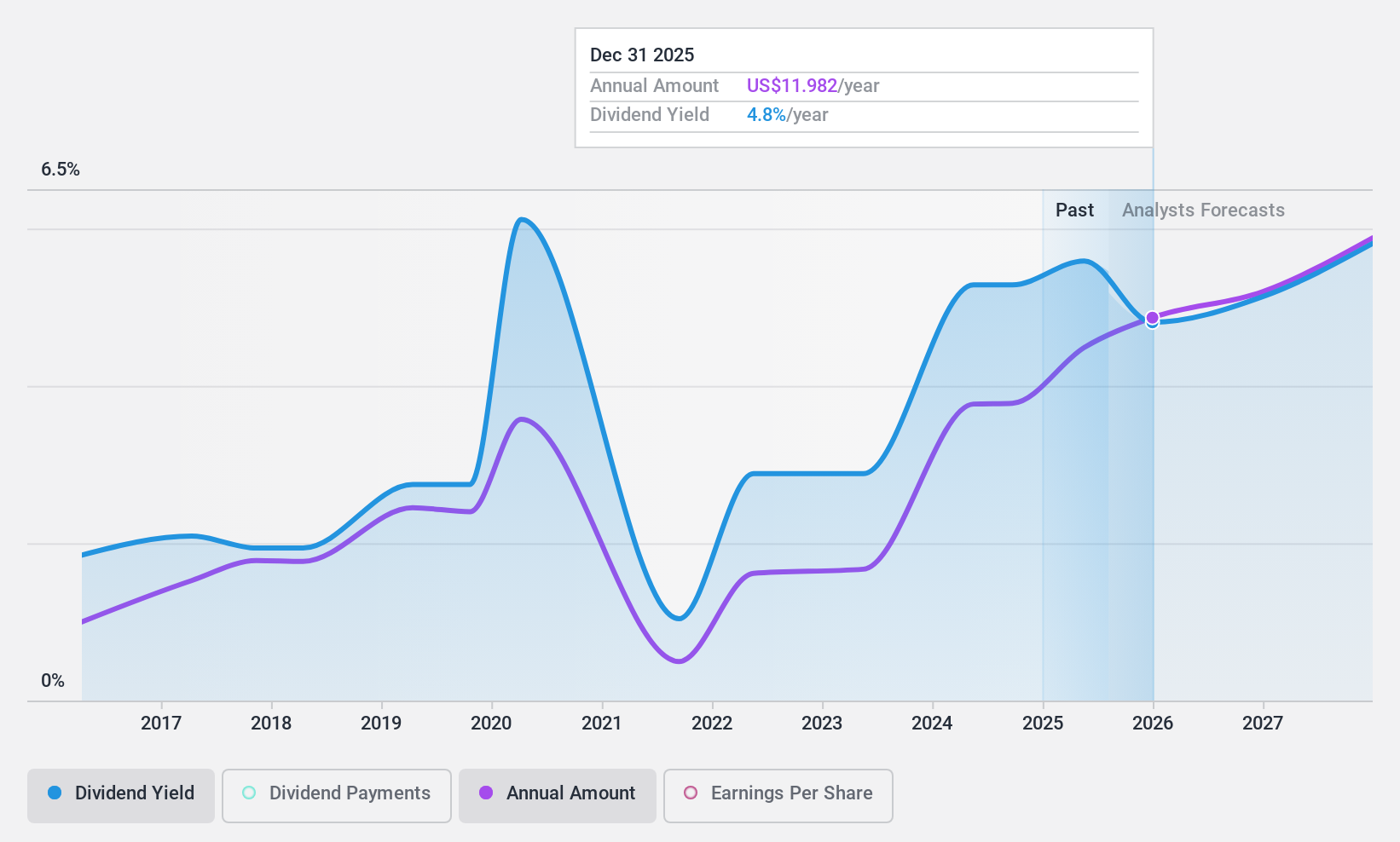

Credicorp (NYSE:BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. is a company offering financial, insurance, and health services primarily in Peru and internationally, with a market cap of approximately $14.92 billion.

Operations: Credicorp Ltd.'s revenue segments include financial services, insurance, and health services, with amounts provided in millions of PEN.

Dividend Yield: 4.9%

Credicorp's dividend yield of 4.89% ranks in the top 25% among US dividend payers, with a payout ratio of 53.3%, indicating coverage by earnings and forecasted sustainability over three years. Despite earnings growth of 3.6%, past dividends have been volatile, experiencing drops over 20%. The stock trades at a significant discount to its estimated fair value but faces challenges with high non-performing loans at 5.9% and low allowance for bad loans at 99%.

- Click here and access our complete dividend analysis report to understand the dynamics of Credicorp.

- Our expertly prepared valuation report Credicorp implies its share price may be lower than expected.

Key Takeaways

- Click this link to deep-dive into the 149 companies within our Top US Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet average dividend payer.