- United States

- /

- Banks

- /

- NasdaqGM:LSBK

Shareholders May Not Be So Generous With Lake Shore Bancorp, Inc.'s (NASDAQ:LSBK) CEO Compensation And Here's Why

In the past three years, the share price of Lake Shore Bancorp, Inc. (NASDAQ:LSBK) has struggled to generate growth for its shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 19 May 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for Lake Shore Bancorp

Comparing Lake Shore Bancorp, Inc.'s CEO Compensation With the industry

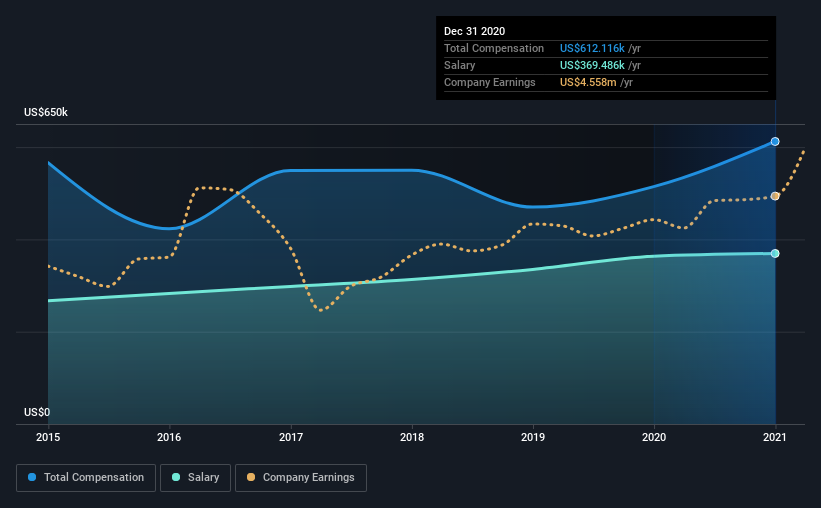

Our data indicates that Lake Shore Bancorp, Inc. has a market capitalization of US$82m, and total annual CEO compensation was reported as US$612k for the year to December 2020. We note that's an increase of 19% above last year. We note that the salary portion, which stands at US$369.5k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$535k. This suggests that Lake Shore Bancorp remunerates its CEO largely in line with the industry average. Moreover, Dan Reininga also holds US$982k worth of Lake Shore Bancorp stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$369k | US$363k | 60% |

| Other | US$243k | US$151k | 40% |

| Total Compensation | US$612k | US$514k | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Lake Shore Bancorp pays out 60% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Lake Shore Bancorp, Inc.'s Growth

Over the past three years, Lake Shore Bancorp, Inc. has seen its earnings per share (EPS) grow by 17% per year. It achieved revenue growth of 9.4% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Lake Shore Bancorp, Inc. Been A Good Investment?

Since shareholders would have lost about 10% over three years, some Lake Shore Bancorp, Inc. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Lake Shore Bancorp that you should be aware of before investing.

Switching gears from Lake Shore Bancorp, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Lake Shore Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:LSBK

Lake Shore Bancorp

Operates as the bank holding company for Lake Shore Bank that provides banking products and services in New York.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026