- United States

- /

- Banks

- /

- NasdaqGS:IBCP

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As U.S. markets grapple with heightened volatility and concerns over new tariffs, investors are seeking stability amid the turbulence. In such an environment, dividend stocks can offer a reliable income stream, providing a cushion against market swings while potentially enhancing long-term portfolio resilience.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 5.42% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.93% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.76% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.82% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.77% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.41% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 5.21% | ★★★★★★ |

Click here to see the full list of 177 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Independent Bank (NasdaqGS:IBCP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corporation, with a market cap of $591.64 million, operates as the bank holding company for Independent Bank, offering various banking services across the United States.

Operations: Independent Bank Corporation generates its revenue primarily from its banking services segment, which amounts to $221.35 million.

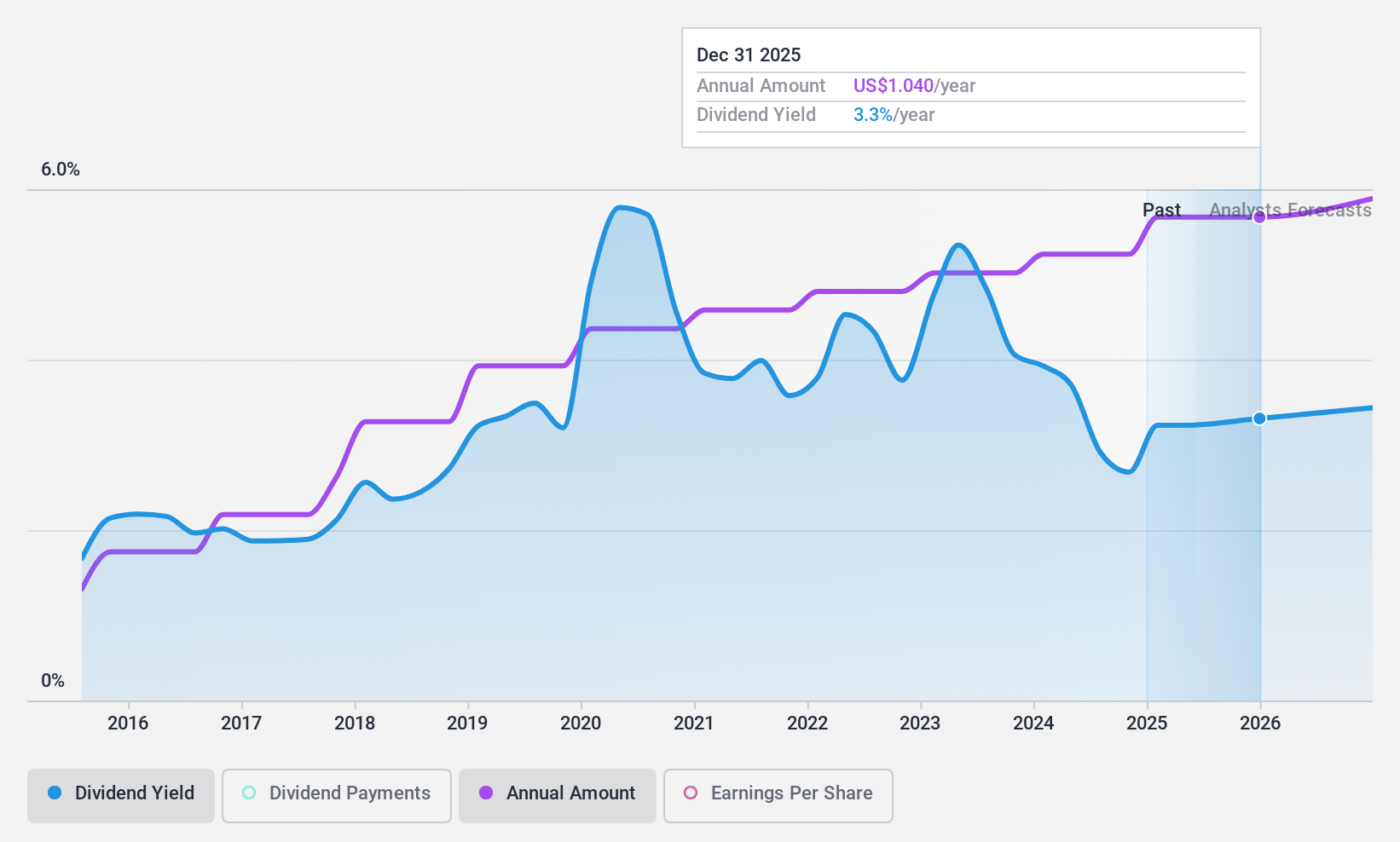

Dividend Yield: 3.6%

Independent Bank offers a stable dividend with a current yield of 3.64%, though lower than the top 25% of US dividend payers. The dividends have been consistently reliable and are well covered by earnings, with a payout ratio of 30%. Recent financials show growth in net income and earnings per share, supporting future payouts. The company announced an 8% increase in its quarterly dividend for 2025, reflecting confidence in its financial health.

- Click here to discover the nuances of Independent Bank with our detailed analytical dividend report.

- Our valuation report unveils the possibility Independent Bank's shares may be trading at a discount.

United Bankshares (NasdaqGS:UBSI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Bankshares, Inc. operates as a provider of commercial and retail banking products and services in the United States, with a market capitalization of approximately $4.51 billion.

Operations: United Bankshares, Inc. generates revenue through its commercial and retail banking operations in the United States.

Dividend Yield: 4.7%

United Bankshares maintains a reliable dividend history, with recent affirmations of a US$0.37 per share payout for Q1 2025, amounting to US$53 million. The dividend yield stands at 4.7%, slightly below the top quartile of US payers but remains well-covered by earnings with a 53.7% payout ratio. Earnings showed modest growth last year and are expected to continue rising, supporting future dividends despite trading below estimated fair value by 42.6%.

- Unlock comprehensive insights into our analysis of United Bankshares stock in this dividend report.

- In light of our recent valuation report, it seems possible that United Bankshares is trading behind its estimated value.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (NYSE:BLX) is a financial institution that specializes in providing trade financing solutions primarily within Latin America, with a market cap of approximately $1.21 billion.

Operations: Banco Latinoamericano de Comercio Exterior S.A. generates its revenue from two main segments: Treasury, contributing $27.87 million, and Commercial, which accounts for $258.47 million.

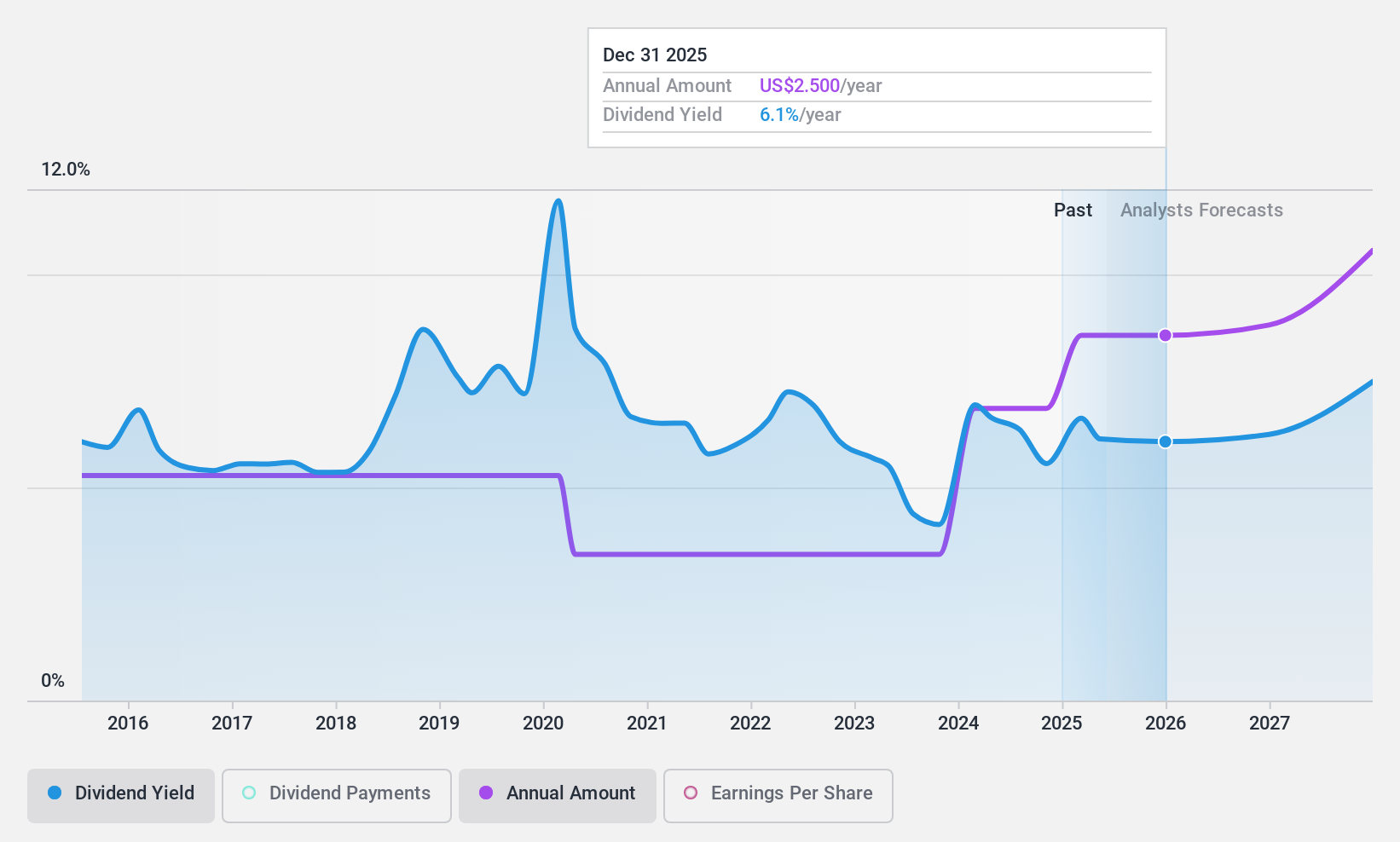

Dividend Yield: 7.5%

Banco Latinoamericano de Comercio Exterior, S.A. recently announced a quarterly dividend of US$0.625 per share, supported by a low payout ratio of 37.9%, indicating strong earnings coverage. Despite past volatility in dividends, its yield is among the top 25% in the US market. The bank's strategic initiatives like launching a digital trade finance platform and securing a US$200 million syndicated loan highlight operational growth potential, though dividend reliability remains uncertain due to historical inconsistencies.

- Navigate through the intricacies of Banco Latinoamericano de Comercio Exterior S. A with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Banco Latinoamericano de Comercio Exterior S. A's current price could be quite moderate.

Seize The Opportunity

- Take a closer look at our Top US Dividend Stocks list of 177 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBCP

Independent Bank

Operates as the bank holding company for Independent Bank that provides banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives