- United States

- /

- Banks

- /

- NasdaqGS:OZK

Independent Bank And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst ongoing economic concerns and recent fluctuations in major U.S. stock indices, investors are increasingly focused on strategies that can provide stability and income in uncertain times. Dividend stocks, known for their potential to offer consistent returns through regular payouts, can be an attractive addition to a portfolio, especially when navigating market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.39% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.68% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.29% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.00% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.01% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.49% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.12% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.79% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Independent Bank (NasdaqGS:IBCP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corporation, with a market cap of $710.04 million, operates as the bank holding company for Independent Bank, offering commercial banking services to individuals and businesses in rural and suburban communities in Michigan.

Operations: Independent Bank Corporation generates revenue of $218.14 million through its subsidiary, Independent Bank, by providing commercial banking services in Michigan.

Dividend Yield: 3.1%

Independent Bank's dividend strategy remains robust with a sustainable payout ratio of 30%, ensuring dividends are well-covered by earnings. The bank's dividends have been stable and growing over the past decade, recently increasing by 8% to US$0.26 per share. Despite a relatively low yield of 3.06%, the stock trades at an attractive valuation, significantly below its estimated fair value. Recent earnings growth and strategic buyback plans further underscore its financial health and commitment to shareholder returns.

- Click here to discover the nuances of Independent Bank with our detailed analytical dividend report.

- Our valuation report here indicates Independent Bank may be undervalued.

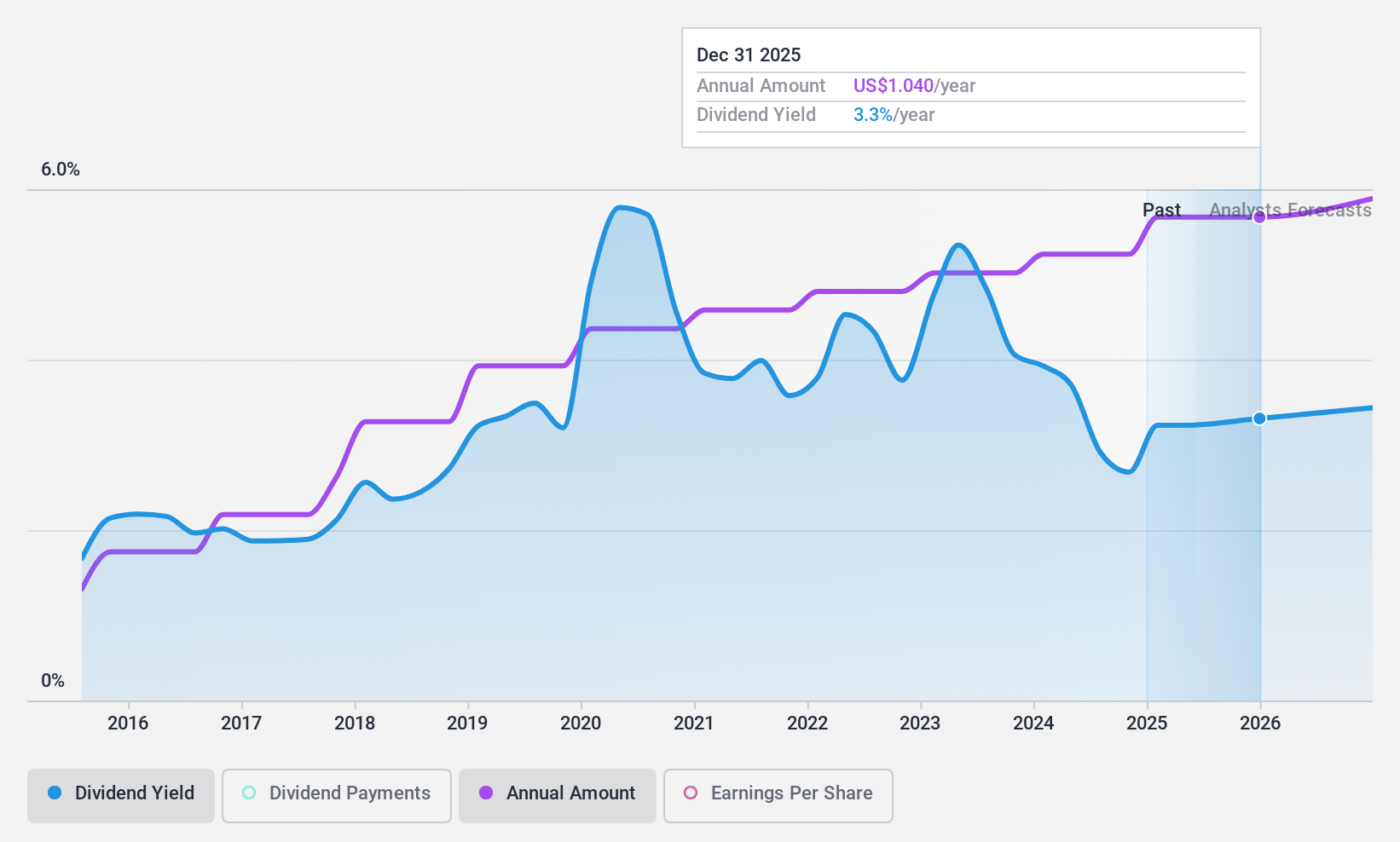

Bank OZK (NasdaqGS:OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK offers a range of retail and commercial banking services to individuals and businesses across the United States, with a market cap of approximately $5.45 billion.

Operations: Bank OZK generates revenue primarily through its Community Banking segment, which amounts to $1.48 billion.

Dividend Yield: 3.5%

Bank OZK's dividend strategy is marked by a sustainable payout ratio of 25.6%, indicating strong coverage by earnings. The bank has consistently increased its quarterly dividends for 58 consecutive quarters, with the latest rise to US$0.42 per share. Despite a lower yield of 3.5% compared to top-tier payers, the dividend remains reliable and stable over the past decade. Recent earnings growth supports continued dividend payments, while trading at a favorable valuation enhances its appeal for investors seeking income stability.

- Delve into the full analysis dividend report here for a deeper understanding of Bank OZK.

- Our comprehensive valuation report raises the possibility that Bank OZK is priced lower than what may be justified by its financials.

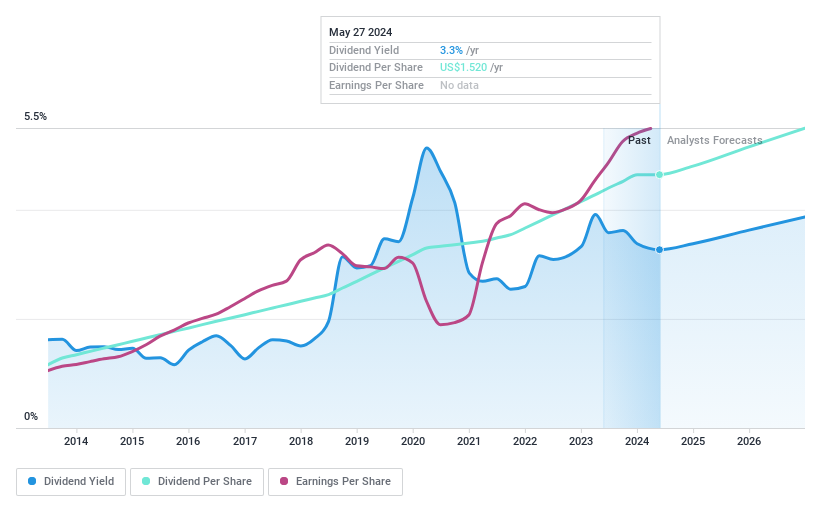

Coca-Cola FEMSA. de (NYSE:KOF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V., with a market cap of $18.73 billion, is a franchise bottler that produces, markets, sells, and distributes Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil.

Operations: Coca-Cola FEMSA generates revenue primarily from its Non-Alcoholic Beverages segment, which accounted for MX$279.79 billion.

Dividend Yield: 3.3%

Coca-Cola FEMSA offers a reliable dividend profile, with dividends covered by earnings and cash flows, reflected in payout ratios of 58.7% and 65.9% respectively. Its dividends have been stable and growing over the past decade, though its yield of 3.33% is modest compared to top-tier US payers. Recent financial performance shows robust growth, with net income rising to MXN 23.73 billion for the full year 2024, supporting continued dividend payments amidst favorable valuation metrics.

- Navigate through the intricacies of Coca-Cola FEMSA. de with our comprehensive dividend report here.

- According our valuation report, there's an indication that Coca-Cola FEMSA. de's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top US Dividend Stocks list of 142 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank OZK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OZK

Bank OZK

Provides various retail and commercial banking services for individuals and businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives