- United States

- /

- Machinery

- /

- NYSE:KMT

Top 3 US Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences slight fluctuations following record highs for the S&P 500, investors are keenly observing how major indices will react to ongoing economic signals and corporate earnings reports. In this climate, dividend stocks can offer a stable income stream and potential growth opportunities, making them an attractive option for those looking to bolster their portfolios amidst market uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.23% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.16% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.11% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.48% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.75% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.85% | ★★★★★★ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

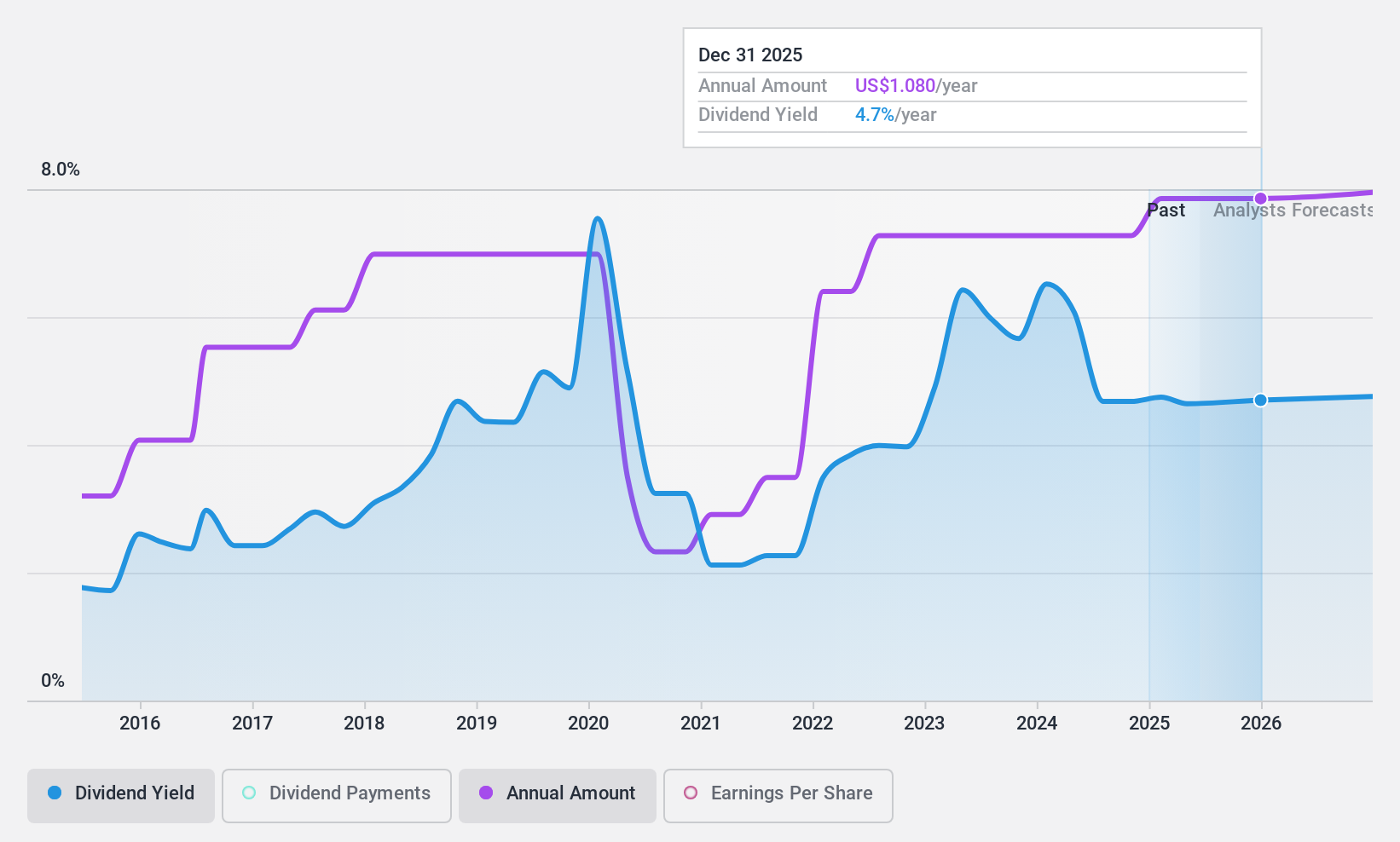

Hanmi Financial (NasdaqGS:HAFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanmi Financial Corporation, with a market cap of $743.69 million, operates as the holding company for Hanmi Bank, offering business banking products and services in the United States.

Operations: Hanmi Financial Corporation generates revenue primarily through its financial services segment, which accounts for $229.94 million.

Dividend Yield: 4.4%

Hanmi Financial recently increased its dividend to US$0.27 per share, marking an 8% rise from the previous quarter, with a payout ratio of 48.3%, indicating dividends are well covered by earnings. Despite a volatile dividend history over the past decade, the company's current value is considered favorable compared to peers and industry standards. However, recent financials show declining net income and earnings per share year-over-year, which may impact future dividend stability.

- Click here to discover the nuances of Hanmi Financial with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hanmi Financial shares in the market.

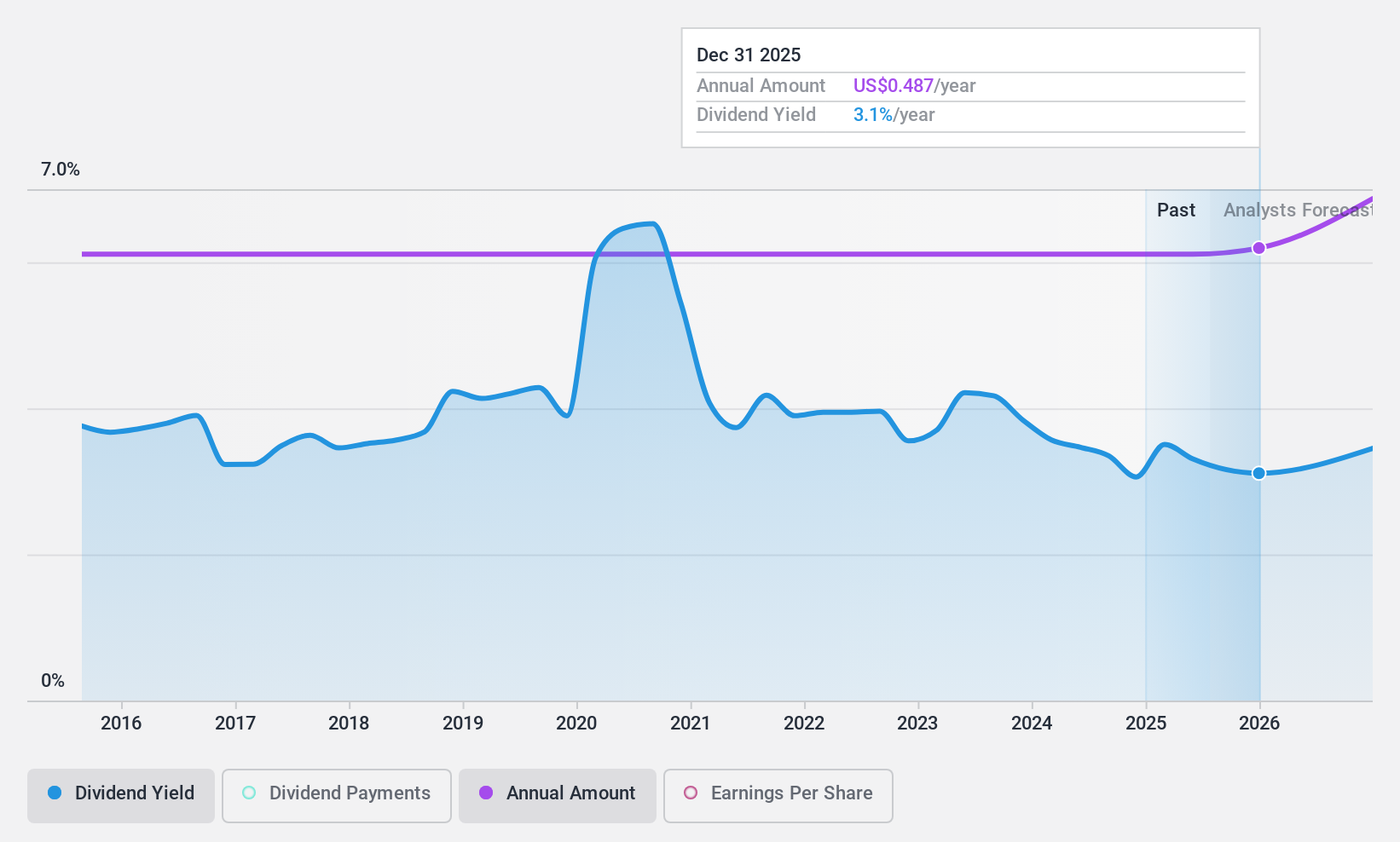

F.N.B (NYSE:FNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: F.N.B. Corporation is a bank and financial holding company offering various financial products and services to consumers, corporations, governments, and small- to medium-sized businesses in the United States, with a market cap of $5.61 billion.

Operations: F.N.B. Corporation generates revenue through its diverse financial offerings to a broad range of clients, including consumers, corporations, governments, and small- to medium-sized businesses across the U.S.

Dividend Yield: 3.1%

F.N.B. Corporation offers a stable dividend of US$0.12 per share with a payout ratio of 37.8%, indicating dividends are well covered by earnings, and this coverage is expected to improve in three years. While the dividend yield of 3.1% is below top-tier payers, it remains reliable despite not growing over the past decade. Recent developments include the opening of their new headquarters in Pittsburgh, enhancing operational efficiencies and potentially supporting future growth initiatives.

- Click to explore a detailed breakdown of our findings in F.N.B's dividend report.

- Our valuation report unveils the possibility F.N.B's shares may be trading at a discount.

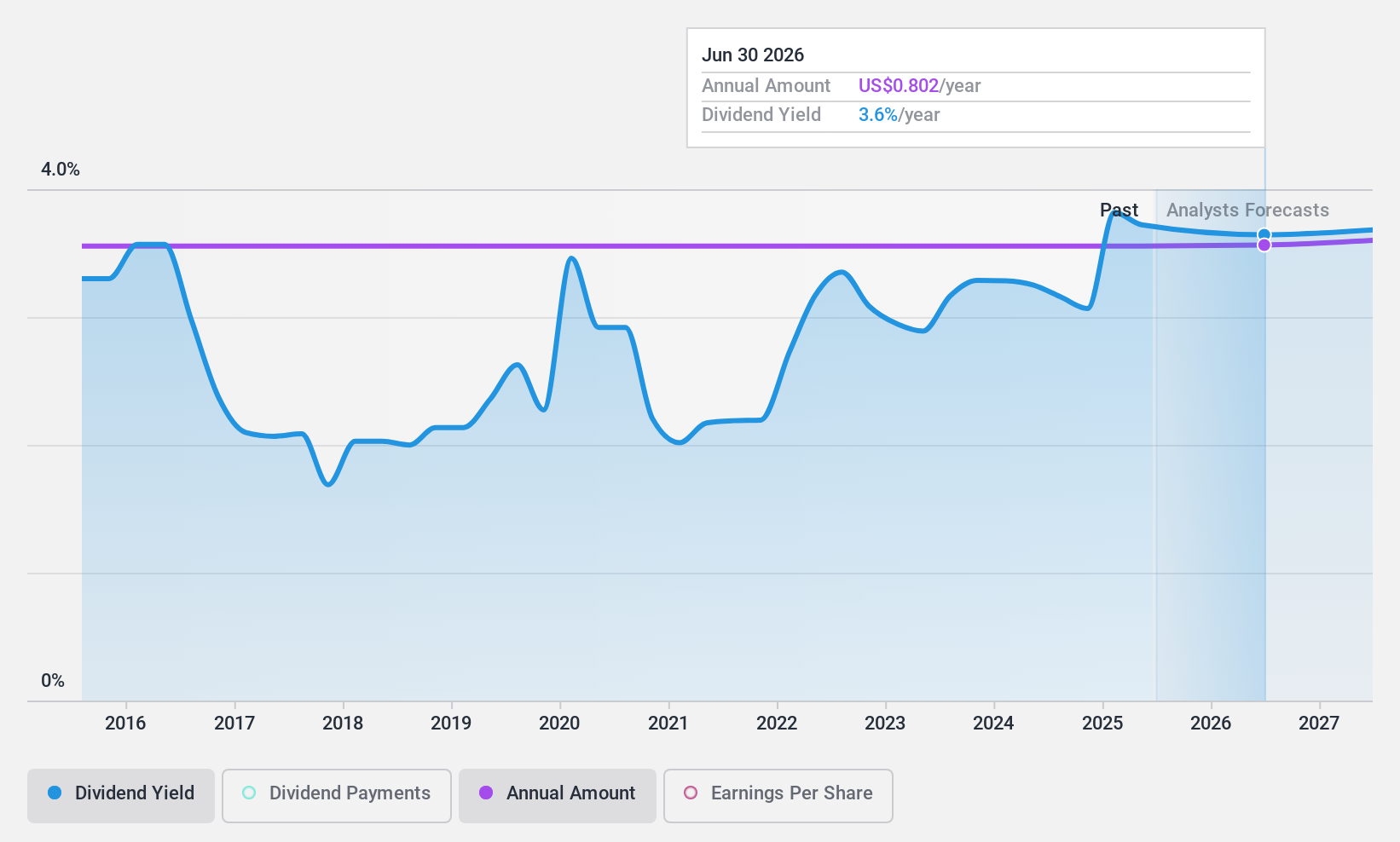

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. specializes in developing and applying tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications, with a market cap of approximately $1.76 billion.

Operations: Kennametal Inc.'s revenue is primarily derived from its Metal Cutting segment, which generated $1.26 billion, and its Infrastructure segment, which contributed $767.31 million.

Dividend Yield: 3.5%

Kennametal offers a stable dividend of US$0.20 per share, supported by a payout ratio of 65.2%, ensuring coverage by earnings and cash flows. Despite recent earnings declines, the dividend remains reliable, having grown over the past decade. The company's ongoing share buyback program and recent board changes indicate strategic adjustments amid legal challenges involving intellectual property disputes with MachiningCloud, seeking significant damages from Kennametal.

- Take a closer look at Kennametal's potential here in our dividend report.

- Upon reviewing our latest valuation report, Kennametal's share price might be too pessimistic.

Turning Ideas Into Actions

- Investigate our full lineup of 134 Top US Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives