- United States

- /

- Banks

- /

- NasdaqGS:FUNC

Discover 3 Undervalued Small Caps In US With Recent Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, contributing to a 21% increase over the past year, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying small-cap stocks with potential for growth and recent insider buying can offer intriguing opportunities for investors seeking value in an expanding market.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| McEwen Mining | 3.8x | 2.0x | 49.80% | ★★★★★☆ |

| OptimizeRx | NA | 1.2x | 40.18% | ★★★★★☆ |

| First United | 12.7x | 3.4x | 36.16% | ★★★★☆☆ |

| Quanex Building Products | 30.7x | 0.8x | 43.87% | ★★★★☆☆ |

| Innovex International | 9.2x | 2.1x | 48.25% | ★★★★☆☆ |

| Arrow Financial | 15.0x | 3.3x | 43.11% | ★★★☆☆☆ |

| West Bancorporation | 15.5x | 4.7x | 43.32% | ★★★☆☆☆ |

| Franklin Financial Services | 14.9x | 2.4x | 25.83% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -84.57% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -40.35% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Capital Southwest (NasdaqGS:CSWC)

Simply Wall St Value Rating: ★★★★★☆

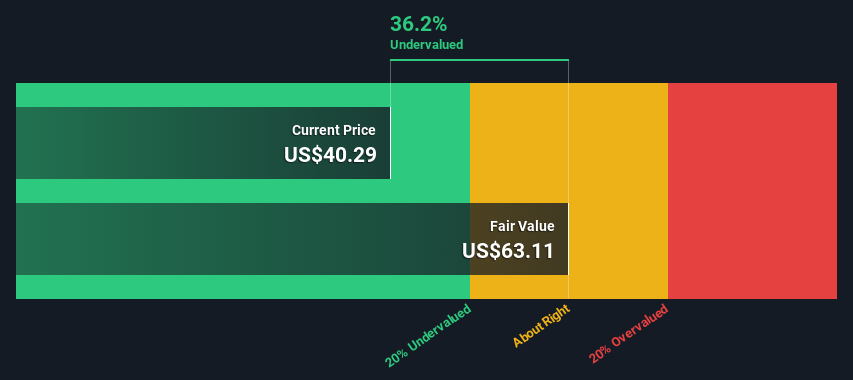

Overview: Capital Southwest is a business development company focused on providing financing solutions to middle-market companies, with a market capitalization of approximately $0.52 billion.

Operations: The company's revenue primarily comes from its investment activities, with a recent quarterly revenue of $198.46 million. Operating expenses have shown variability, with the latest figure at $25.51 million. The net income margin has fluctuated over time, recently recorded at 33.49%.

PE: 17.5x

Capital Southwest, a smaller U.S. company, recently announced a supplemental dividend of US$0.06 and a regular dividend of US$0.58 per share for Q1 2025, indicating steady shareholder returns despite lower net income of US$16.27 million in Q3 2024 compared to the previous year’s US$23.48 million. Revenue grew to US$51.97 million from last year's US$48.57 million, hinting at potential growth amid insider confidence from recent share purchases throughout 2024's latter half, reflecting management's belief in future prospects despite financial hurdles like high-risk funding sources and decreased profit margins from 52% to 33%.

- Take a closer look at Capital Southwest's potential here in our valuation report.

Understand Capital Southwest's track record by examining our Past report.

First United (NasdaqGS:FUNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First United is a financial services company providing banking and related services, with a market cap of approximately $0.16 billion.

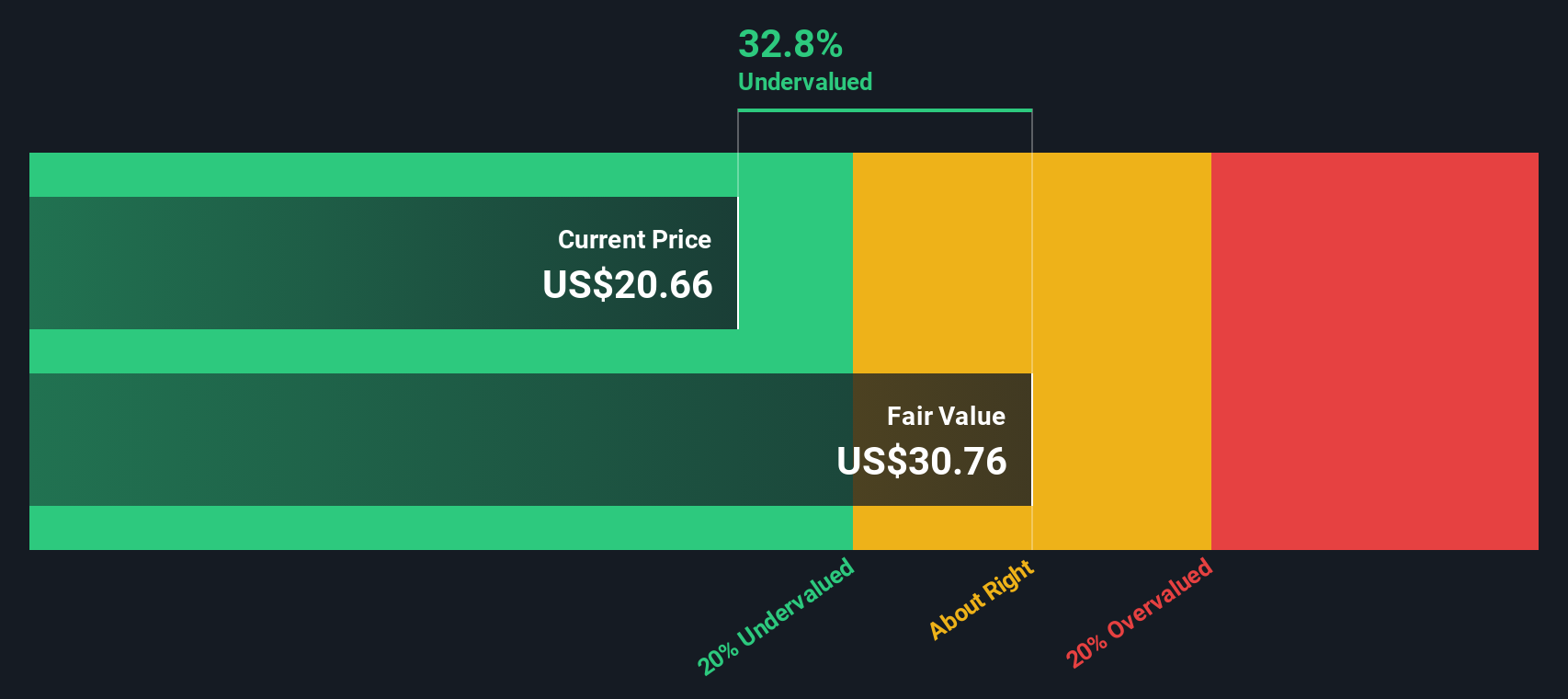

Operations: FUNC generates revenue entirely from its gross profit, with a consistent gross profit margin of 100% across all periods. Operating expenses are primarily driven by general and administrative expenses, which frequently exceed $30 million. The net income margin has shown variability, reaching as high as 33.82% in some periods but also dropping to lower levels such as 8.14%.

PE: 12.7x

First United's recent earnings reveal a significant boost, with net income rising to US$6.19 million in Q4 2024 from US$1.76 million the previous year, and annual net income reaching US$20.57 million. The firm’s earnings per share also jumped to US$0.95 from US$0.26 year-over-year for Q4, indicating strong financial health despite no share buybacks recently completed. With forecasted earnings growth of 14% annually, First United presents potential for future value appreciation amidst its sector challenges and opportunities.

- Dive into the specifics of First United here with our thorough valuation report.

Examine First United's past performance report to understand how it has performed in the past.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★☆☆☆

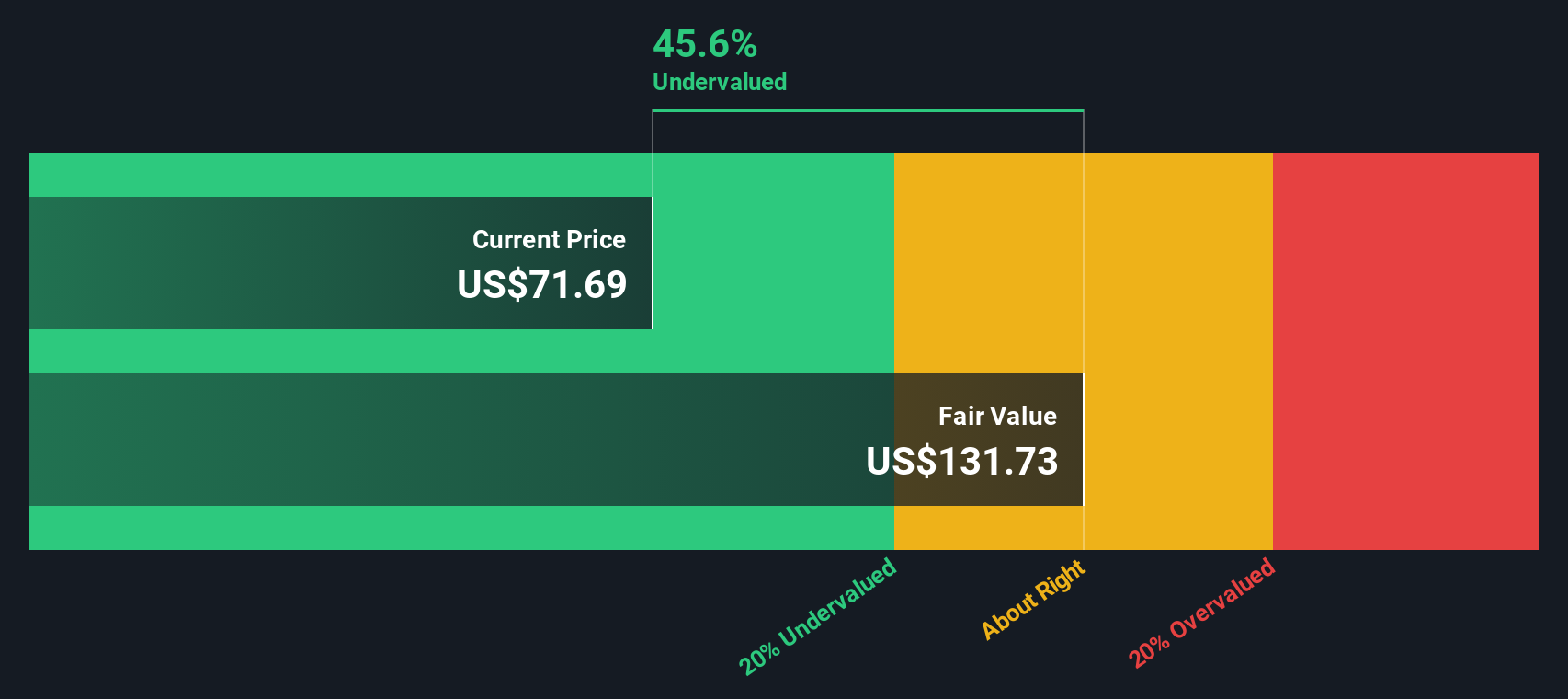

Overview: Tompkins Financial is a financial services company providing banking, insurance, and wealth management services with a market cap of approximately $1.01 billion.

Operations: The company generates revenue primarily from its operations, with a notable net income margin trend peaking at 31.13% in March 2021 and declining to 3.29% by March 2024 before recovering to 24.21% in December 2024. Operating expenses consistently form a significant portion of the company's cost structure, with general and administrative expenses being the largest component, reaching $148.11 million by December 2024.

PE: 14.4x

Tompkins Financial has shown strong financial performance, with net interest income rising to US$56.28 million in Q4 2024 from US$52.36 million the previous year, and net income increasing to US$19.66 million from US$15 million. Basic earnings per share improved to US$1.38 from US$1.06, reflecting operational efficiency. Insider confidence is evident as they have been purchasing shares recently, suggesting belief in future growth prospects supported by an expected annual earnings growth of 11.98%.

- Delve into the full analysis valuation report here for a deeper understanding of Tompkins Financial.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 49 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FUNC

First United

Operates as the bank holding company for First United Bank & Trust that provides various retail and commercial banking services to businesses and individuals.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives