- United States

- /

- Banks

- /

- NasdaqGS:FULT

Top Dividend Stocks Featuring First Merchants And Two More

Reviewed by Simply Wall St

As the U.S. equities market rebounds from a recent slump, investors are closely watching major indices like the Dow Jones Industrial Average and S&P 500, which have shown signs of recovery amidst ongoing economic uncertainties. In such a fluctuating environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking consistent returns in turbulent times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.81% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.81% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.03% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.21% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.62% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.37% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.91% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.45% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.82% | ★★★★★★ |

Click here to see the full list of 155 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

First Merchants (NasdaqGS:FRME)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Merchants Corporation is a financial holding company for First Merchants Bank, offering commercial and consumer banking services, with a market cap of $2.38 billion.

Operations: First Merchants Corporation generates revenue primarily through its Community Banking segment, which accounted for $610.99 million.

Dividend Yield: 3.4%

First Merchants Corporation recently declared a $0.35 per share dividend, payable on March 21, 2025. The company has maintained stable and growing dividends over the past decade, supported by a low payout ratio of 40.6%, indicating sustainability. Despite trading at a significant discount to estimated fair value, its dividend yield of 3.44% is below the top quartile in the US market but remains reliable with consistent earnings coverage projected for three years ahead at a 35.1% payout ratio.

- Unlock comprehensive insights into our analysis of First Merchants stock in this dividend report.

- Our valuation report here indicates First Merchants may be undervalued.

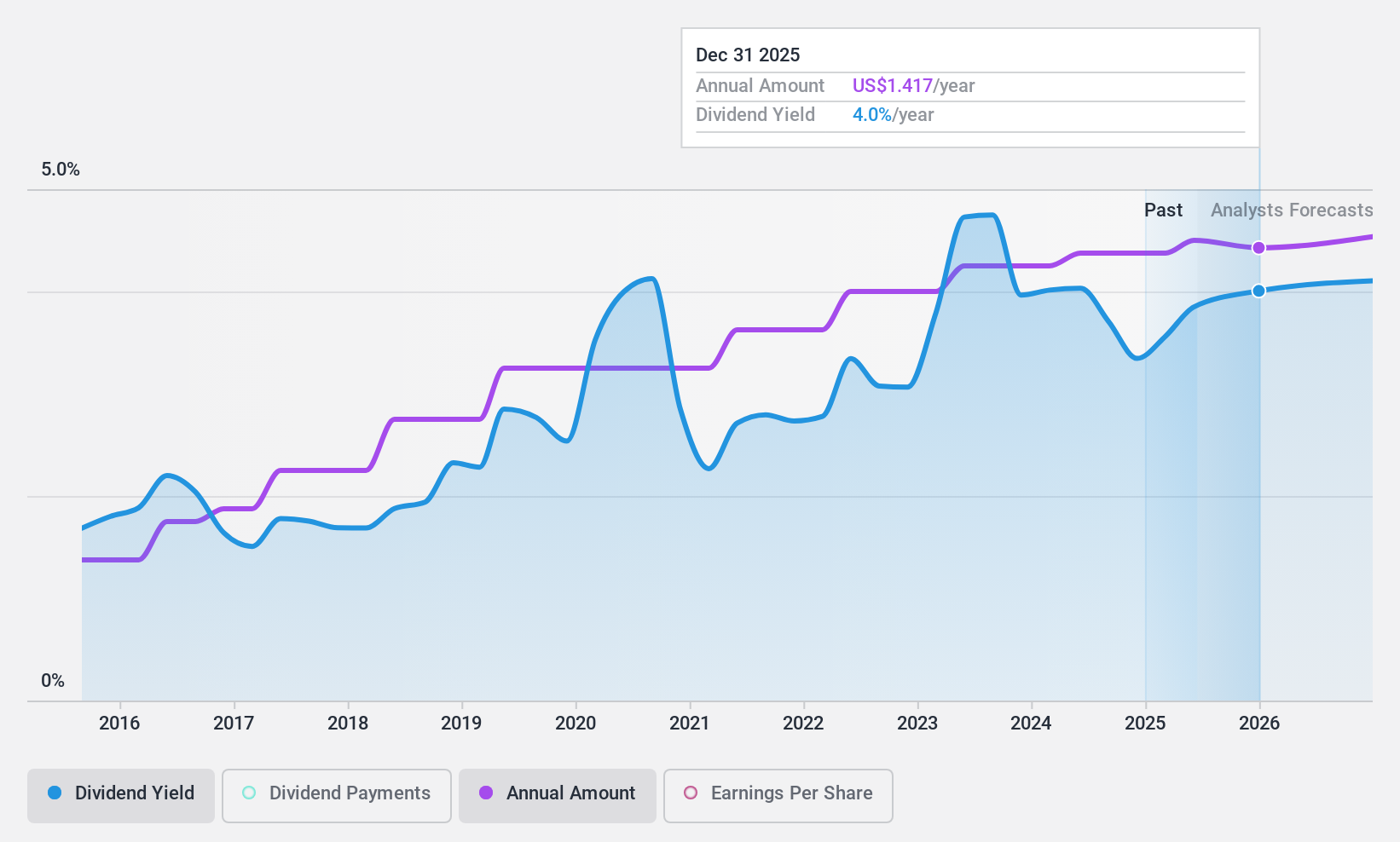

Fulton Financial (NasdaqGS:FULT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fulton Financial Corporation, with a market cap of $3.29 billion, operates as the bank holding company for Fulton Bank, offering a range of banking and financial products and services in the United States.

Operations: Fulton Financial Corporation generates its revenue primarily from its banking segment, which accounts for $1.15 billion.

Dividend Yield: 4%

Fulton Financial offers a reliable dividend yield of 3.95%, supported by a low payout ratio of 43.5%, ensuring earnings coverage and sustainability. The company's dividends have been stable and growing over the past decade, though its yield is below the top quartile in the US market. Despite trading at 54.8% below estimated fair value, recent executive changes might impact strategic direction, while earnings growth remains modest at 1.6% for the past year.

- Delve into the full analysis dividend report here for a deeper understanding of Fulton Financial.

- The analysis detailed in our Fulton Financial valuation report hints at an deflated share price compared to its estimated value.

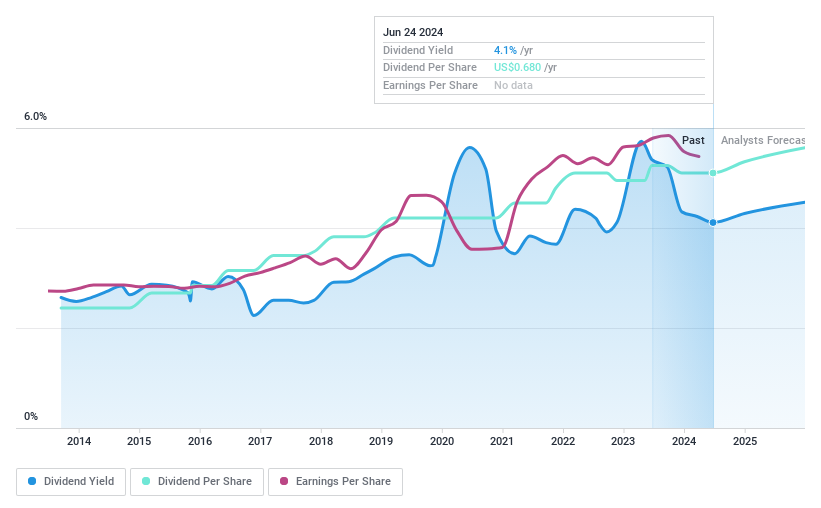

Coterra Energy (NYSE:CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of approximately $21.11 billion.

Operations: Coterra Energy Inc. generates its revenue primarily from the development, exploitation, exploration, and production of natural gas and oil, amounting to $5.24 billion.

Dividend Yield: 3.1%

Coterra Energy's dividend, recently increased to US$0.22 per share, is covered by earnings and cash flows with payout ratios of 55.7% and 65.7%, respectively, despite a history of volatility over the past decade. The company trades below its estimated fair value but faces challenges from significant insider selling and recent executive retirements. Although Coterra's dividend yield of 3.13% is lower than top-tier payers, its earnings are projected to grow substantially at 19.75% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of Coterra Energy.

- According our valuation report, there's an indication that Coterra Energy's share price might be on the cheaper side.

Seize The Opportunity

- Unlock our comprehensive list of 155 Top US Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FULT

Fulton Financial

Operates as the bank holding company for Fulton Bank that provides banking and financial products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.