- United States

- /

- Banks

- /

- NasdaqGS:TRST

3 US Dividend Stocks Offering Up To 5.6% Yield

Reviewed by Simply Wall St

As investors navigate the mixed signals from recent tariff developments and earnings reports, the U.S. stock market reflects a cautious optimism with varied performances across major indices. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance risk while capitalizing on yield opportunities.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.64% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.93% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.92% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.58% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

First Bancorp (NasdaqGS:FNLC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The First Bancorp, Inc. is the holding company for First National Bank, offering a variety of banking products and services to individuals and businesses, with a market cap of $288.26 million.

Operations: The First Bancorp, Inc. generates revenue primarily through its banking operations, amounting to $79.74 million.

Dividend Yield: 5.7%

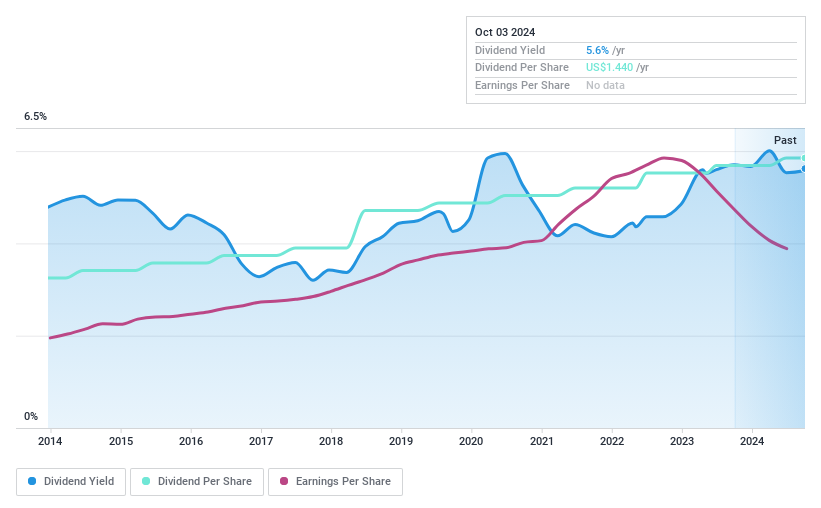

First Bancorp offers a compelling dividend profile with stable and growing dividends over the past decade. Its current dividend yield of 5.67% ranks in the top 25% of US payers, supported by a reasonable payout ratio of 58.4%. Despite recent earnings showing slight declines—net income at US$27.05 million from US$29.52 million—the company declared a consistent quarterly cash dividend of US$0.36 per share, reinforcing its reliability for income investors.

- Navigate through the intricacies of First Bancorp with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that First Bancorp is priced lower than what may be justified by its financials.

TrustCo Bank Corp NY (NasdaqGS:TRST)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TrustCo Bank Corp NY, with a market cap of $611.68 million, operates as the holding company for Trustco Bank, offering personal and business banking services to individuals and businesses.

Operations: TrustCo Bank Corp NY generates revenue primarily through its Community Banking segment, which accounts for $169.77 million.

Dividend Yield: 4.5%

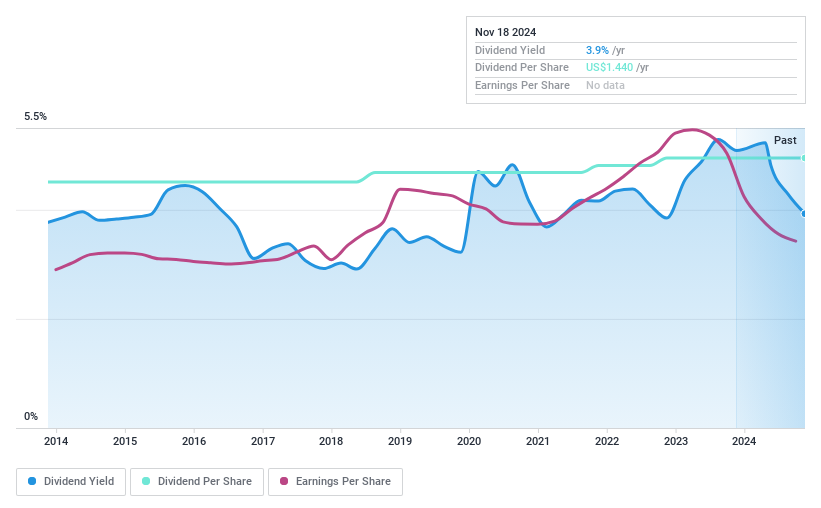

TrustCo Bank Corp NY maintains a solid dividend profile with stable and growing dividends over the past decade, supported by a reasonable payout ratio of 56.1%. Its current yield of 4.52% places it in the top 25% of US dividend payers. Recent events include a quarterly cash dividend declaration of $0.36 per share, payable on January 2, 2025, and reduced net charge offs to $102,000 for Q4 compared to $248,000 the previous year.

- Unlock comprehensive insights into our analysis of TrustCo Bank Corp NY stock in this dividend report.

- Upon reviewing our latest valuation report, TrustCo Bank Corp NY's share price might be too pessimistic.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX) is a financial institution that specializes in providing trade financing solutions across Latin America, with a market cap of approximately $1.38 billion.

Operations: Banco Latinoamericano de Comercio Exterior S. A's revenue is derived from two main segments: Treasury, contributing $29.70 million, and Commercial, generating $250.08 million.

Dividend Yield: 5.4%

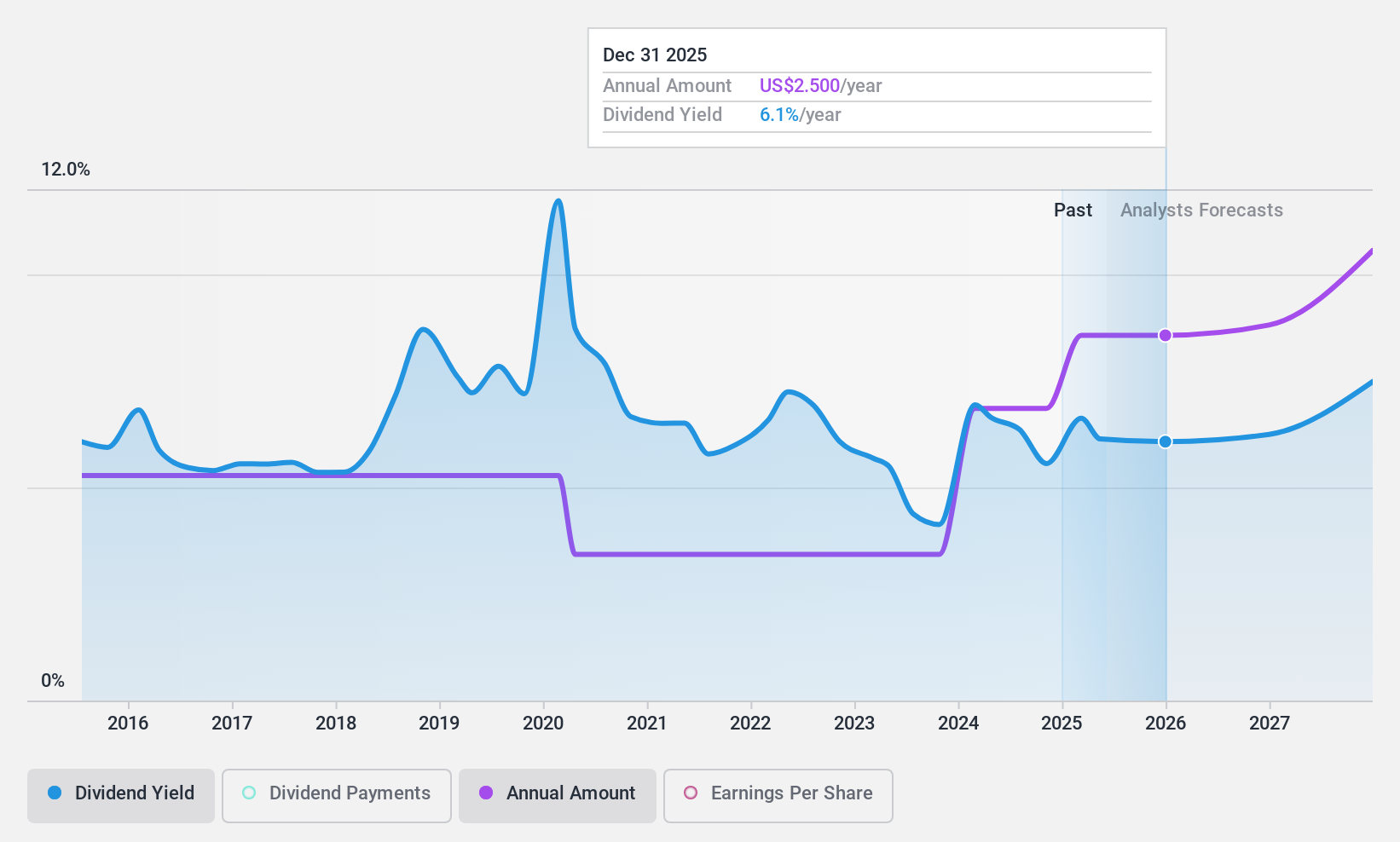

Banco Latinoamericano de Comercio Exterior, S.A. offers a high dividend yield of 5.35%, ranking in the top 25% among US dividend payers. Despite its attractive yield, the bank's dividends have been volatile over the past decade and lack reliability, with occasional significant drops exceeding 20%. The company’s low payout ratio of 36.5% suggests dividends are currently well covered by earnings, though future sustainability remains uncertain due to insufficient data on long-term coverage.

- Take a closer look at Banco Latinoamericano de Comercio Exterior S. A's potential here in our dividend report.

- According our valuation report, there's an indication that Banco Latinoamericano de Comercio Exterior S. A's share price might be on the cheaper side.

Next Steps

- Click this link to deep-dive into the 140 companies within our Top US Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TrustCo Bank Corp NY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRST

TrustCo Bank Corp NY

Operates as the holding company for Trustco Bank, a federal savings bank that provides personal and business banking services to individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives