- United States

- /

- Banks

- /

- NasdaqCM:ACNB

Top US Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

As of August 2024, U.S. markets are experiencing a robust rally with the S&P 500 and Nasdaq Composite extending their winning streaks, buoyed by investor optimism and expectations of upcoming interest rate cuts from the Federal Reserve. With major indices nearing all-time highs, investors are increasingly looking towards dividend stocks as a reliable source of income amid market volatility. In such an environment, strong dividend stocks can offer stability and consistent returns, making them particularly attractive for those seeking to balance growth with income.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.94% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 5.44% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.60% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.14% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.09% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.81% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.60% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.44% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.49% | ★★★★★★ |

Click here to see the full list of 180 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

ACNB (NasdaqCM:ACNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACNB Corporation, a financial holding company with a market cap of $340.71 million, provides banking, insurance, and financial services to individual, business, and government customers in the United States.

Operations: ACNB Corporation generates revenue primarily from its banking segment, which accounts for $94.72 million, and its insurance segment, contributing $9.44 million.

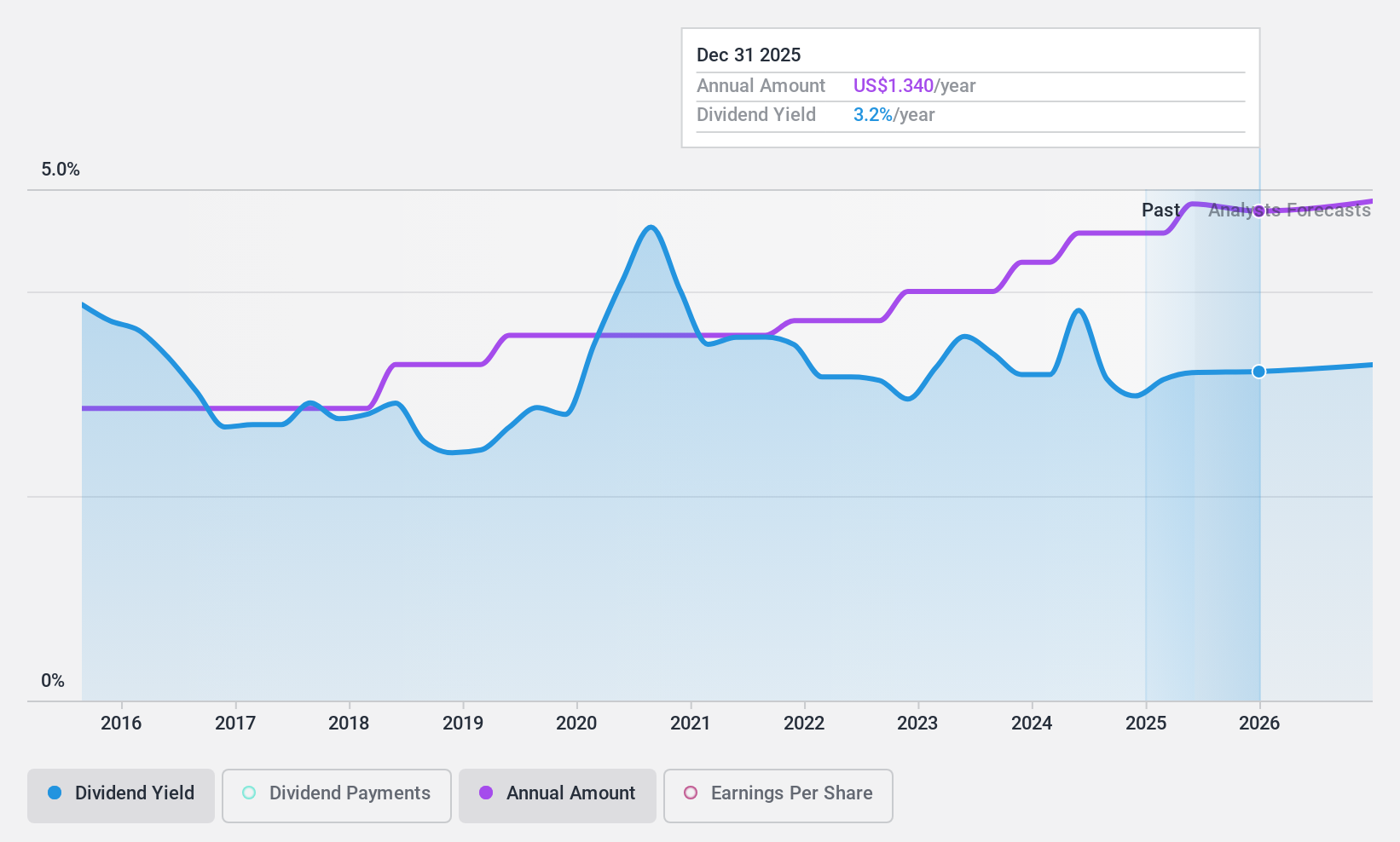

Dividend Yield: 3.2%

ACNB Corporation's dividend yield of 3.18% is lower than the top quartile of US dividend payers but remains reliable and well-covered by earnings with a payout ratio of 32.7%. Despite earnings forecasts to decline by 9.1% annually over the next three years, revenue is expected to grow at 14.54% per year. Recent earnings showed mixed results, with net income improving in Q2 but declining for the six months ended June 30, 2024. The company increased its quarterly dividend by 14.3%, reflecting stable and growing payouts over the past decade.

- Get an in-depth perspective on ACNB's performance by reading our dividend report here.

- The valuation report we've compiled suggests that ACNB's current price could be quite moderate.

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering banking, trust, and financial services to individuals, small businesses, and corporate customers with a market cap of $272.45 million.

Operations: Fidelity D & D Bancorp, Inc. generates $70.43 million from its banking, trust, and financial services segments.

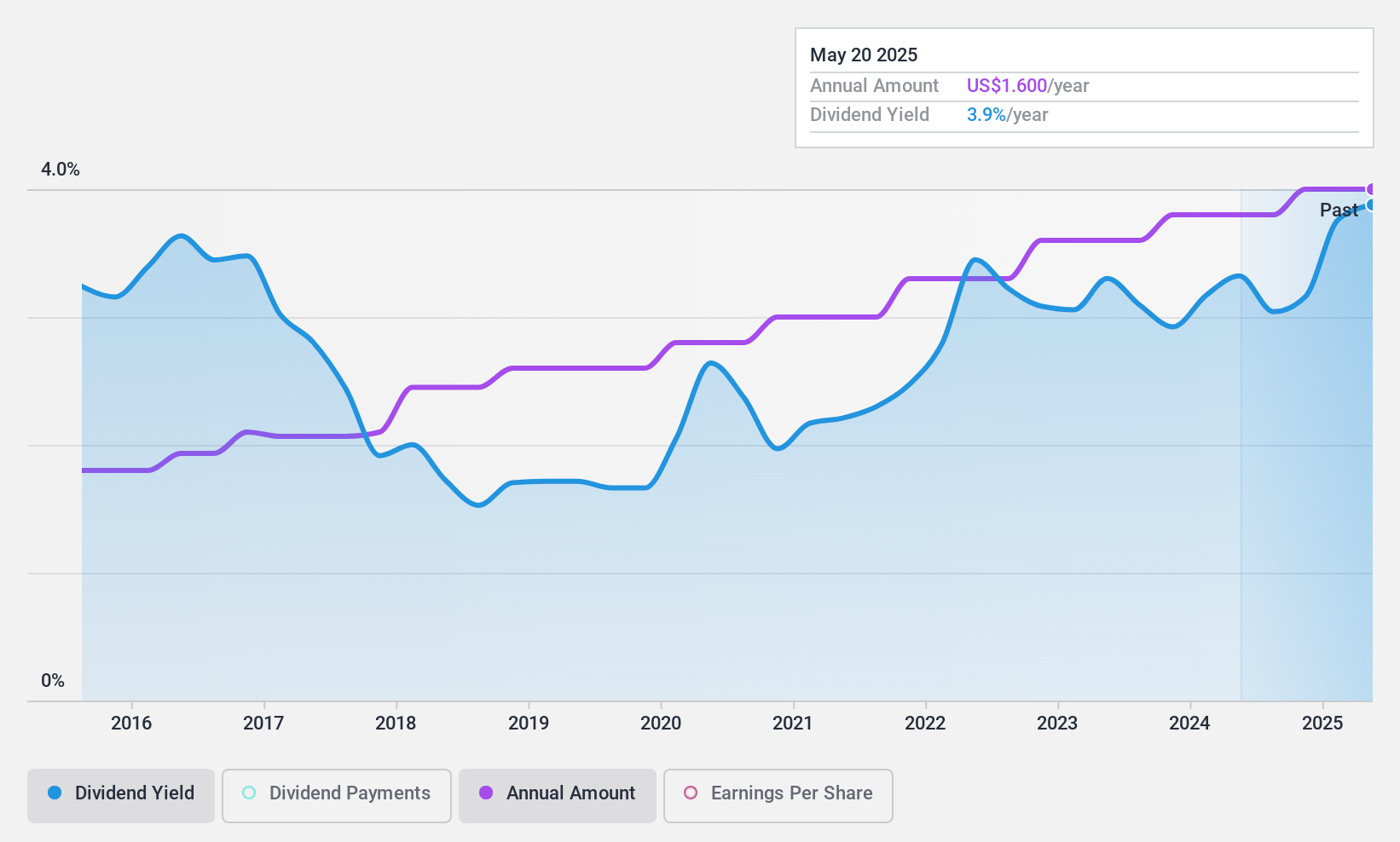

Dividend Yield: 3.1%

Fidelity D & D Bancorp's dividend yield of 3.14% is lower than the top quartile of US dividend payers but remains reliable and well-covered by earnings with a payout ratio of 54.2%. Dividends have been stable and growing over the past decade, though recent earnings showed a decline in net income for Q2 and the first half of 2024. Significant insider selling occurred recently, which may be a concern for some investors.

- Take a closer look at Fidelity D & D Bancorp's potential here in our dividend report.

- The analysis detailed in our Fidelity D & D Bancorp valuation report hints at an inflated share price compared to its estimated value.

First Bancorp (NasdaqGS:FNLC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The First Bancorp, Inc. operates as the holding company for First National Bank, offering a range of banking products and services to individuals and businesses, with a market cap of $280.05 million.

Operations: The company generates $77.08 million from its banking operations segment.

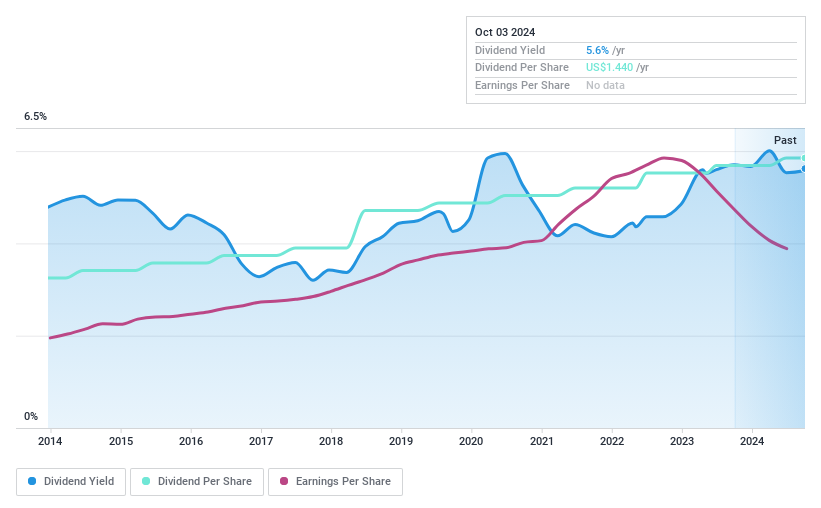

Dividend Yield: 5.6%

First Bancorp offers a high and reliable dividend yield of 5.56%, placing it in the top 25% of US dividend payers. The company's dividends have been stable and growing over the past decade, with a reasonable payout ratio of 59%. Recent earnings showed a decline, with Q2 net income at US$6.17 million compared to US$7.39 million last year. Additionally, the company declared an increased quarterly cash dividend of 36 cents per share in June 2024.

- Dive into the specifics of First Bancorp here with our thorough dividend report.

- Our valuation report unveils the possibility First Bancorp's shares may be trading at a discount.

Make It Happen

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 177 more companies for you to explore.Click here to unveil our expertly curated list of 180 Top US Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026