- United States

- /

- Banks

- /

- NasdaqGM:FDBC

Is It Smart To Buy Fidelity D & D Bancorp, Inc. (NASDAQ:FDBC) Before It Goes Ex-Dividend?

Fidelity D & D Bancorp, Inc. (NASDAQ:FDBC) is about to trade ex-dividend in the next 4 days. Investors can purchase shares before the 16th of February in order to be eligible for this dividend, which will be paid on the 10th of March.

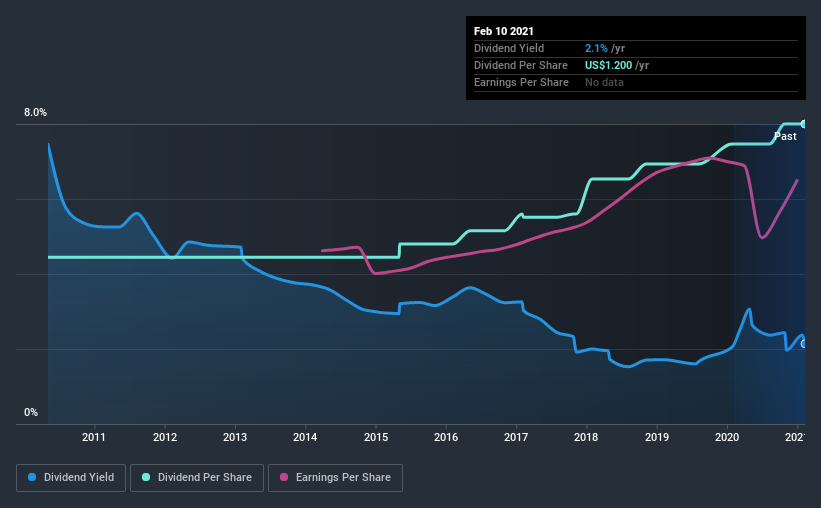

Fidelity D & D Bancorp's next dividend payment will be US$0.30 per share, and in the last 12 months, the company paid a total of US$1.20 per share. Last year's total dividend payments show that Fidelity D & D Bancorp has a trailing yield of 2.1% on the current share price of $56.09. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Fidelity D & D Bancorp

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Fidelity D & D Bancorp's payout ratio is modest, at just 40% of profit.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see how much of its profit Fidelity D & D Bancorp paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Fidelity D & D Bancorp earnings per share are up 7.9% per annum over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Fidelity D & D Bancorp has increased its dividend at approximately 6.1% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is Fidelity D & D Bancorp worth buying for its dividend? Fidelity D & D Bancorp has seen its earnings per share grow slowly in recent years, and the company reinvests more than half of its profits in the business, which generally bodes well for its future prospects. We think this is a pretty attractive combination, and would be interested in investigating Fidelity D & D Bancorp more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 1 warning sign for Fidelity D & D Bancorp and you should be aware of it before buying any shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Fidelity D & D Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion