- United States

- /

- Insurance

- /

- NasdaqGS:ITIC

Exploring 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals with major indices like the S&P 500 and Dow Jones aiming to extend their winning streaks, investors are closely watching economic indicators and Federal Reserve decisions that could impact small-cap companies. In this dynamic environment, identifying undiscovered gems requires a keen eye for stocks that demonstrate resilience and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: First Community Bankshares, Inc. serves as the financial holding company for First Community Bank, offering a range of banking products and services with a market capitalization of approximately $708.86 million.

Operations: First Community Bankshares generates revenue primarily from its community banking segment, amounting to $162.59 million. The company has a market capitalization of approximately $708.86 million.

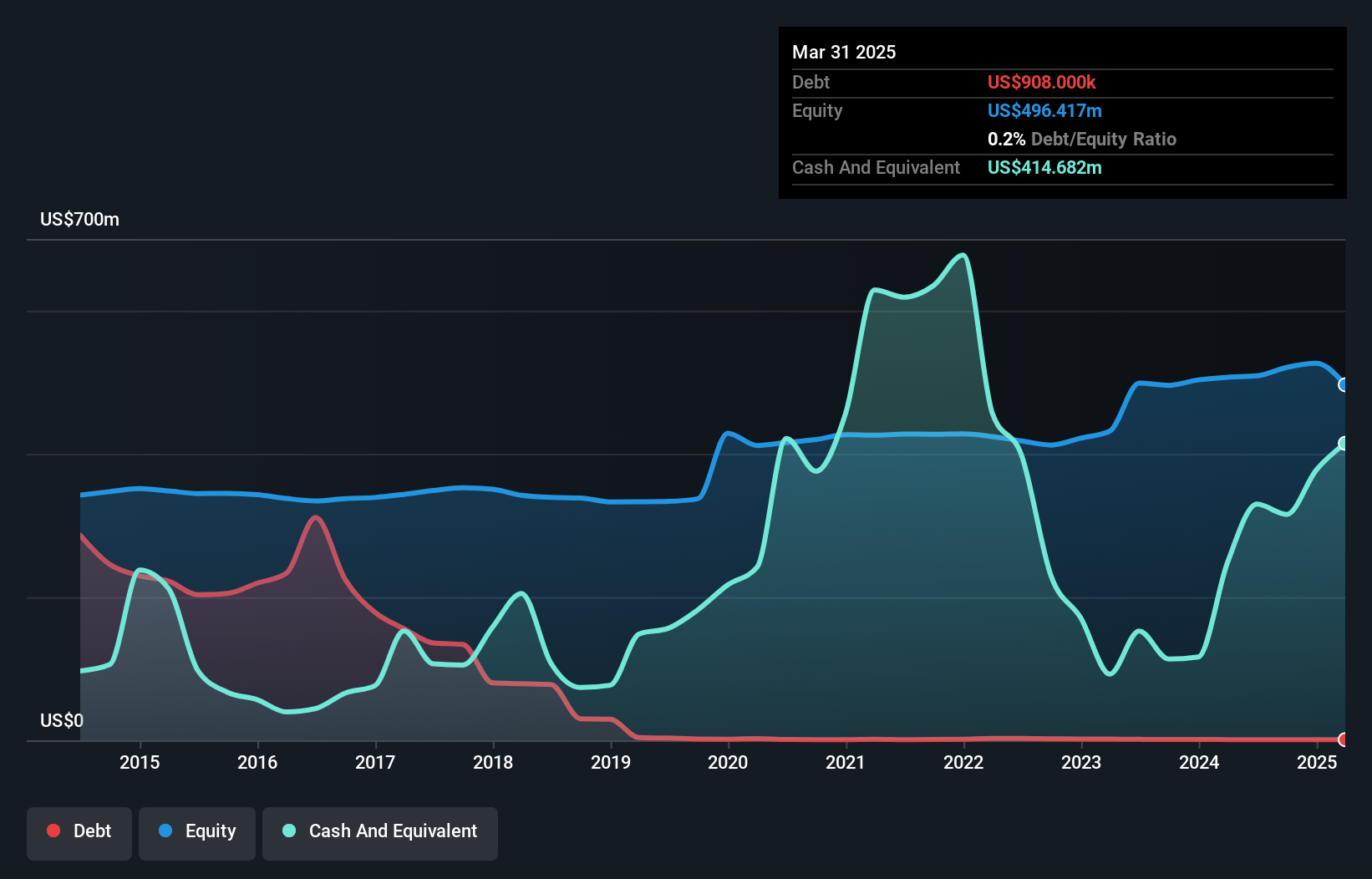

First Community Bankshares, with total assets of US$3.2 billion and equity of US$496.4 million, stands out for its high-quality earnings and primarily low-risk funding structure, as 98% of liabilities are customer deposits. The bank's non-performing loans are at an appropriate level of 0.8%, supported by a sufficient allowance covering 168% of bad loans. Despite trading at a notable discount to fair value by 28.7%, its earnings have grown annually by 6.3% over five years but lagged behind the industry last year with only a 3% increase compared to the industry's 4.6%.

- Delve into the full analysis health report here for a deeper understanding of First Community Bankshares.

Learn about First Community Bankshares' historical performance.

Investors Title (NasdaqGS:ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company specializes in providing title insurance for residential, institutional, commercial, and industrial properties, with a market capitalization of $454 million.

Operations: Investors Title generates revenue primarily from title insurance, contributing $255.33 million, and exchange services at $11.10 million.

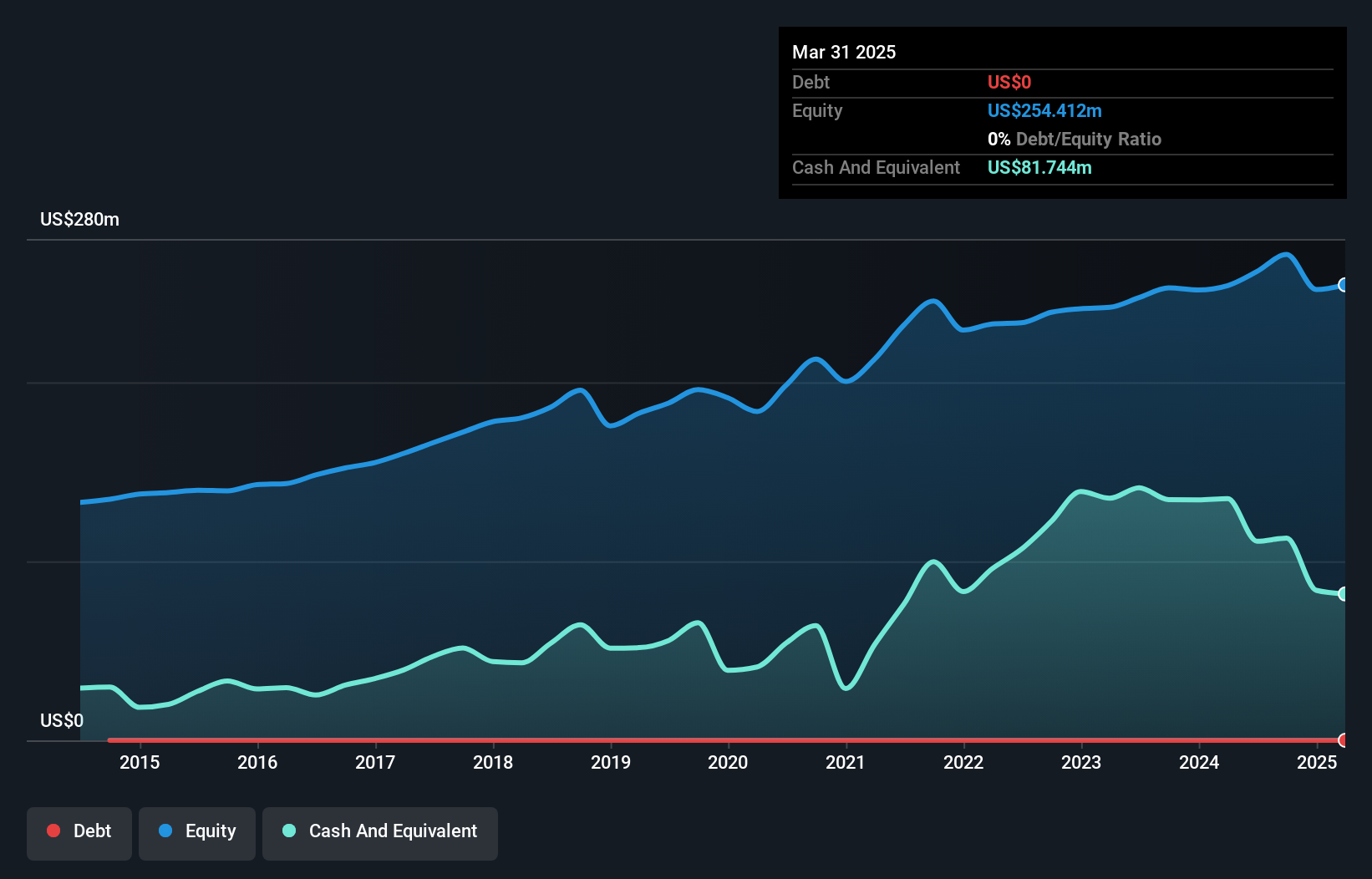

Investors Title, a nimble player in the insurance sector, has demonstrated impressive earnings growth of 43% over the past year, outpacing its industry peers. The company reported a full-year net income of US$31.07 million and revenue of US$258.3 million, marking significant improvements from previous figures. Trading at 19% below estimated fair value suggests potential undervaluation. With no debt on its books for five years and consistent free cash flow positivity, financial stability appears robust. Recent board changes include David L. Francis's retirement after decades of service, while dividends remain steady at $0.46 per share for shareholders as of March 2025.

- Dive into the specifics of Investors Title here with our thorough health report.

Assess Investors Title's past performance with our detailed historical performance reports.

Legacy Housing (NasdaqGS:LEGH)

Simply Wall St Value Rating: ★★★★★★

Overview: Legacy Housing Corporation focuses on the construction, sale, and financing of manufactured homes and tiny houses mainly in the southern United States, with a market capitalization of $608.54 million.

Operations: Legacy Housing Corporation generates revenue primarily from manufactured buildings, amounting to $184.19 million.

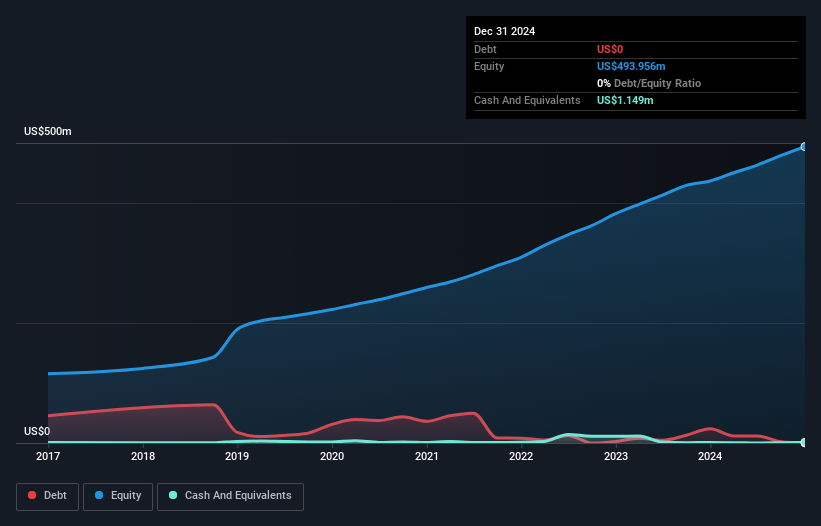

Legacy Housing, a nimble player in the housing sector, has demonstrated robust earnings growth of 13% over the past year, outpacing the Consumer Durables industry average of 3%. Debt-free and trading at an attractive valuation—82% below its estimated fair value—the company is well-positioned for future expansion. With high-quality earnings and positive free cash flow, Legacy's strategic moves in Texas and Georgia could bolster profit margins. Despite these strengths, potential risks include reliance on non-core asset sales and production cost challenges. Investors should weigh these factors against their expectations before making decisions.

Taking Advantage

- Click this link to deep-dive into the 282 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITIC

Investors Title

Engages in the issuance of residential and commercial title insurance for residential, institutional, commercial, and industrial properties.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives