- United States

- /

- Banks

- /

- NasdaqGS:CTBI

Discover 3 US Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with the S&P 500 surpassing 6,000 points for the first time since February amid easing trade tensions and strong corporate earnings, investors are increasingly on the lookout for opportunities in lesser-known stocks that could offer substantial growth potential. In this environment, identifying promising small-cap companies can be particularly rewarding as they often benefit from economic resilience and have room to grow within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

PC Connection (CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc. offers a range of information technology solutions globally and has a market capitalization of approximately $1.66 billion.

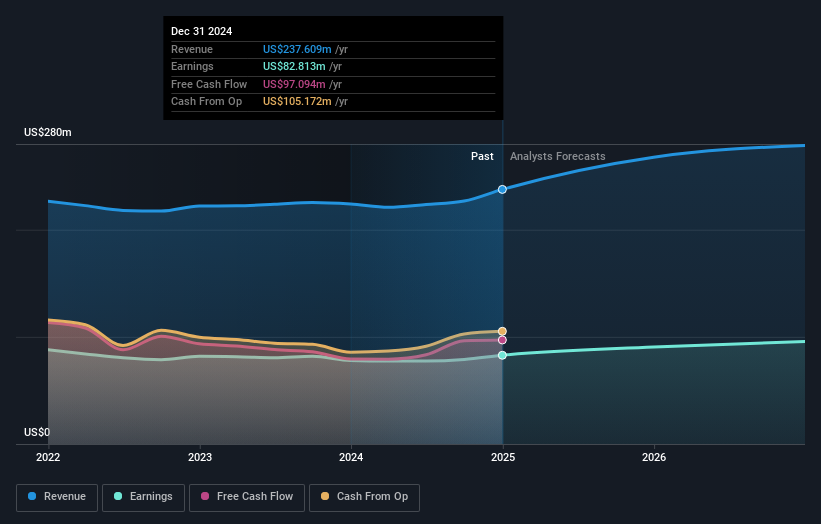

Operations: PC Connection generates revenue through three main segments: Business Solutions ($1.05 billion), Enterprise Solutions ($1.20 billion), and Public Sector Solutions ($622.99 million). The company's net profit margin provides insight into its profitability efficiency relative to its total revenue streams.

PC Connection, a nimble player in the tech sector, has been making waves with its strategic investments in AI and CRM systems aimed at enhancing efficiency. Over the past year, earnings grew by 6%, outpacing the electronic industry’s -4% performance. The company is debt-free and free cash flow positive, reflecting robust financial health. Recent initiatives include a $50 million increase in its buyback plan and a quarterly dividend of $0.15 per share, signaling management's confidence. Despite trading 7% below estimated fair value, challenges like supply chain issues could affect future profitability projections of $104 million by 2028.

Community Trust Bancorp (CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc., with a market cap of $939.60 million.

Operations: Community Trust Bancorp generates revenue primarily through its Community Banking Services, contributing $249.26 million. The net profit margin reflects the company's profitability trends over time.

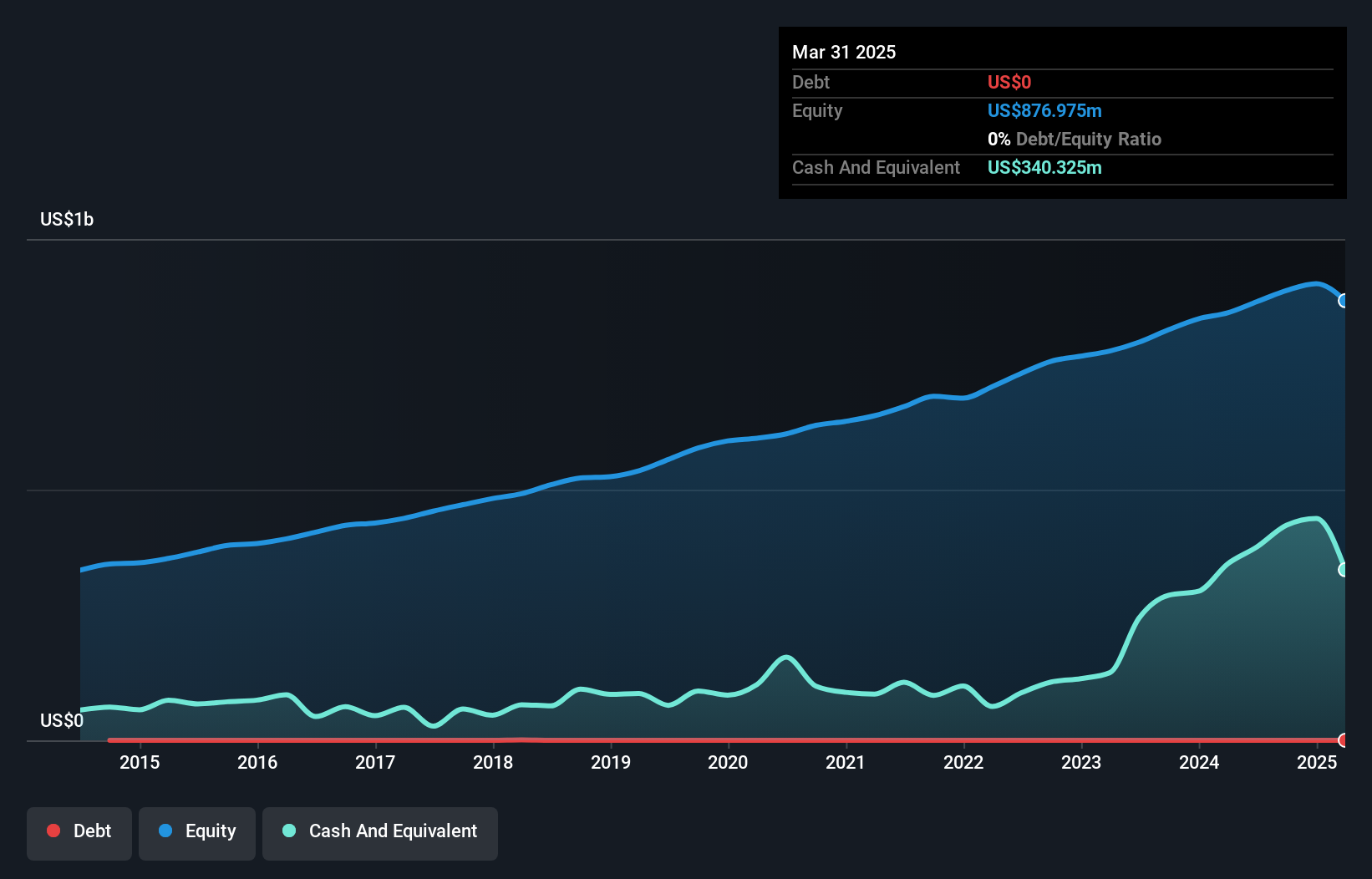

With total assets of $6.3 billion and equity of $784.2 million, Community Trust Bancorp is positioned as a noteworthy player in the banking sector. The company boasts a net interest margin of 3.4% and maintains a sufficient allowance for bad loans at 0.6% of total loans, reflecting prudent risk management practices. Deposits stand at $5.1 billion against loans totaling $4.6 billion, supported by primarily low-risk funding sources accounting for 93% of liabilities. Trading at nearly 59% below estimated fair value, CTBI's earnings growth outpaced the industry average over the past year with an impressive increase of 11%.

- Click to explore a detailed breakdown of our findings in Community Trust Bancorp's health report.

Understand Community Trust Bancorp's track record by examining our Past report.

First Community Bankshares (FCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: First Community Bankshares, Inc. is the financial holding company for First Community Bank, offering a range of banking products and services, with a market capitalization of $700.09 million.

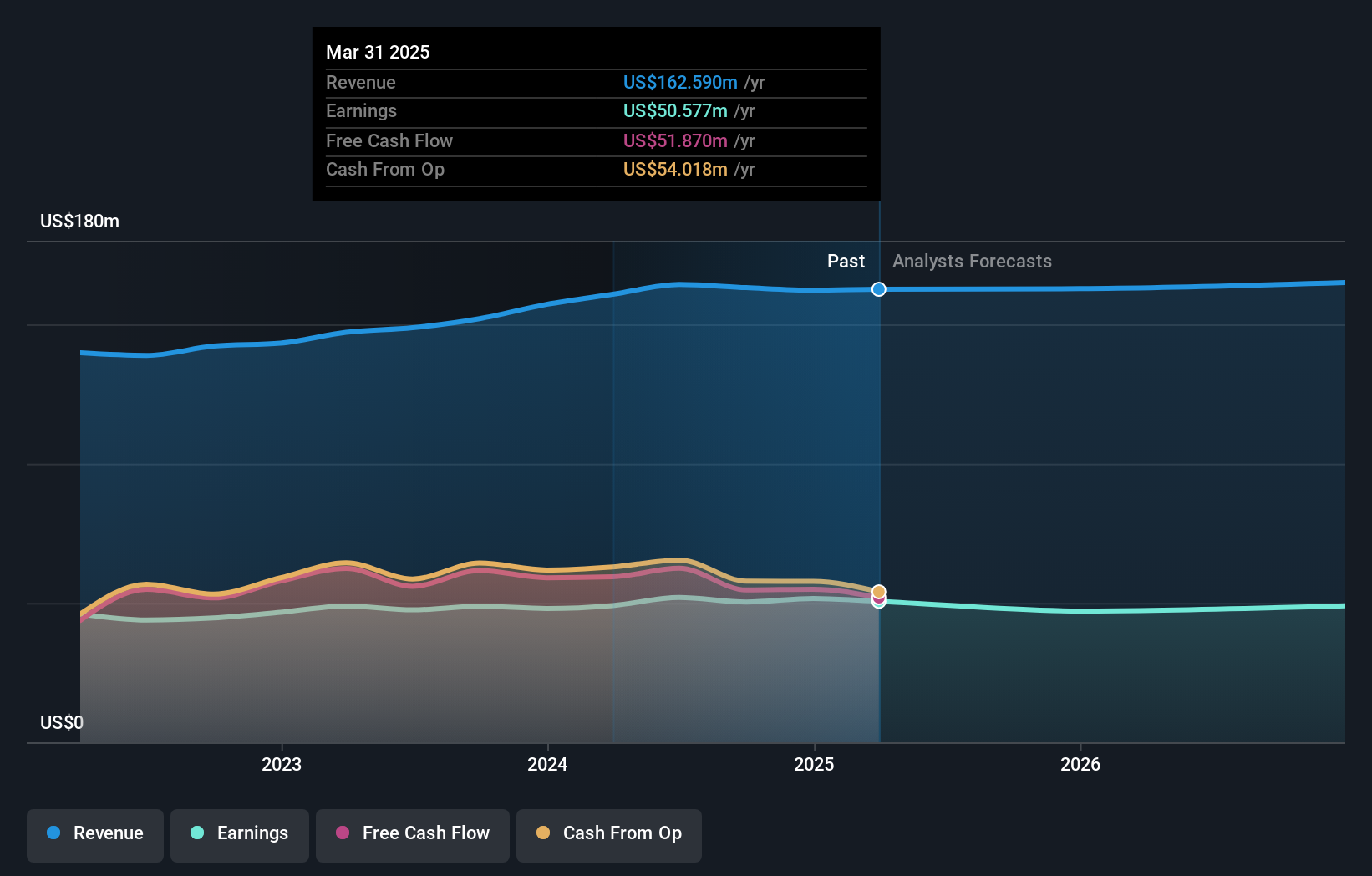

Operations: First Community Bankshares generates revenue primarily through its community banking segment, with reported revenues of $162.59 million.

First Community Bankshares, with assets totaling $3.2 billion and equity of $496.4 million, stands out for its primarily low-risk funding, as 98% of liabilities are customer deposits. The bank's total deposits and loans are $2.7 billion and $2.3 billion respectively, complemented by a net interest margin of 4.4%. It has a sufficient allowance for bad loans at 0.8% of total loans, ensuring financial stability amidst market fluctuations. Despite earnings growth averaging 6% annually over five years, future prospects indicate an average decline in earnings by 1.5% per year over the next three years.

Key Takeaways

- Click through to start exploring the rest of the 278 US Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives