- United States

- /

- Banks

- /

- NasdaqCM:FCAP

3 Dividend Stocks To Consider With Up To 5.3% Yield

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with major indices experiencing fluctuations due to investor reactions to corporate earnings and tariff announcements, dividend stocks continue to attract attention for their potential stability and income generation. In such uncertain times, selecting dividend stocks with strong yields can offer investors a reliable stream of income while potentially cushioning against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.43% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.77% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.76% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.55% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.96% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.32% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.97% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.20% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

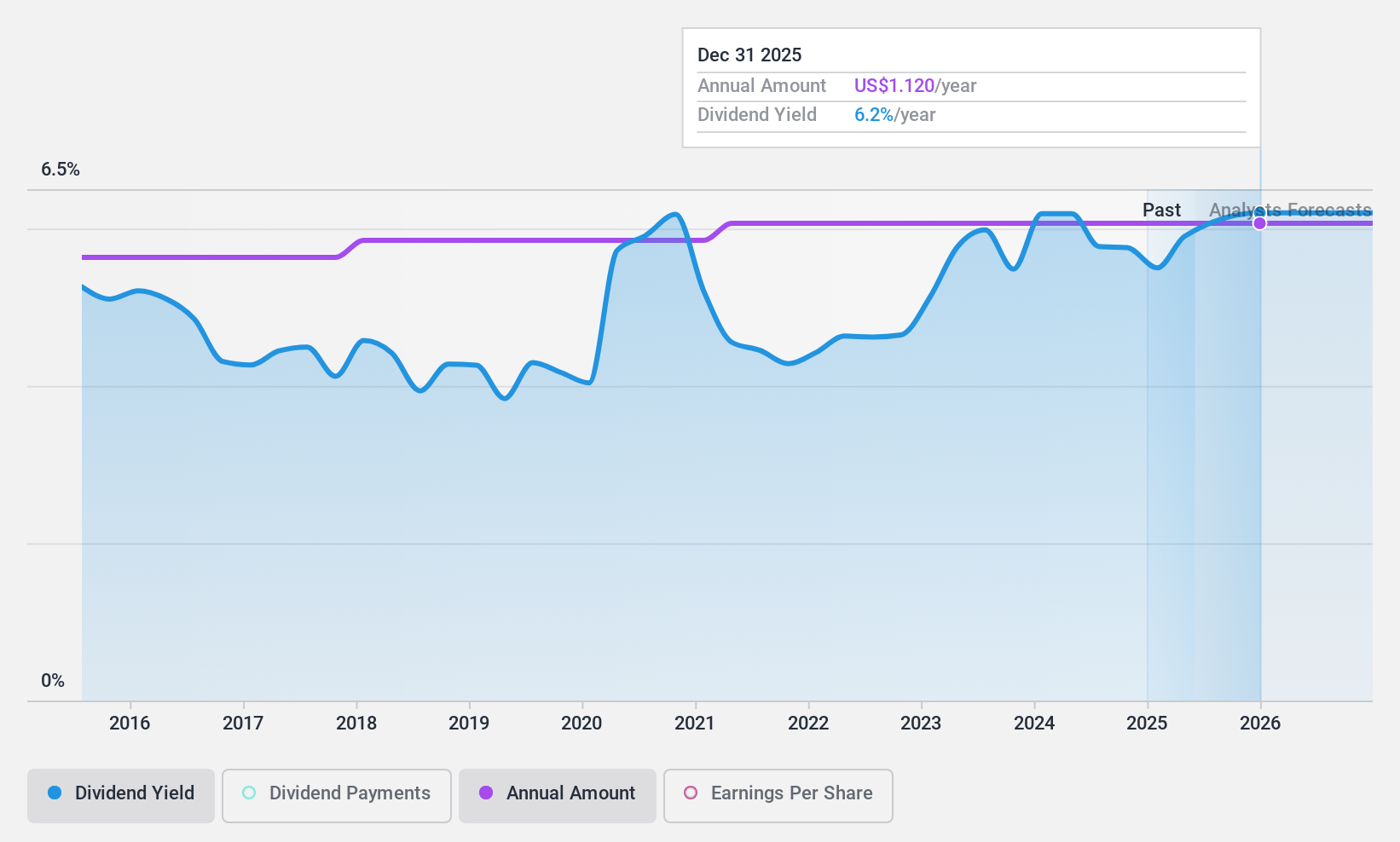

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Citizens & Northern Corporation, with a market cap of $323.64 million, operates as the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate customers.

Operations: Citizens & Northern Corporation generates revenue primarily from its Community Banking segment, which accounts for $106.13 million.

Dividend Yield: 5.3%

Citizens & Northern offers a stable dividend history, with payments increasing over the past decade and a current yield of 5.32%, placing it in the top 25% of U.S. dividend payers. The payout ratio is at 66.3%, suggesting dividends are well-covered by earnings, with future coverage forecasted to improve to 55.6%. Recent board actions affirmed a quarterly cash dividend of US$0.28 per share, maintaining its commitment to shareholder returns amidst stable earnings growth and value trading below estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Citizens & Northern.

- Our comprehensive valuation report raises the possibility that Citizens & Northern is priced lower than what may be justified by its financials.

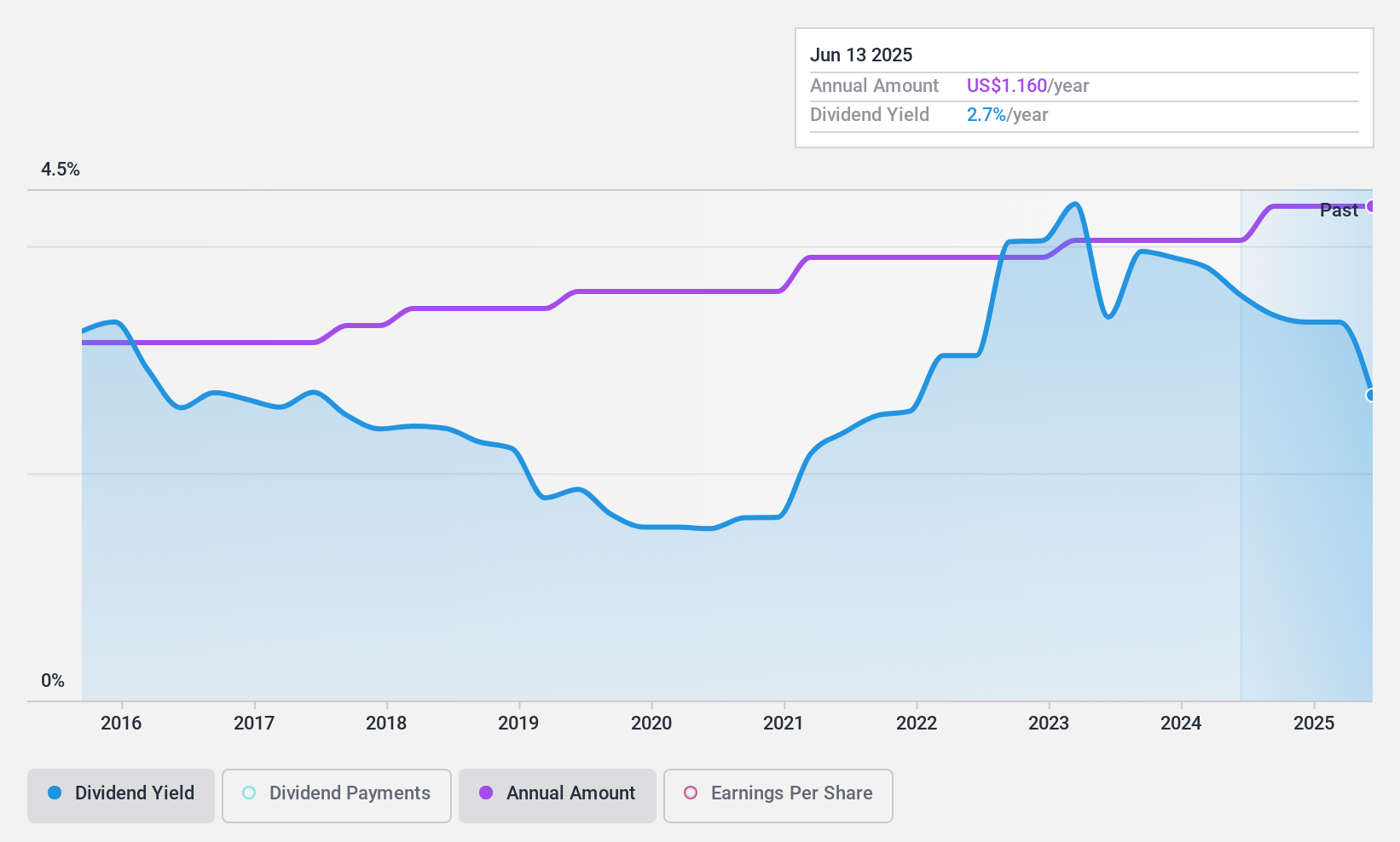

First Capital (NasdaqCM:FCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc., with a market cap of $119.23 million, operates as the bank holding company for First Harrison Bank, offering a range of banking services to individual and business customers.

Operations: First Capital, Inc.'s revenue primarily stems from its banking segment, which generated $42 million.

Dividend Yield: 3.3%

First Capital's dividends have been stable and reliable over the past decade, with a current yield of 3.26%. Although this yield is below the top quartile of U.S. dividend payers, its payout ratio of 31.4% indicates strong coverage by earnings. Recent board actions declared a quarterly cash dividend of US$0.29 per share, reinforcing its commitment to consistent shareholder returns while trading at 38.2% below estimated fair value.

- Get an in-depth perspective on First Capital's performance by reading our dividend report here.

- Our valuation report here indicates First Capital may be undervalued.

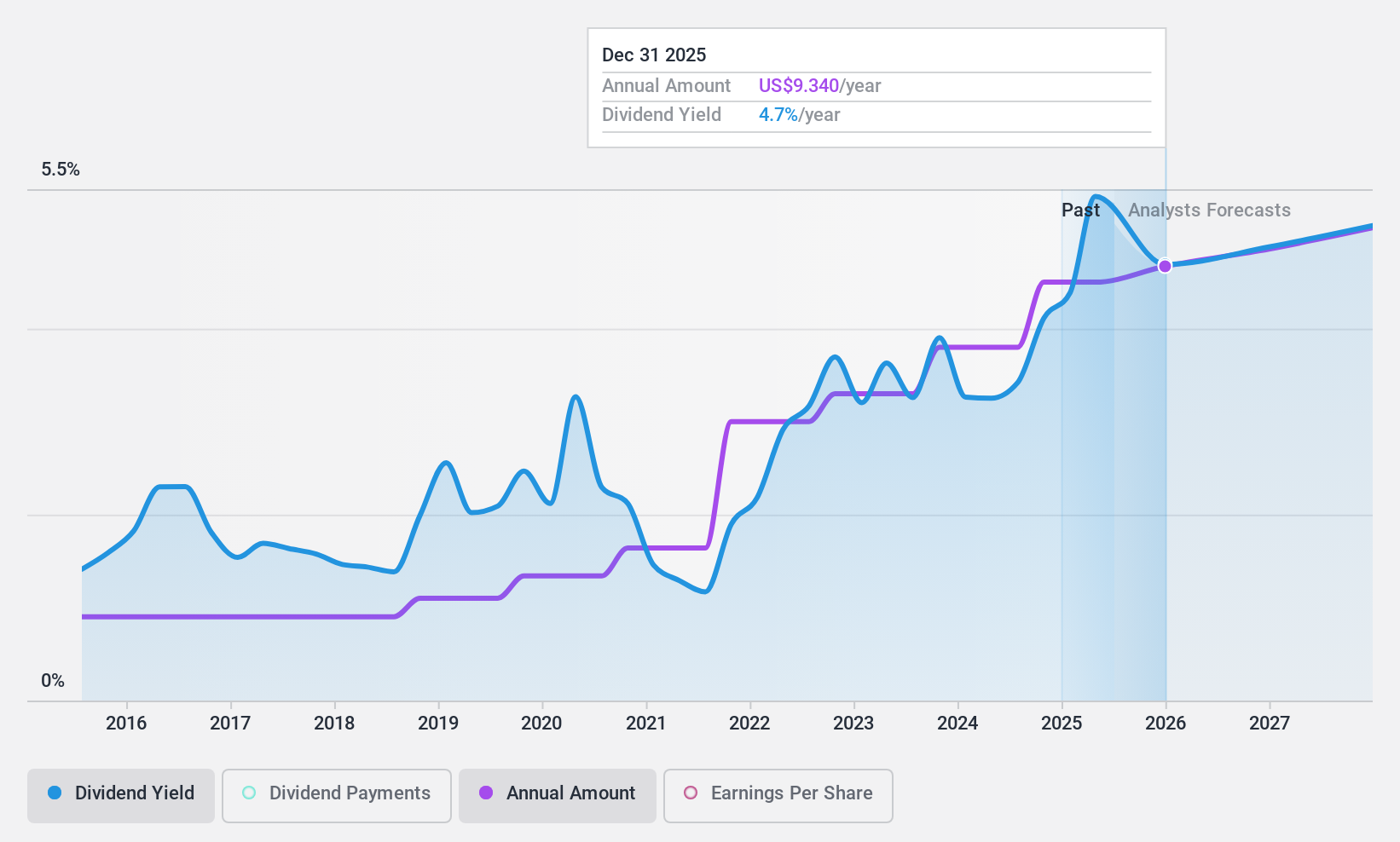

Virtus Investment Partners (NYSE:VRTS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of approximately $1.27 billion.

Operations: Virtus Investment Partners generates revenue primarily through its asset management segment, providing investment management and related services, amounting to $906.95 million.

Dividend Yield: 5%

Virtus Investment Partners offers a high dividend yield of 4.97%, placing it in the top 25% of U.S. dividend payers, with stable and growing dividends over the past decade. Its payout ratios—48.3% from earnings and 59.7% from cash flows—indicate sustainable coverage, supported by recent earnings growth and a declared quarterly dividend of US$2.25 per share for Q1 2025, highlighting consistent shareholder returns while trading below estimated fair value by 37%.

- Click here and access our complete dividend analysis report to understand the dynamics of Virtus Investment Partners.

- The analysis detailed in our Virtus Investment Partners valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Explore the 143 names from our Top US Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FCAP

First Capital

Operates as the bank holding company for First Harrison Bank that provides various banking services to individuals and business customers in Indiana and Kentucky, the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives