- United States

- /

- Health Care REITs

- /

- NYSE:SILA

3 Top Dividend Stocks Yielding Up To 6% For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market faces turbulence amid new export restrictions to China, with major indices like the S&P 500 and Nasdaq Composite experiencing notable declines, investors are increasingly seeking stability through reliable income streams. In such uncertain times, dividend stocks can provide a steady return on investment by offering regular payouts, making them an attractive option for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.57% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.25% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.62% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.29% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.33% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.82% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.27% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.22% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.08% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

East West Bancorp (NasdaqGS:EWBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: East West Bancorp, Inc. is the bank holding company for East West Bank, offering a variety of personal and commercial banking services to businesses and individuals in the United States, with a market cap of approximately $10.30 billion.

Operations: East West Bancorp's revenue is primarily derived from its Commercial Banking segment at $1.16 billion and Consumer and Business Banking segment at $1.25 billion.

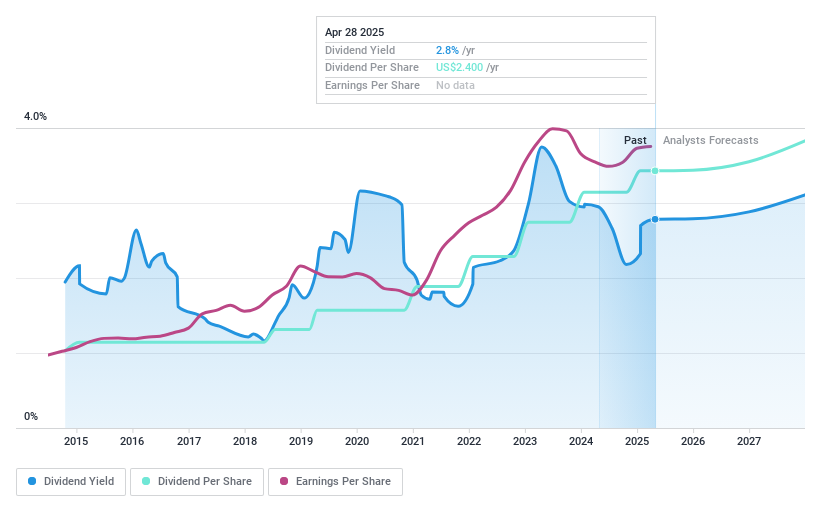

Dividend Yield: 3.2%

East West Bancorp offers a stable dividend profile, recently increasing its quarterly dividend by 9% to US$0.60 per share, translating to an annual equivalent of US$2.40 per share. The payout ratio is low at 26.2%, suggesting dividends are well covered by earnings and likely sustainable in the future. Despite trading below fair value estimates and showing reliable dividend growth over the past decade, its yield of 3.17% remains below top-tier U.S. market levels.

- Take a closer look at East West Bancorp's potential here in our dividend report.

- Upon reviewing our latest valuation report, East West Bancorp's share price might be too pessimistic.

Sila Realty Trust (NYSE:SILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, operates as a net lease real estate investment trust specializing in the healthcare sector and has a market cap of approximately $1.43 billion.

Operations: Sila Realty Trust, Inc. generates revenue primarily through its commercial real estate investments in the healthcare sector, amounting to $186.86 million.

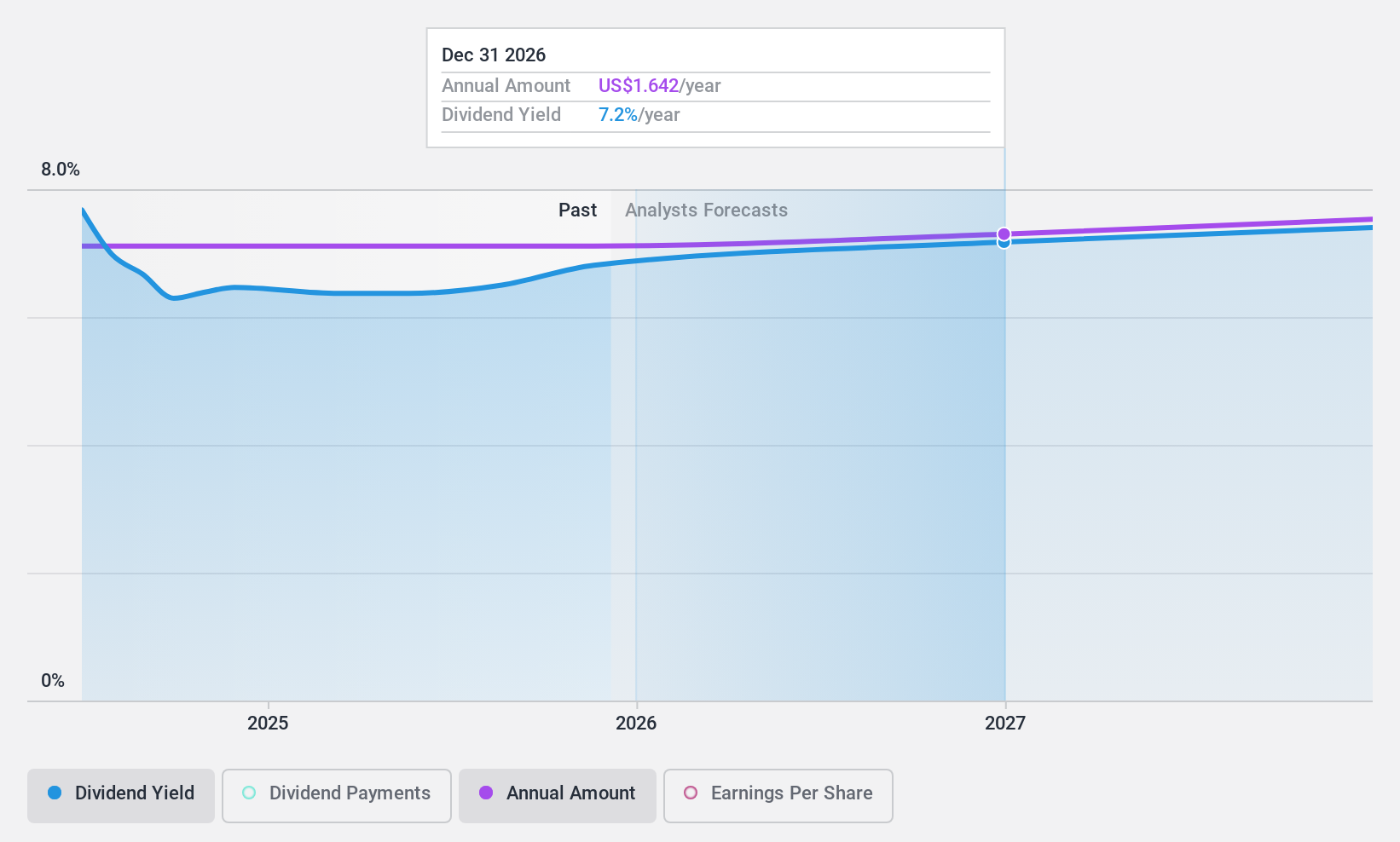

Dividend Yield: 6.1%

Sila Realty Trust's dividend yield of 6.07% ranks in the top 25% among U.S. dividend payers, supported by a payout ratio of 68.8%, ensuring coverage by earnings and cash flows. However, its four-year dividend history is marked by volatility and reductions, raising concerns about reliability. Recent strategic moves include a $35.12 million acquisition in Tennessee and securing a $600 million revolving credit facility to bolster financial flexibility, potentially impacting future dividends positively or negatively depending on execution outcomes.

- Delve into the full analysis dividend report here for a deeper understanding of Sila Realty Trust.

- In light of our recent valuation report, it seems possible that Sila Realty Trust is trading beyond its estimated value.

SM Energy (NYSE:SM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SM Energy Company is an independent energy firm focused on acquiring, exploring, developing, and producing oil, gas, and natural gas liquids in Texas with a market cap of $2.51 billion.

Operations: SM Energy's revenue primarily comes from its Exploration and Production Segment of the Oil and Gas Industry, generating $2.57 billion.

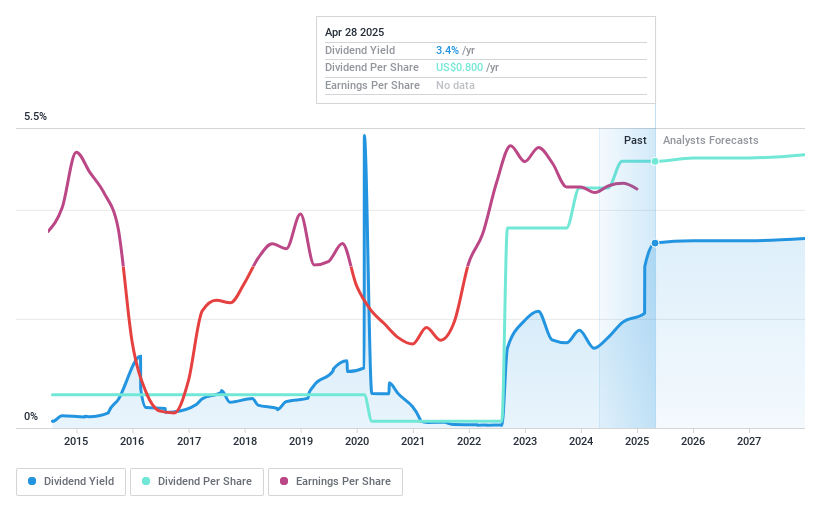

Dividend Yield: 3.7%

SM Energy's dividend yield of 3.68% lags behind the top U.S. dividend payers, yet its dividends have grown steadily over the past decade with minimal volatility. Despite a low payout ratio of 11.3%, indicating strong earnings coverage, the dividends are not well-supported by free cash flows, raising sustainability concerns. Recent board affirmations maintain a quarterly dividend of $0.20 per share amidst leadership changes and stable historical payouts, reflecting ongoing commitment to shareholders despite financial challenges.

- Click here to discover the nuances of SM Energy with our detailed analytical dividend report.

- Our expertly prepared valuation report SM Energy implies its share price may be lower than expected.

Where To Now?

- Explore the 170 names from our Top US Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives