- United States

- /

- Banks

- /

- NasdaqGS:EBTC

Discover 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

In the midst of a highly volatile trading environment, marked by significant swings in major indices like the S&P 500 and Dow Jones Industrial Average due to tariff uncertainties, investors are increasingly seeking opportunities beyond the well-trodden paths of large-cap stocks. As market participants navigate these turbulent waters, identifying promising small-cap companies that demonstrate resilience and potential for growth becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Enterprise Bancorp (NasdaqGS:EBTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Enterprise Bancorp, Inc. is the holding company for Enterprise Bank and Trust Company, offering community-focused commercial banking products and services, with a market cap of $424.36 million.

Operations: Enterprise Bancorp generates revenue primarily from its banking segment, amounting to $168.76 million.

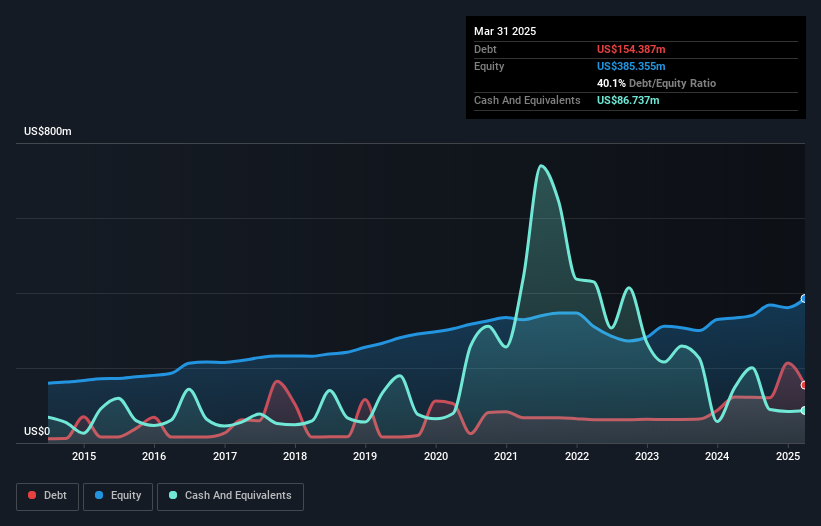

Enterprise Bancorp, with total assets of US$4.8 billion and equity of US$360.7 million, stands out for its robust financial position. The company has total deposits amounting to US$4.2 billion and loans at US$3.9 billion, reflecting a strong banking operation supported by a net interest margin of 3.2%. Its allowance for bad loans is well-covered at 238%, with non-performing loans kept low at 0.7% of total loans, showcasing high-quality earnings growth that surpassed the industry average last year by growing 1.8%. Recently trading significantly below its estimated fair value presents potential opportunities for investors seeking value in the financial sector.

- Get an in-depth perspective on Enterprise Bancorp's performance by reading our health report here.

Explore historical data to track Enterprise Bancorp's performance over time in our Past section.

Third Coast Bancshares (NasdaqGS:TCBX)

Simply Wall St Value Rating: ★★★★★★

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, offering a range of commercial banking solutions to small and medium-sized businesses and professionals in the United States, with a market cap of $391.47 million.

Operations: Third Coast Bancshares generates revenue primarily from its community banking segment, amounting to $165.68 million. The net profit margin for the company reflects its financial efficiency and profitability in managing expenses relative to its revenue generation.

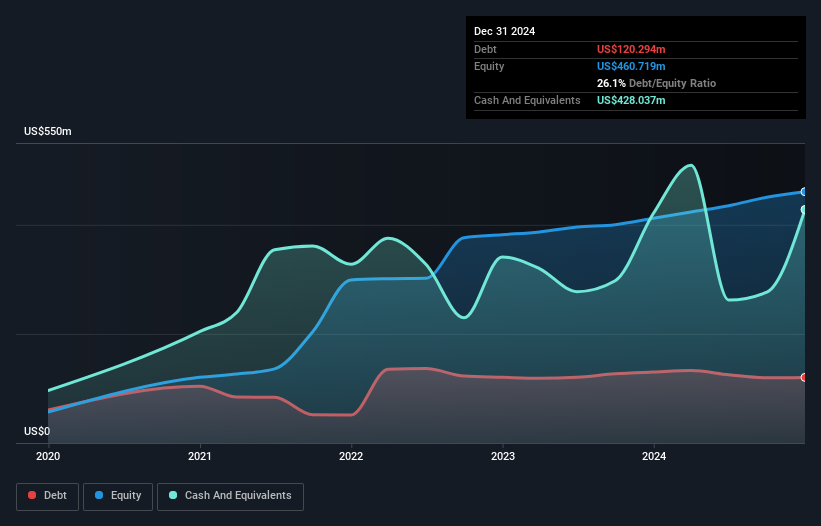

Third Coast Bancshares, a bank with $4.9 billion in assets and $460.7 million in equity, is gaining attention for its robust growth and strategic initiatives. The bank's earnings surged by 49.7% last year, outpacing the industry average of -1.2%. With total deposits at $4.3 billion and loans at $3.9 billion, it maintains a net interest margin of 3.7% and has an appropriate bad loan allowance at 0.7%. Trading below fair value by 44%, it offers potential upside as analysts forecast annual revenue growth of 10.7%, though competition and economic uncertainties remain considerations for investors.

Oil-Dri Corporation of America (NYSE:ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in the development, manufacturing, and marketing of sorbent products both domestically and internationally, with a market capitalization of approximately $625.91 million.

Operations: Oil-Dri generates revenue primarily from two segments: Business to Business Products ($166.91 million) and Retail and Wholesale Products ($298.43 million).

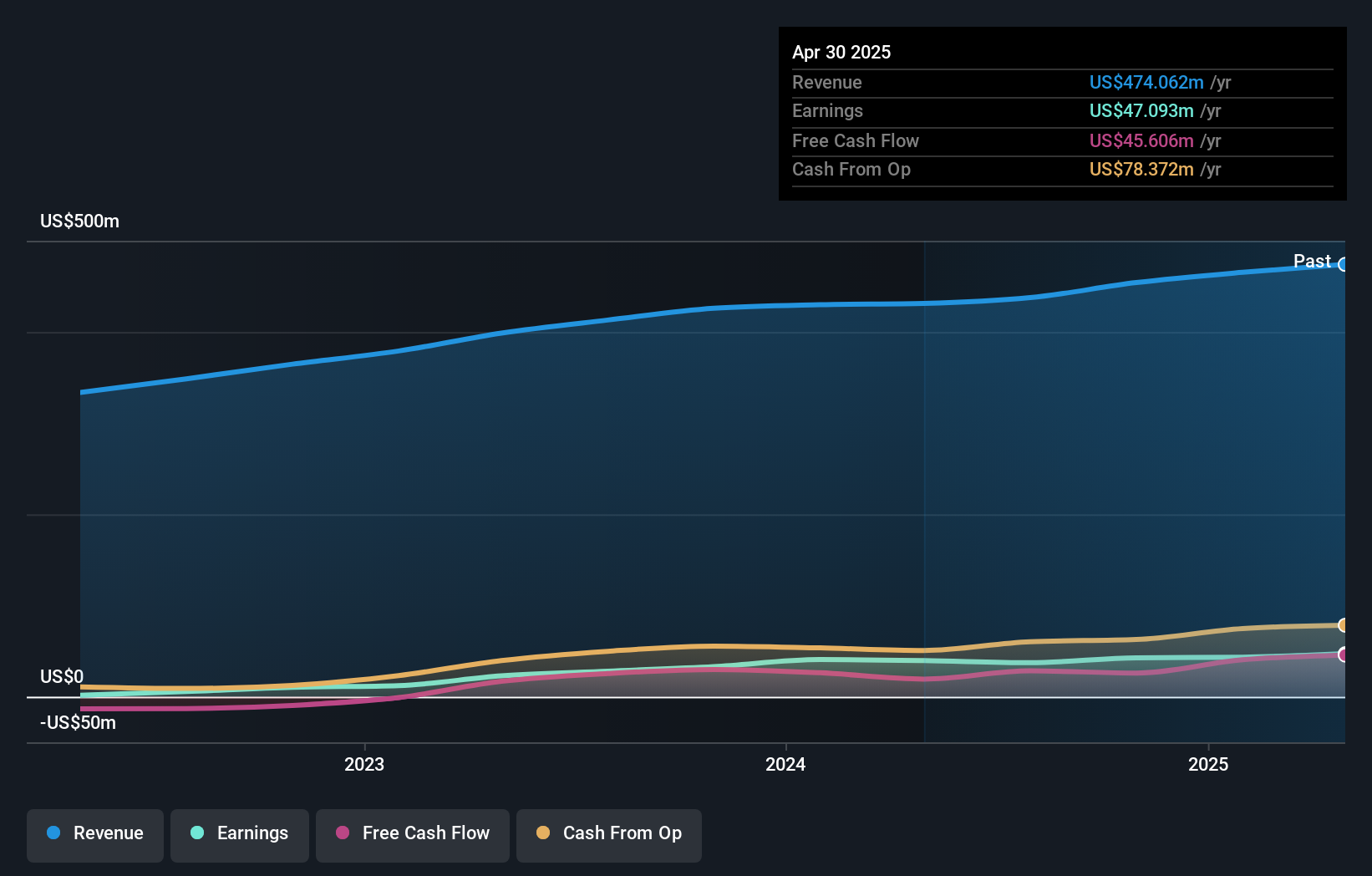

With a focus on innovation and sustainability, Oil-Dri Corporation of America has shown solid financial performance. Recent earnings growth of 6.5% outpaced the industry’s 4.9%, reflecting its competitive edge. The company reported net income of US$12.92 million for the second quarter, up from US$12.38 million the previous year, alongside sales increasing to US$116.91 million from US$105.67 million year-on-year. Its net debt to equity ratio is deemed satisfactory at 7.7%, and interest coverage stands strong at 34 times EBIT, indicating robust financial health despite increased debt levels over five years from 2.1% to 17%.

Turning Ideas Into Actions

- Click here to access our complete index of 283 US Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBTC

Enterprise Bancorp

Operates as the holding company for Enterprise Bank and Trust Company that provides community focused commercial banking products and services.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives