- United States

- /

- Banks

- /

- NasdaqGS:SRCE

US Market's Hidden Gems: 3 Promising Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

The United States market has remained flat over the last week but has experienced a 13% increase over the past year, with earnings forecasted to grow by 15% annually. In this environment, identifying small-cap stocks with strong fundamentals can offer unique opportunities for investors seeking potential growth beyond the broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Community Trust Bancorp (CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. functions as the bank holding company for Community Trust Bank, Inc., with a market cap of $1.02 billion.

Operations: Community Trust Bancorp generates revenue primarily from Community Banking Services, which contributes $249.26 million, and the Holding Company segment, contributing $88.77 million. The company has a market cap of approximately $1.02 billion.

Community Trust Bancorp, with assets totaling $6.3 billion and equity of $784.2 million, stands out in its sector by trading at 56.2% below estimated fair value. The bank's total deposits of $5.1 billion and loans amounting to $4.6 billion underscore its solid financial base, while a net interest margin of 3.4% highlights efficient operations without delving into specifics like net interest income or cash reserves. With an allowance for bad loans at 0.6%, well within acceptable limits, and earnings growth of 11% outpacing the industry average, CTBI showcases robust performance backed by primarily low-risk funding sources.

- Take a closer look at Community Trust Bancorp's potential here in our health report.

Learn about Community Trust Bancorp's historical performance.

1st Source (SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to clients in the United States with a market cap of approximately $1.61 billion.

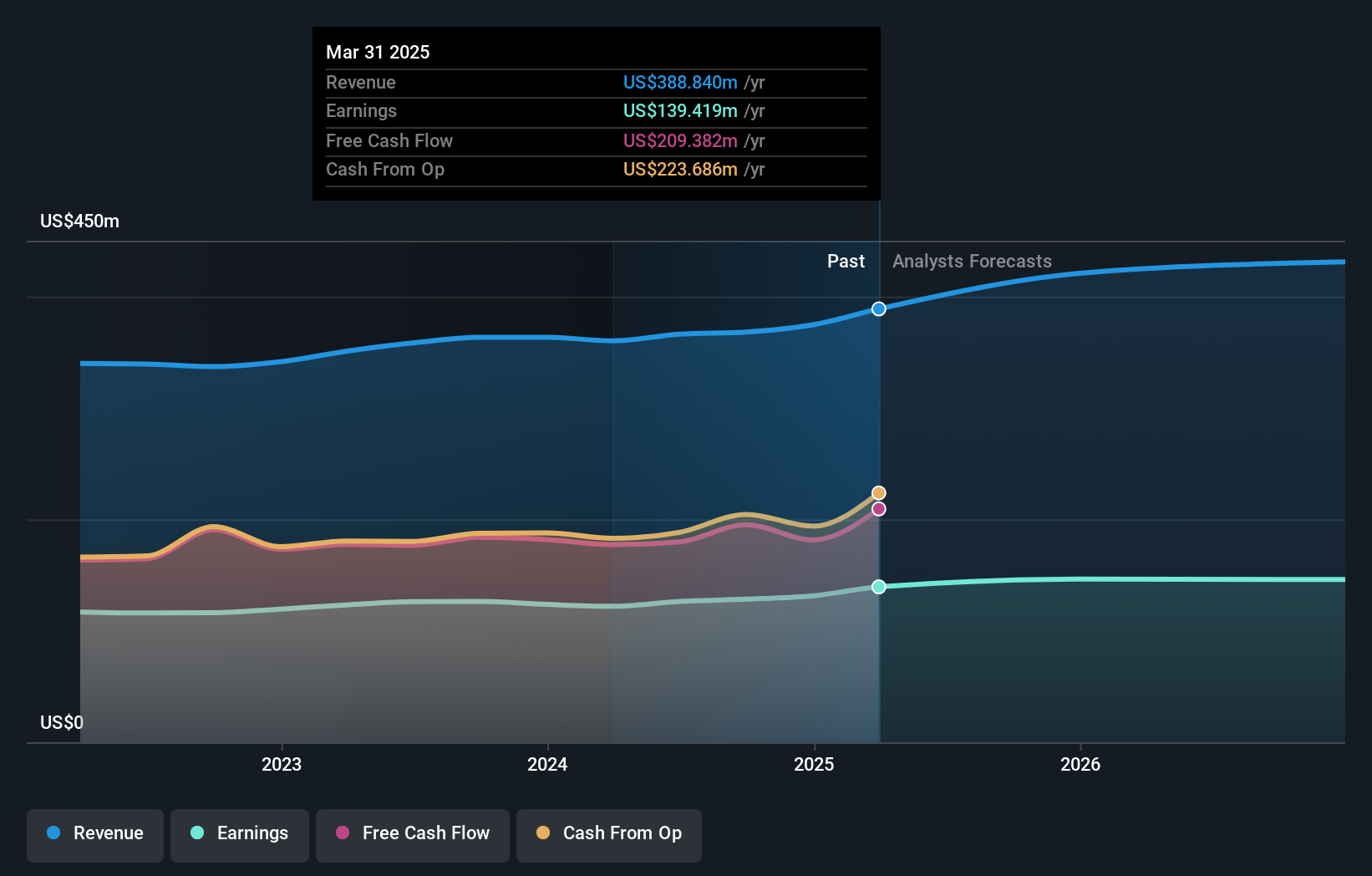

Operations: 1st Source generates revenue primarily from its commercial banking segment, which accounts for $388.84 million.

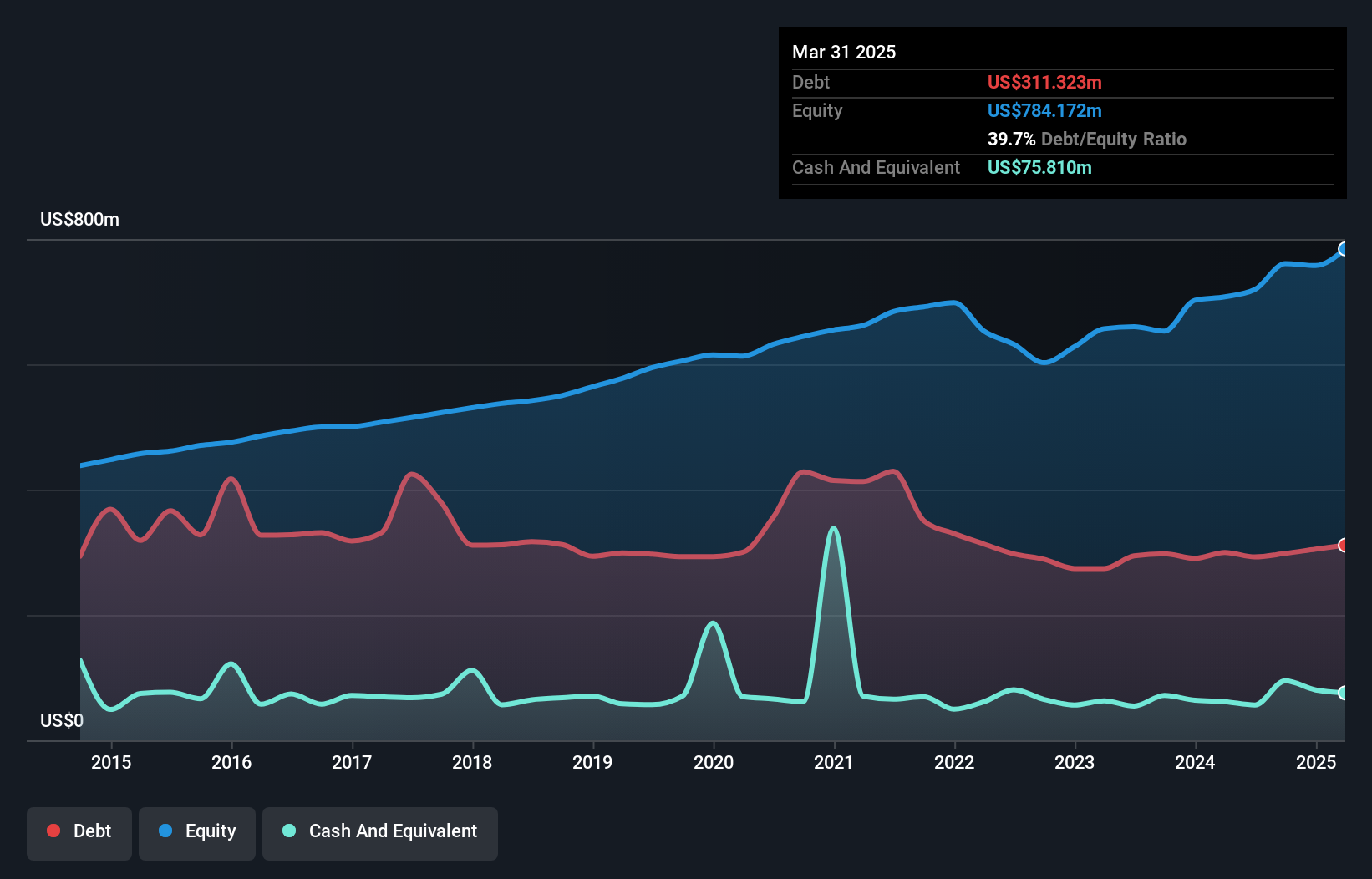

With total assets of US$9 billion and equity of US$1.2 billion, 1st Source stands out with its robust financial health, supported by customer deposits making up 96% of its liabilities. The bank's total deposits are US$7.4 billion against loans of US$6.7 billion, earning a net interest margin of 3.6%. It maintains a sufficient allowance for bad loans at 0.6%, well below industry norms, showcasing high-quality earnings with a notable growth rate of 14.2% over the past year—outpacing the broader banking sector's growth rate significantly—and trades at an attractive valuation below its estimated fair value by 57%.

- Navigate through the intricacies of 1st Source with our comprehensive health report here.

Gain insights into 1st Source's past trends and performance with our Past report.

Yalla Group (YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited, along with its subsidiaries, operates a social networking and gaming platform in the Middle East and North Africa region, with a market cap of approximately $1.07 billion.

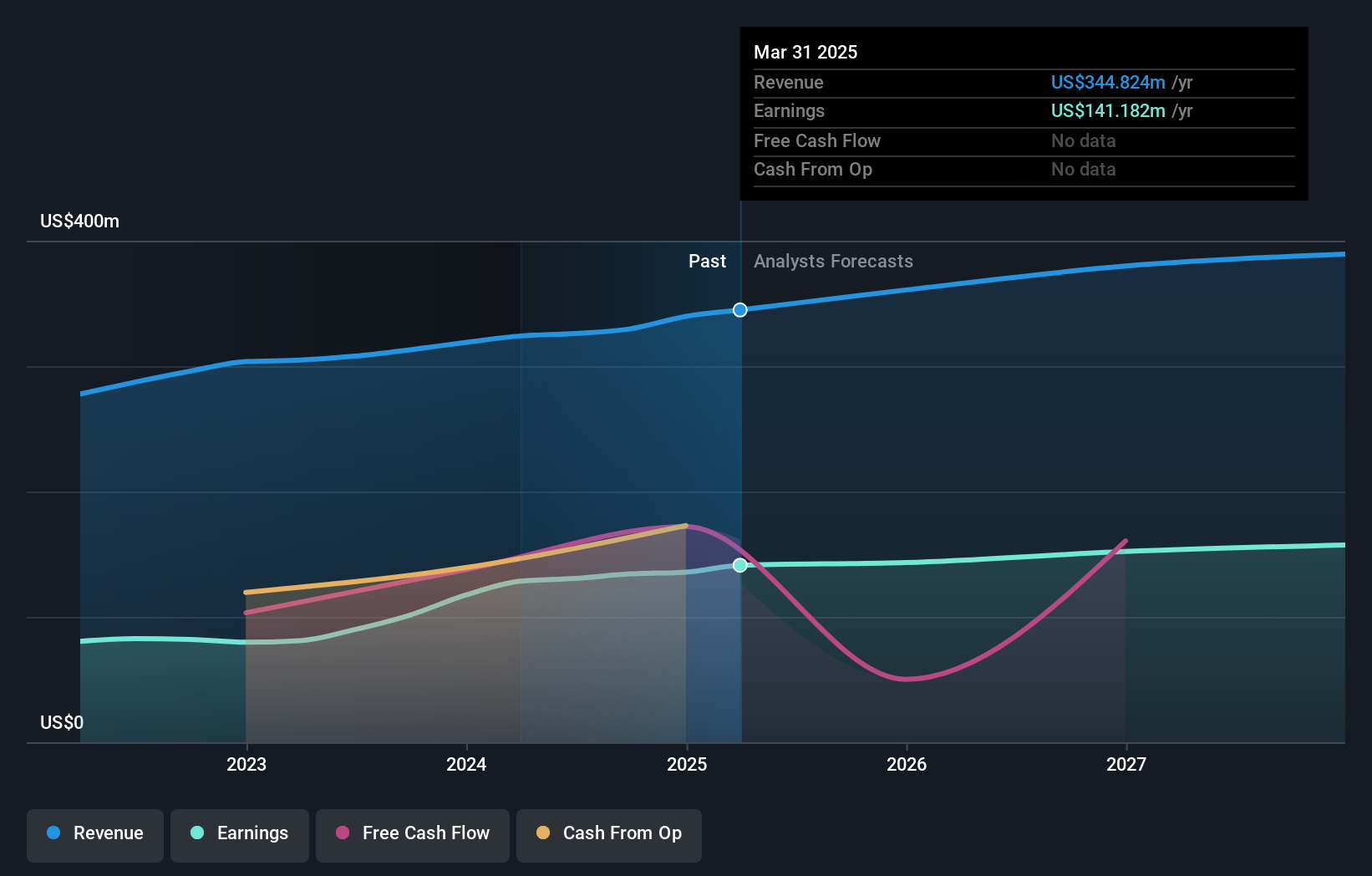

Operations: The group generates revenue primarily from its social networking and entertainment platform, amounting to $344.82 million.

Yalla Group, a nimble player in the digital realm, has shown robust financial health with no debt over the past five years. Its earnings have surged by 38% annually during this period. Despite being outpaced by its industry peers last year, Yalla's strategic focus on AI and mid-core game development within the MENA region holds promise for future growth. The company repurchased 4.28 million shares recently, signaling confidence in its valuation. With net income of US$37 million for Q1 2025 and projected modest revenue growth of 4.7%, Yalla seems well-positioned amidst competitive pressures and expansion challenges.

Summing It All Up

- Delve into our full catalog of 278 US Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives