- United States

- /

- Insurance

- /

- NYSE:HMN

Exploring 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility marked by recent declines in major indices following comments from Federal Reserve Chair Jerome Powell, investors are eyeing opportunities beyond the usual tech giants. In this dynamic environment, uncovering lesser-known stocks that exhibit strong fundamentals and potential for growth can offer intriguing possibilities for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Daily Journal (DJCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Daily Journal Corporation operates by publishing newspapers and websites in regions including California, Arizona, Utah, and Australia, with a market cap of $616.80 million.

Operations: Daily Journal Corporation generates revenue primarily from its Journal Technologies segment, contributing $61.41 million, and its Traditional Business segment, adding $17.75 million.

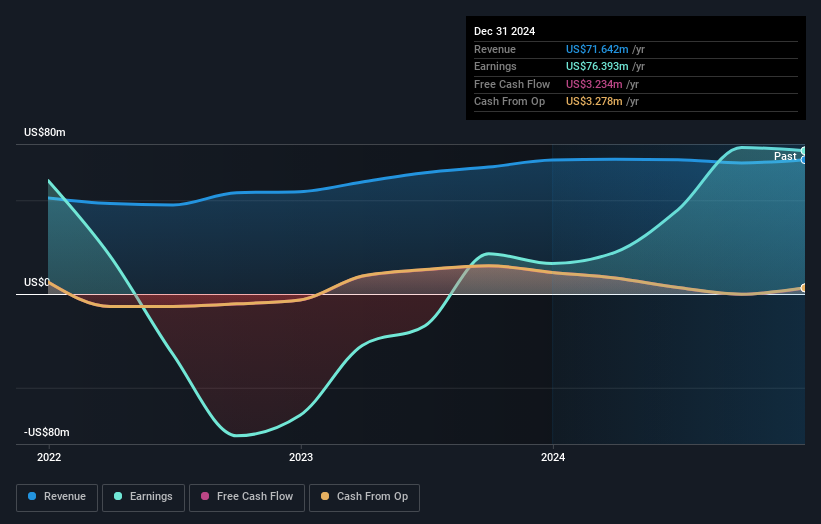

Daily Journal, a nimble player in the market, has demonstrated robust growth with earnings surging by 115% over the past year, outpacing the software industry's 15.5% rise. The company boasts a favorable price-to-earnings ratio of 6.5x compared to the broader US market's 19.3x, suggesting potential undervaluation. A significant one-off gain of US$118 million has influenced recent financial results, indicating some volatility in earnings quality. Despite this fluctuation, DJCO's debt-to-equity ratio impressively decreased from 29.3% to 7.5% over five years, highlighting an improved financial structure and reduced leverage risk for investors.

Community Trust Bancorp (CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. is the bank holding company for Community Trust Bank, Inc., with a market capitalization of approximately $1.02 billion.

Operations: Community Trust Bancorp generates revenue primarily from Community Banking Services, which contributes $258.28 million, while the Holding Company adds $94.54 million. The company experiences a deduction of $98.98 million due to eliminations in its financial reporting.

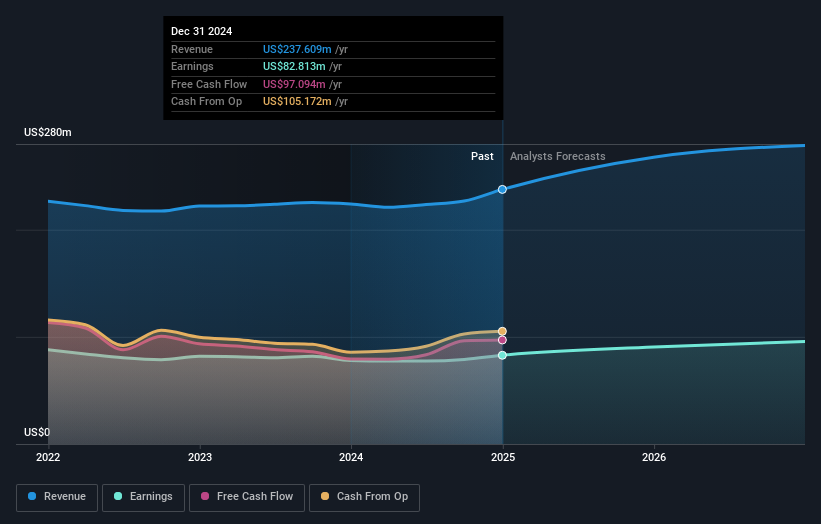

Community Trust Bancorp, a small player with total assets of US$6.4 billion and equity of US$806.9 million, seems to be punching above its weight in the banking sector. It boasts an impressive net interest margin of 3.4%, and its earnings have surged by 18% over the past year, outpacing industry growth. The bank's allowance for bad loans is robust at 237%, covering 0.5% of total loans, indicating sound risk management practices. Trading at a significant discount to estimated fair value by nearly half, CTBI appears well-positioned for those seeking quality earnings and low-risk funding sources primarily from customer deposits.

Horace Mann Educators (HMN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Horace Mann Educators Corporation operates as an insurance holding company in the United States, with a market capitalization of approximately $1.87 billion.

Operations: The company generates revenue primarily from three segments: Property & Casualty ($827.90 million), Life & Retirement ($552.50 million), and Supplemental & Group Benefits ($296.20 million). The Corporate segment contributes a smaller portion at $5.70 million.

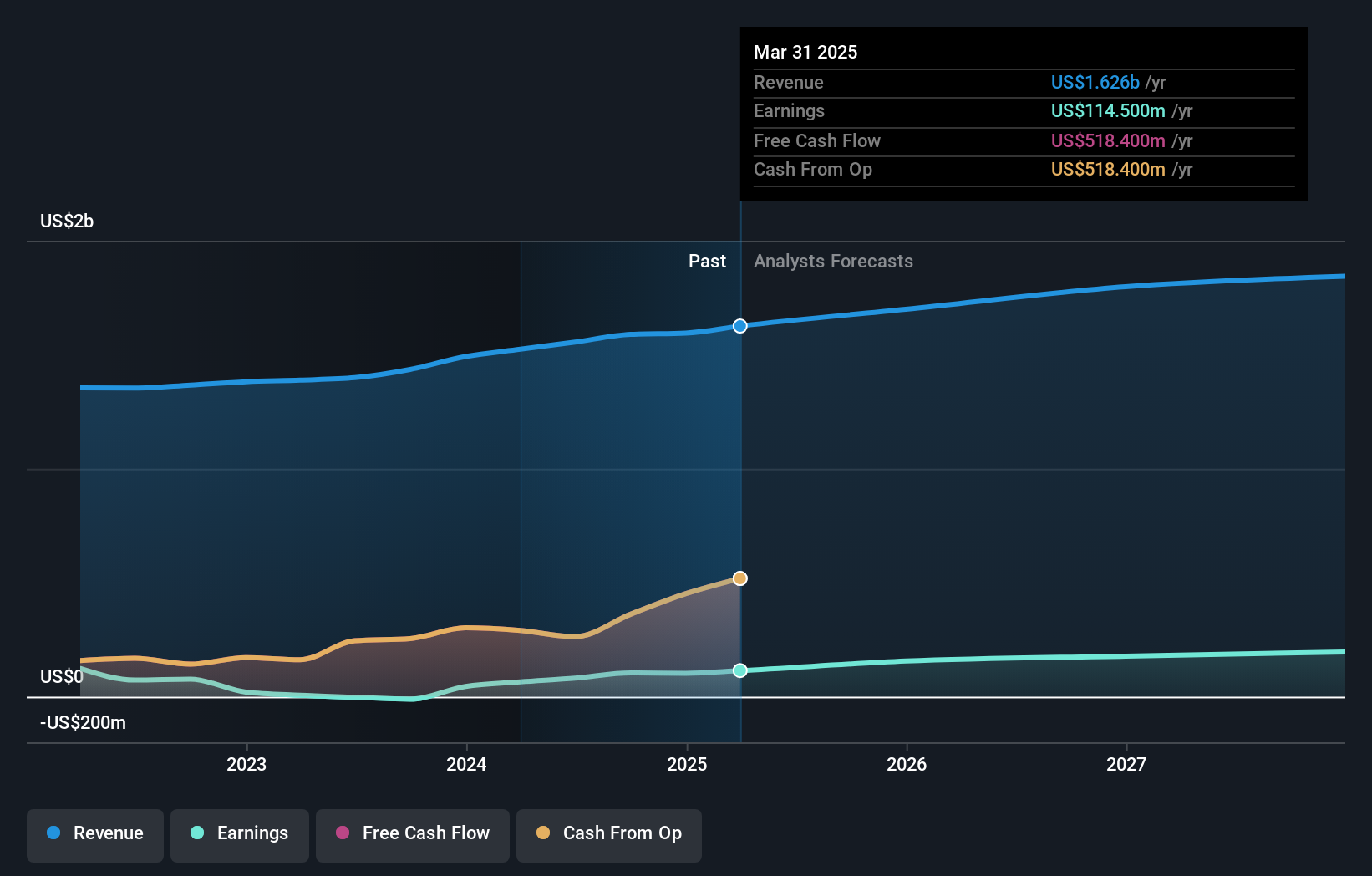

Horace Mann Educators, a niche player in the insurance sector, is making strides with its digital engagement strategy and partnerships aimed at boosting agent productivity. The company reported a significant earnings surge of 71.9% over the past year, surpassing industry averages. With a price-to-earnings ratio of 13.4x, it trades at an attractive valuation compared to the broader market's 19.3x. Recent buybacks saw Horace Mann repurchase shares worth US$30.98 million, reflecting confidence in its financial health despite an increased debt-to-equity ratio from 26.7% to 40.2% over five years and potential climate-related risks looming on the horizon.

Key Takeaways

- Click this link to deep-dive into the 286 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)