- United States

- /

- Banks

- /

- NYSE:AUB

Columbia Banking System Among 3 Stocks Estimated To Be Undervalued

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the Nasdaq and S&P 500 hitting record levels, investors are increasingly on the lookout for opportunities that may be undervalued amidst this bullish environment. In such a thriving market, identifying stocks that are potentially undervalued can offer a strategic advantage by providing entry points at prices below their intrinsic value, making them attractive options for those seeking long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SolarEdge Technologies (SEDG) | $34.71 | $68.38 | 49.2% |

| Pinnacle Financial Partners (PNFP) | $97.68 | $186.59 | 47.7% |

| Phibro Animal Health (PAHC) | $40.54 | $77.67 | 47.8% |

| NeuroPace (NPCE) | $10.32 | $19.97 | 48.3% |

| McGraw Hill (MH) | $13.79 | $26.94 | 48.8% |

| ImmunityBio (IBRX) | $2.85 | $5.67 | 49.7% |

| Exact Sciences (EXAS) | $53.59 | $102.68 | 47.8% |

| Columbia Banking System (COLB) | $26.91 | $53.25 | 49.5% |

| Advanced Flower Capital (AFCG) | $4.50 | $8.76 | 48.6% |

| AbbVie (ABBV) | $221.99 | $442.29 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

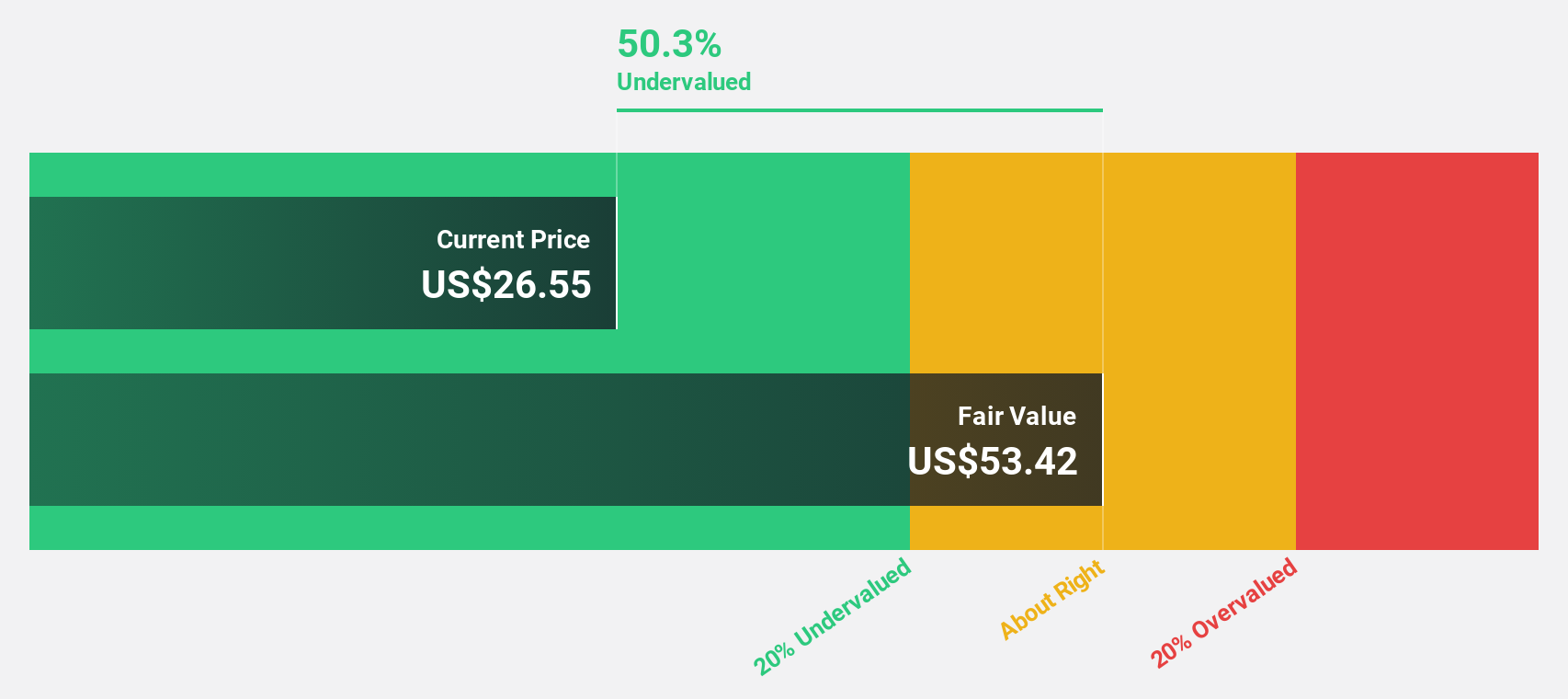

Columbia Banking System (COLB)

Overview: Columbia Banking System, Inc. is a bank holding company for Columbia Bank, offering banking, private banking, mortgage, and other financial services in the United States with a market cap of approximately $5.43 billion.

Operations: The company generates its revenue primarily from its banking segment, which accounts for $1.87 billion.

Estimated Discount To Fair Value: 49.5%

Columbia Banking System is trading at US$26.91, significantly below its estimated fair value of US$53.25, making it an undervalued stock based on cash flows. The company's earnings are expected to grow substantially at 30.5% annually over the next three years, outpacing the broader US market's growth rate. Despite a low forecasted return on equity of 12.4%, Columbia offers a high and reliable dividend yield of 5.35%. Recent strategic expansions and acquisitions further bolster its growth potential.

- Our growth report here indicates Columbia Banking System may be poised for an improving outlook.

- Click here to discover the nuances of Columbia Banking System with our detailed financial health report.

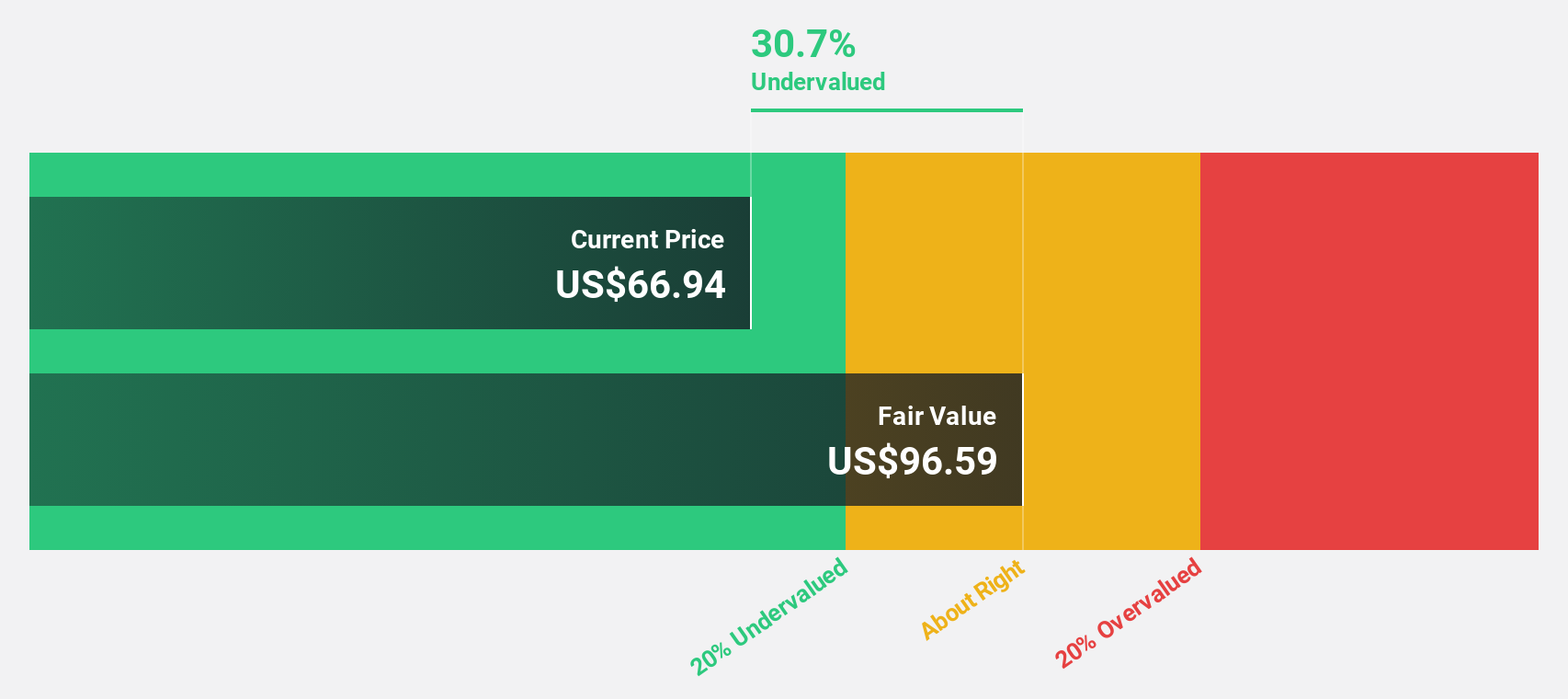

Independent Bank (INDB)

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $3.52 billion.

Operations: The company generates revenue primarily through its Community Banking segment, which accounted for $662.75 million.

Estimated Discount To Fair Value: 17.3%

Independent Bank is trading at US$72.84, below its estimated fair value of US$88.05, suggesting it is undervalued based on cash flows. Its earnings and revenue are expected to grow significantly faster than the US market at 47.7% and 28.2% annually, respectively. The company maintains a reliable dividend yield of 3.24%. Recent announcements include a $0.59 per share dividend and a $150 million share repurchase program valid until July 2026.

- The growth report we've compiled suggests that Independent Bank's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Independent Bank's balance sheet health report.

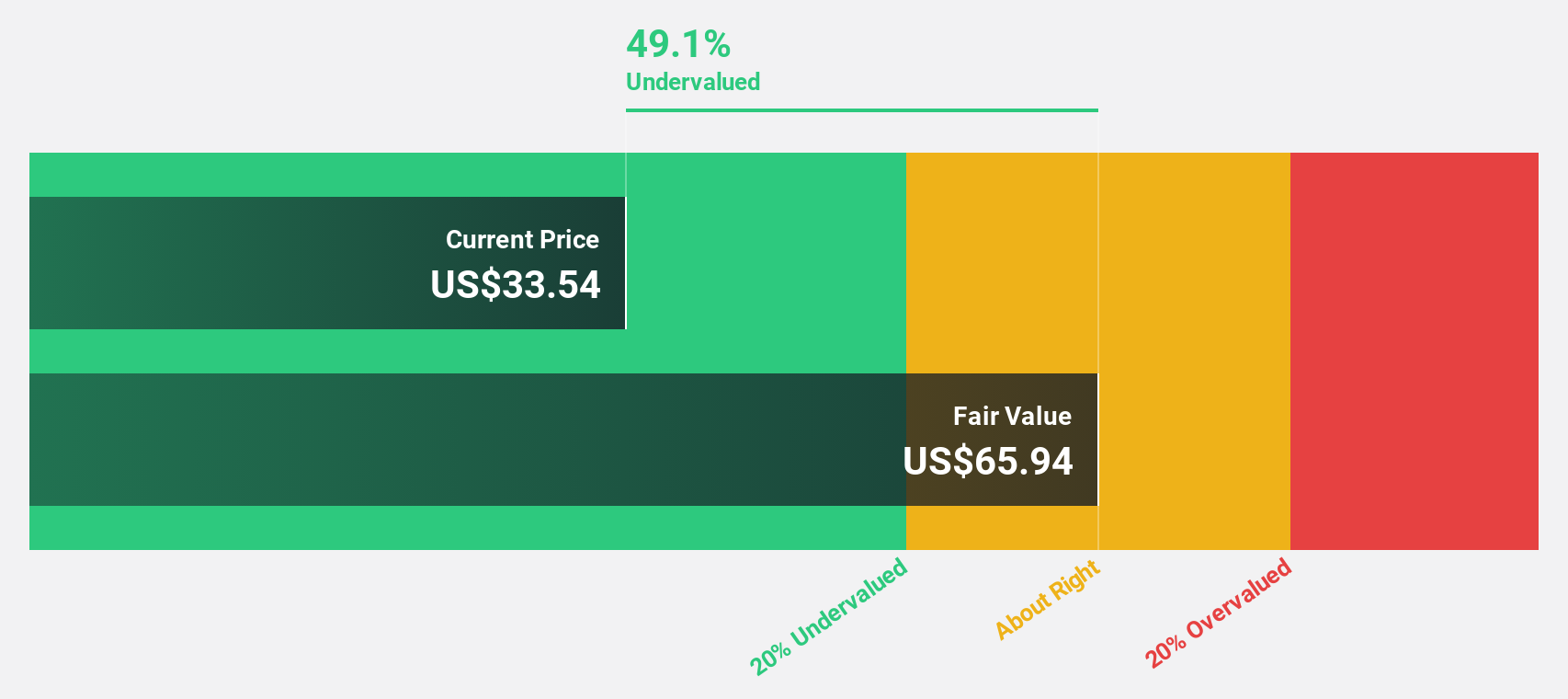

Atlantic Union Bankshares (AUB)

Overview: Atlantic Union Bankshares Corporation is a bank holding company for Atlantic Union Bank, offering banking and financial services to consumers and businesses in the United States, with a market cap of approximately $5.02 billion.

Operations: The company generates its revenue primarily through Consumer Banking, which accounts for $376.28 million, and Wholesale Banking, contributing $411.16 million.

Estimated Discount To Fair Value: 18%

Atlantic Union Bankshares is trading at $36.56, below its estimated fair value of $44.58, indicating it is undervalued based on cash flows. The company's earnings and revenue are forecast to grow significantly faster than the US market at 46.9% and 22.4% annually, respectively. Despite recent shareholder dilution and a low return on equity forecast, Atlantic Union maintains an attractive dividend yield of approximately 4%, with recent dividends affirmed by the Board of Directors.

- Our earnings growth report unveils the potential for significant increases in Atlantic Union Bankshares' future results.

- Navigate through the intricacies of Atlantic Union Bankshares with our comprehensive financial health report here.

Summing It All Up

- Get an in-depth perspective on all 192 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives