- United States

- /

- Banks

- /

- NasdaqGS:CCBG

Discovering US Market Undiscovered Gems in February 2025

Reviewed by Simply Wall St

In recent days, the United States market has experienced a 4.8% decline, yet it has still achieved a notable 15% increase over the past year, with earnings projected to grow by 14% annually. In this dynamic environment, identifying stocks that possess strong fundamentals and potential for growth can be key to uncovering promising opportunities amidst market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

ACNB (NasdaqCM:ACNB)

Simply Wall St Value Rating: ★★★★★★

Overview: ACNB Corporation is a financial holding company that provides banking, insurance, and financial services to individual, business, and government customers in the United States with a market cap of $430.03 million.

Operations: ACNB generates revenue primarily from banking and financial services. The company's net profit margin is 31.25%, reflecting its efficiency in converting revenue into profit after expenses.

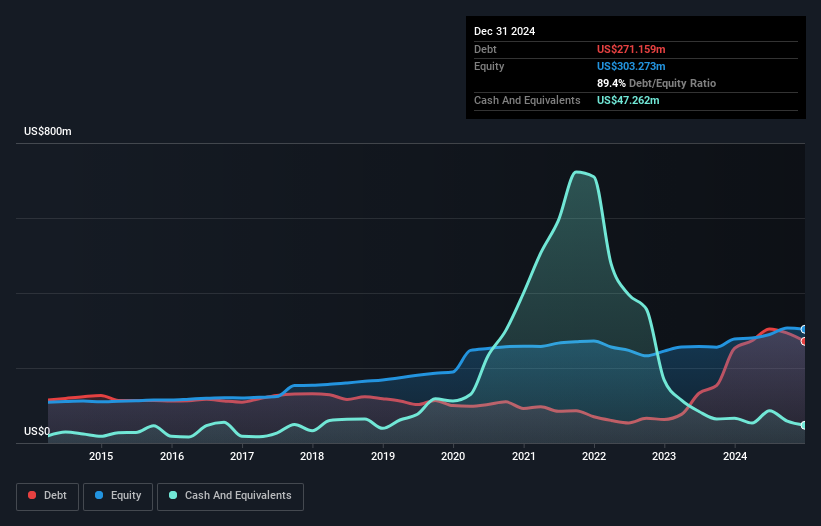

ACNB, with total assets of US$2.4 billion and equity of US$303.3 million, stands out for its robust financial health and prudent management. The bank's total loans amount to US$1.7 billion, supported by a sufficient allowance for bad loans at 254%, while non-performing loans are just 0.4%. Its net interest margin is a solid 3.8%, reflecting efficient operations in the banking sector. Recent board additions from Traditions Bancorp bring decades of experience, potentially enhancing strategic direction following their acquisition move this February. Despite past shareholder dilution, ACNB's earnings growth outpaced the industry average last year at 0.5%.

- Navigate through the intricacies of ACNB with our comprehensive health report here.

Examine ACNB's past performance report to understand how it has performed in the past.

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. operates as the financial holding company for Capital City Bank, offering a variety of banking-related services to individual and corporate clients, with a market capitalization of $617.46 million.

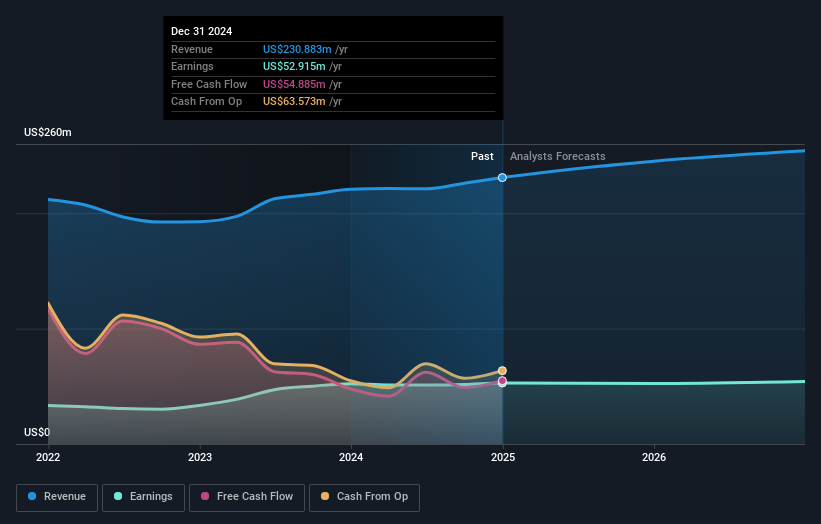

Operations: Capital City Bank Group generates revenue primarily from its commercial banking segment, which amounted to $230.88 million. The company's financial performance is reflected in its market capitalization of $617.46 million.

Capital City Bank Group, with assets totaling US$4.3 billion and equity of US$495.3 million, showcases a robust financial position. Its low-risk funding structure is evident as 96% of liabilities stem from customer deposits, reducing external borrowing risks. The bank's allowance for bad loans is more than sufficient at 0.2% of total loans, indicating strong credit management practices. Recent earnings growth outpaced the industry average with a 1.3% increase over the past year, highlighting its competitive edge in the banking sector. Additionally, trading at 52.3% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

- Click to explore a detailed breakdown of our findings in Capital City Bank Group's health report.

Understand Capital City Bank Group's track record by examining our Past report.

Weis Markets (NYSE:WMK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Weis Markets, Inc. operates a chain of supermarkets focused on the retail sale of food across Pennsylvania and nearby states, with a market capitalization of approximately $1.97 billion.

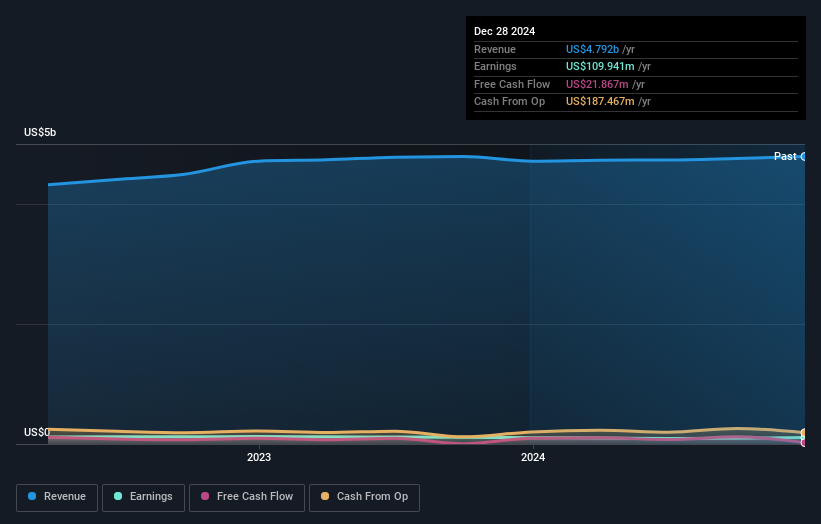

Operations: The primary revenue stream for Weis Markets comes from its retail grocery stores, generating approximately $4.79 billion.

Weis Markets, a notable player in the retail sector, is making strides with its recent earnings report showing net income rising to US$34.68 million for Q4 2024, up from US$20.52 million the previous year. Despite earnings growth of 1.8% annually over five years, it lags behind the industry’s pace of 9.8%. The company has more cash than total debt and trades at a significant discount to estimated fair value by 52.2%. With plans for expansion in Delaware and strategic partnerships enhancing customer access, Weis Markets seems poised for continued development within its competitive landscape.

- Get an in-depth perspective on Weis Markets' performance by reading our health report here.

Review our historical performance report to gain insights into Weis Markets''s past performance.

Taking Advantage

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 283 more companies for you to explore.Click here to unveil our expertly curated list of 286 US Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCBG

Capital City Bank Group

Operates as the financial holding company for Capital City Bank that provides a range of banking services to individual and corporate clients.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives