- United States

- /

- Banks

- /

- NasdaqCM:BWB

3 US Growth Stocks Insiders Own With 19% Revenue Growth

Reviewed by Simply Wall St

As U.S. markets react to recent inflation data and the potential for a Federal Reserve interest rate cut, investors are keenly observing how these economic shifts might influence growth stocks. In this context, companies with high insider ownership and robust revenue growth can be particularly appealing, as they often signal confidence in the business's future prospects from those most familiar with its operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 45.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 61.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

Underneath we present a selection of stocks filtered out by our screen.

Bridgewater Bancshares (NasdaqCM:BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States with a market cap of $415.22 million.

Operations: The company generates revenue of $105.68 million from its banking operations, catering to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States.

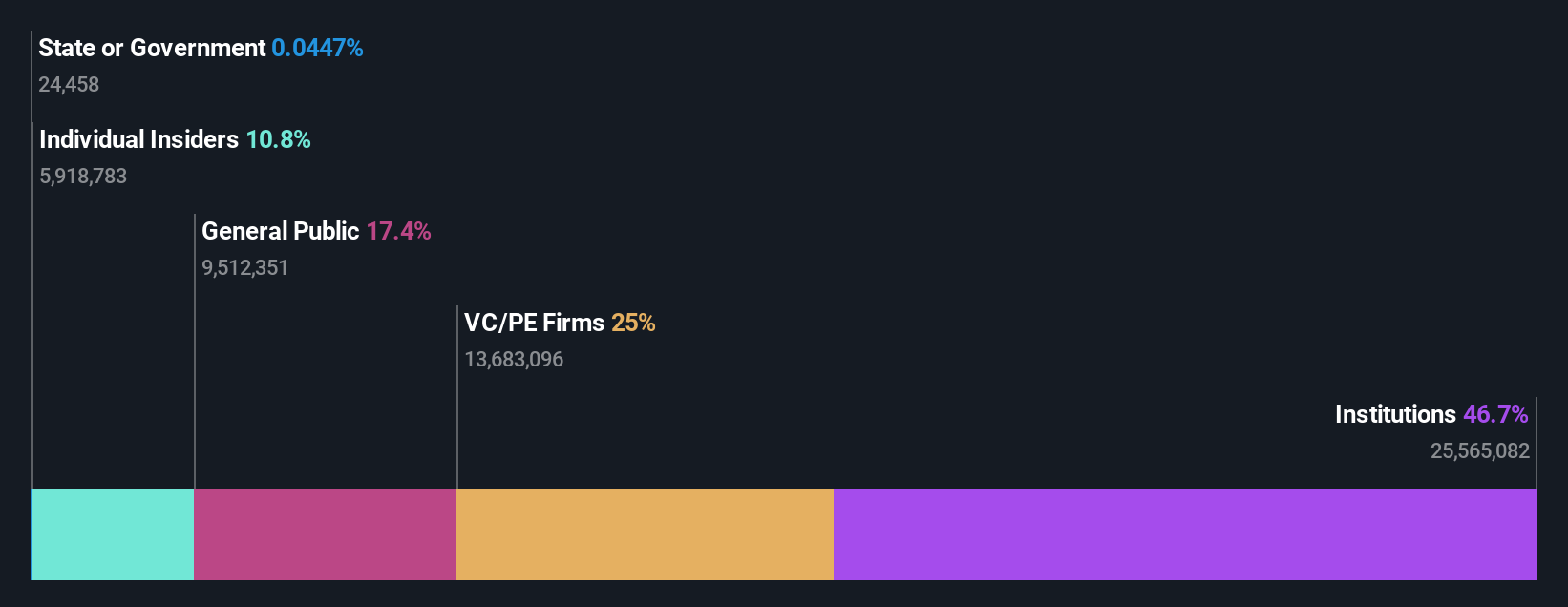

Insider Ownership: 20.5%

Revenue Growth Forecast: 15% p.a.

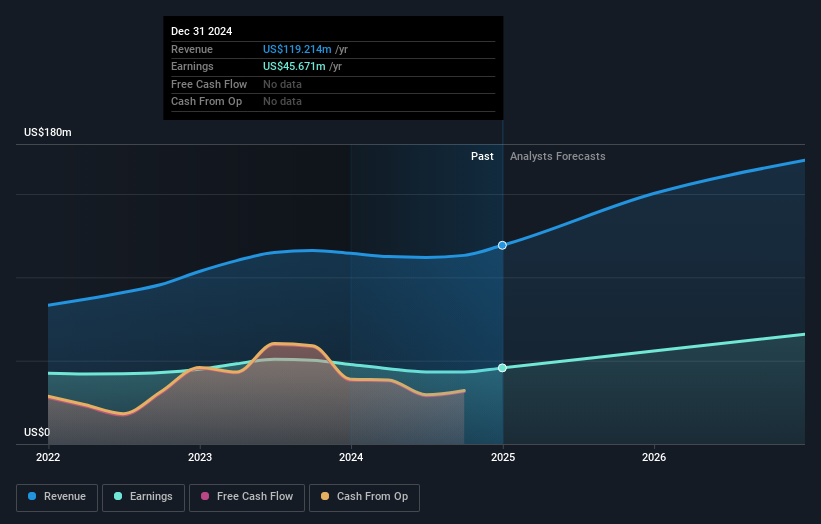

Bridgewater Bancshares demonstrates potential as a growth company with high insider ownership. Despite recent earnings showing a slight decline in net income to US$8.68 million for Q3 2024, the company's earnings are expected to grow significantly at 20.2% annually over the next three years, outpacing the US market average of 15.5%. Revenue is also forecasted to grow faster than the market at 15% per year, although it remains below 20%.

- Click here to discover the nuances of Bridgewater Bancshares with our detailed analytical future growth report.

- The analysis detailed in our Bridgewater Bancshares valuation report hints at an deflated share price compared to its estimated value.

Five Star Bancorp (NasdaqGS:FSBC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five Star Bancorp is the bank holding company for Five Star Bank, offering a variety of banking products and services to small and medium-sized businesses, professionals, and individuals in Northern California, with a market cap of $699.48 million.

Operations: The company generates revenue of $113.17 million from its financial service operations, catering to small and medium-sized businesses, professionals, and individuals in Northern California.

Insider Ownership: 24.6%

Revenue Growth Forecast: 19.1% p.a.

Five Star Bancorp's earnings are forecast to grow significantly at 20.7% annually, surpassing the US market average of 15.5%. Despite trading at a substantial discount to its estimated fair value, revenue growth is projected at 19.1% annually, faster than the market but below the 20% mark. Recent Q3 results showed net interest income rising to US$30.39 million, though net income slightly declined year-over-year to US$10.94 million with diluted EPS dropping to US$0.52 from US$0.64.

- Take a closer look at Five Star Bancorp's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Five Star Bancorp's share price might be too optimistic.

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. is involved in the development, operation, and sale of metallurgical coal with a market cap of approximately $640.60 million.

Operations: The company generates its revenue primarily from the Metals & Mining segment, specifically through coal sales amounting to $698.13 million.

Insider Ownership: 10.1%

Revenue Growth Forecast: 13.9% p.a.

Ramaco Resources shows potential with earnings projected to grow significantly at 36.91% annually, outpacing the US market's average. Despite a recent net loss of US$0.239 million in Q3 compared to last year's profit, production increased notably to 972,000 tons from 719,000 tons year-over-year. The company completed a US$50 million fixed-income offering and declared dividends for Class A and B shares, indicating strong insider confidence in its future growth trajectory.

- Navigate through the intricacies of Ramaco Resources with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Ramaco Resources' share price might be too pessimistic.

Key Takeaways

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 200 more companies for you to explore.Click here to unveil our expertly curated list of 203 Fast Growing US Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bridgewater Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BWB

Bridgewater Bancshares

Operates as the bank holding company for Bridgewater Bank that provides banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States.

Very undervalued with flawless balance sheet.