- United States

- /

- Banks

- /

- NasdaqCM:CZNC

Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences modest gains amid ongoing concerns about the banking sector and trade tensions with China, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such a volatile environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for those looking to navigate uncertain economic conditions while seeking reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.31% | ★★★★★☆ |

| Regions Financial (RF) | 4.54% | ★★★★★★ |

| Rayonier (RYN) | 11.66% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.93% | ★★★★★☆ |

| OceanFirst Financial (OCFC) | 4.59% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 4.03% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.52% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.41% | ★★★★★★ |

| Ennis (EBF) | 5.74% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.98% | ★★★★★★ |

Click here to see the full list of 144 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

ACNB (ACNB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ACNB Corporation is a financial holding company providing banking, insurance, and financial services to individual, business, and government customers in the United States, with a market cap of $462.67 million.

Operations: ACNB Corporation generates revenue primarily from its banking segment, which accounts for $114.40 million, and its insurance segment, contributing $9.95 million.

Dividend Yield: 3.2%

ACNB offers a reliable dividend yield of 3.17%, although it is lower than the top 25% of US dividend payers. The company maintains stable and growing dividends over the past decade, supported by a low payout ratio of 48.1%, ensuring sustainability. While profit margins have decreased from last year, earnings are forecast to grow significantly at 29.8% annually, reinforcing future dividend coverage (29% payout ratio). Recent buybacks indicate shareholder value focus despite slight dilution last year.

- Unlock comprehensive insights into our analysis of ACNB stock in this dividend report.

- The valuation report we've compiled suggests that ACNB's current price could be inflated.

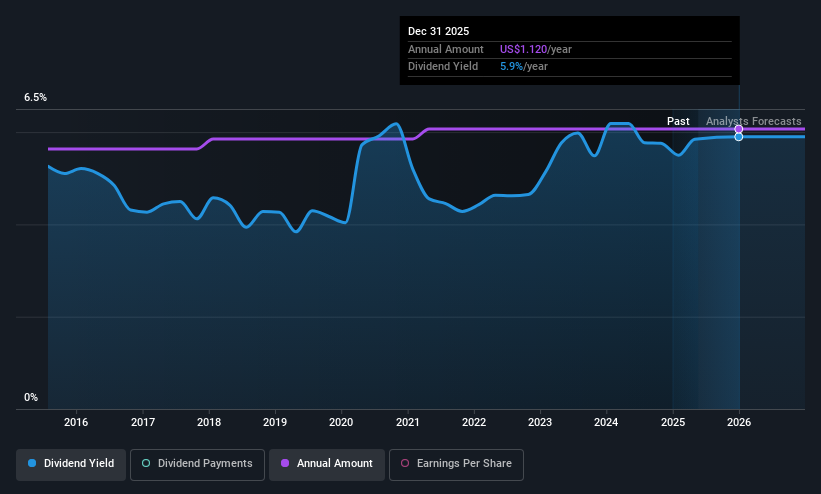

Citizens & Northern (CZNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens & Northern Corporation, with a market cap of $303.32 million, is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate customers.

Operations: Citizens & Northern Corporation generates its revenue primarily through its Community Banking segment, which accounted for $108.31 million.

Dividend Yield: 5.9%

Citizens & Northern offers a high dividend yield of 5.89%, placing it in the top 25% of US dividend payers. The dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 64.2%. Recent strategic changes include a merger with Susquehanna Community Financial Inc., potentially enhancing future growth prospects. Despite some executive reshuffling, earnings have shown consistent growth, with net interest income rising to US$21.14 million in Q2 2025 from US$19.45 million the previous year.

- Navigate through the intricacies of Citizens & Northern with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Citizens & Northern's current price could be quite moderate.

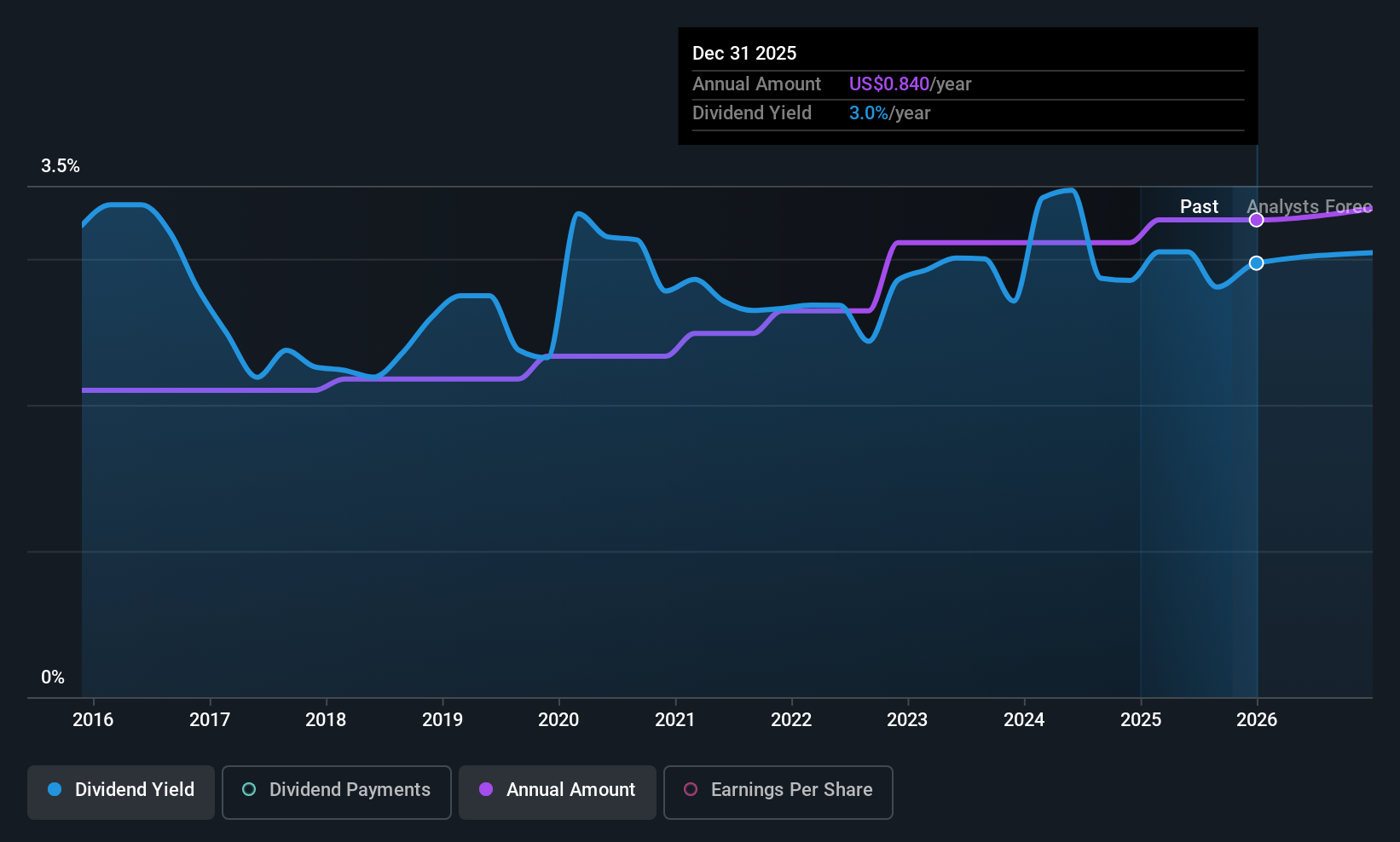

Middlefield Banc (MBCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Middlefield Banc Corp. is the bank holding company for The Middlefield Banking Company, offering a range of commercial banking services to small and medium-sized businesses, professionals, small business owners, and retail customers in northeastern and central Ohio, with a market cap of $231.69 million.

Operations: Middlefield Banc Corp. generates its revenue primarily from banking services, amounting to $71.72 million.

Dividend Yield: 3%

Middlefield Banc pays a reliable dividend of 3.03%, though it's below the top tier in the US market. The dividend has been stable and growing over the past decade, supported by a low payout ratio of 36.4%. Recent earnings growth is strong, with Q2 net income rising to US$6.16 million from US$4.16 million a year ago, indicating solid financial health despite having a low allowance for bad loans at 89%.

- Click here and access our complete dividend analysis report to understand the dynamics of Middlefield Banc.

- Upon reviewing our latest valuation report, Middlefield Banc's share price might be too optimistic.

Key Takeaways

- Click this link to deep-dive into the 144 companies within our Top US Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives