- United States

- /

- Auto

- /

- NYSE:GM

General Motors (GM): Examining the Valuation Behind Recent Share Price Momentum

Reviewed by Simply Wall St

General Motors (GM) has been making waves on Wall Street lately, prompting plenty of back-and-forth among investors over what to do next. While there hasn't been a major headline grabbing event, the recent move in the stock might have caught your eye and sparked questions. Is this uptick just routine market noise, or is something bigger at play for GM’s future trajectory?

GM’s share price has gained 24% over the past year, with momentum building over the past 3 months, up 19%. That said, short-term moves have been less dramatic. This suggests investors are responding mainly to the company’s longer-term growth signals rather than trading on sudden news. Revenue and net income have both grown over the past year, which may indicate the automaker’s fundamentals are steady even as headlines focus on challenges in the car industry.

With growth in both the top and bottom line and the stock’s steady climb, is GM undervalued today or is the market already pricing in all of its future upside?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, General Motors is trading at a price very close to its estimated fair value, based on a comprehensive analysis of projected earnings growth, future profit margins, and other key factors.

Strategic investments in U.S. manufacturing and battery production, including new chemistries (LMR, LFP) and flexible plant capacity, are expected to offset regulatory and tariff headwinds, reduce per-unit costs, and widen margins as scale increases and new capacity comes online by 2027.

What quietly powers this valuation? Dive beneath the surface and you’ll find a financial roadmap built around ambitious cost controls, recurring revenue expansion, and critical assumptions about earnings per share. This narrative holds a twist investors can’t afford to miss. One key projection could define GM’s upside (or limit it) in ways few expect. Are you ready to uncover where the real profit potential may lie?

Result: Fair Value of $57.2 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, unpredictable regulatory changes or slower electric vehicle adoption could quickly undermine GM’s current growth expectations and weaken investor conviction.

Find out about the key risks to this General Motors narrative.Another Perspective: Discounted Cash Flow Tells a Different Story

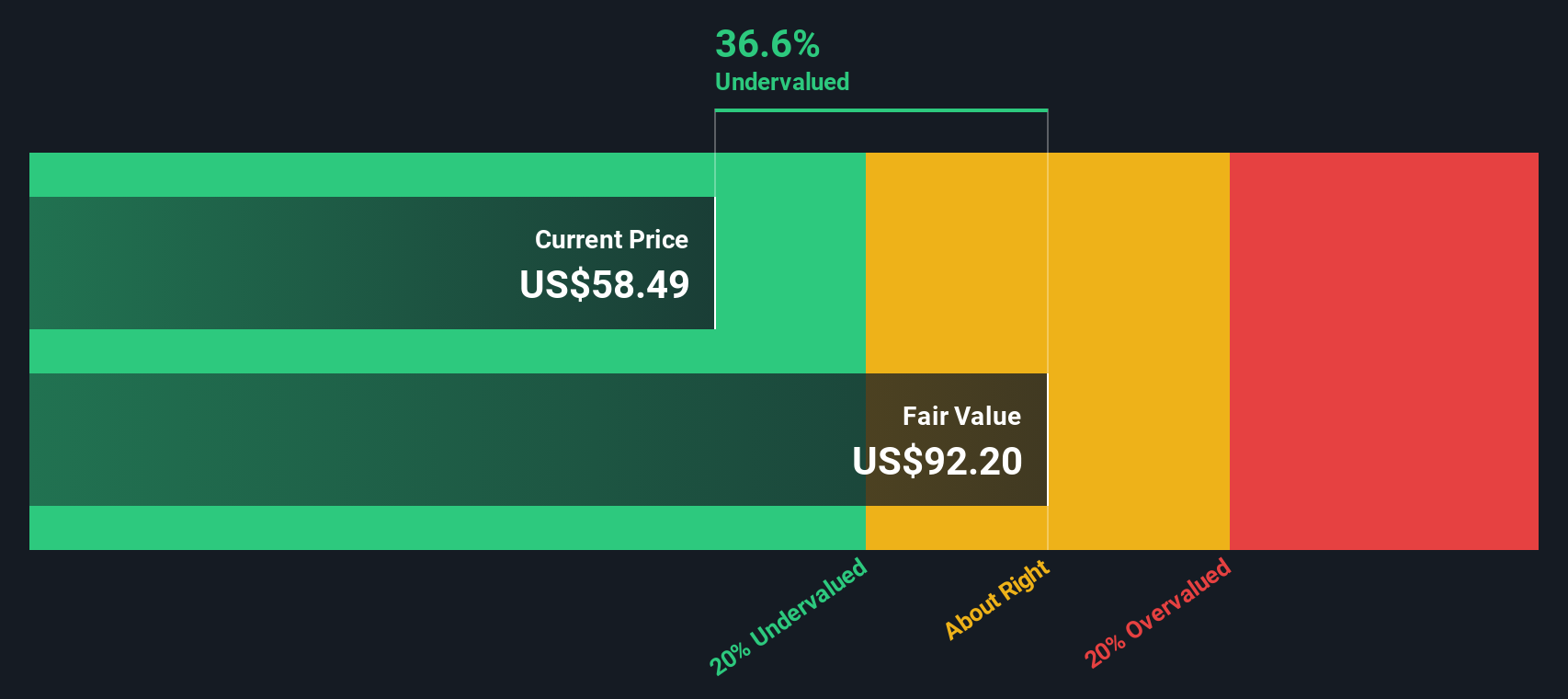

While the typical valuation looks at GM’s share price against earnings, our SWS DCF model presents a much different result. This suggests the market might be underestimating GM’s true worth. Which approach will prove right over time?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own General Motors Narrative

If this narrative does not quite align with your own thinking, or you prefer hands-on discovery, you can craft a personalized analysis in just a few minutes. Do it your way

A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for what you already know. Expand your portfolio with standout stocks that match your ambitions. Tap into fresh themes handpicked for returns and resilience before others catch on.

- Unlock untapped growth by scanning for market underdogs using the penny stocks with strong financials, where financial strength meets surprising upside.

- Power up your holdings with tomorrow’s breakthroughs. Check out companies reshaping medicine and patient outcomes through the healthcare AI stocks.

- Boost your passive income and safeguard your future by targeting reliable yield opportunities in the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion