- United States

- /

- Auto

- /

- NYSE:F

Ford Motor Company (NYSE:F) Expands Europe EV Production, Investors are Cautious

Ford Motor Company (NYSE:F) committed to some capital intensive strides towards more EV production. Today, we will note the latest developments, as well as analyze investor sentiment and stock price.

Today, Ford announced the expansion of their European EV operations:

- Introduce 3 new passenger and 4 commercial EVs by 2024

- Target 600k EV sales in EU by 2026

- 2mln global EV production target, 10% adj. EBIT by 2026

- 2bn expansion of Cologne plant to 1.2mln EV capacity

- New partnered EV battery plant in Turkey

Ford stock is up 20% from a year ago, and the company is pushing EV expansion in the US and Europe. While this development is encouraging for some investors, the current financial performance of the company is hard to get excited about.

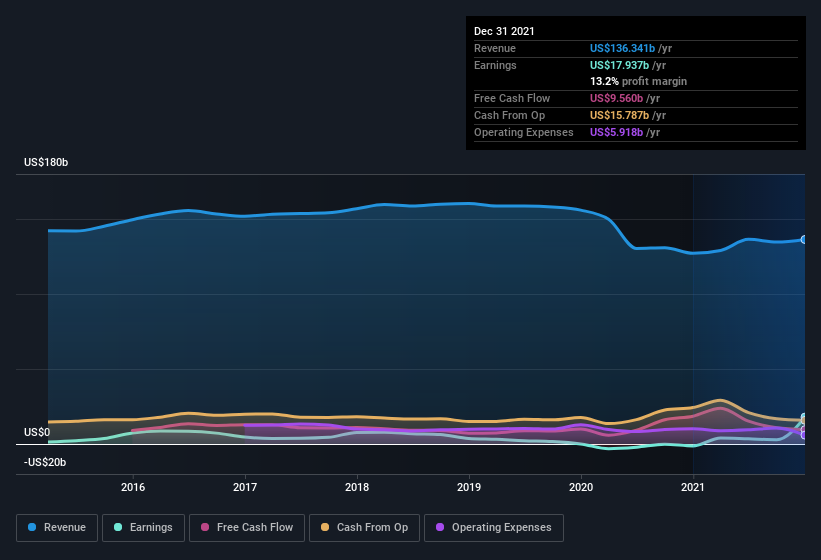

In the chart below, we see that the company has free cash flows consistently hovering around US10b, with noticeable drops in the net profit margin by 2020.

While the EV expansion may be a bid to revitalize the company, it too comes with its own set of challenges, and pivoting to EV assembly lines and supply chains might not be as simple as it looks on the outside.

Gauging Sentiment

Ford is currently a US$63m market cap company, and at first glance a price-to-earnings (or "P/E") ratio of 3.6x may be sending very bullish signals, given that almost half of all companies in the United States have P/E ratios greater than 16x.

However, we saw that this is a result of the last 12 months of earnings, while before that, the stock had significantly less net income.

See our latest analysis for Ford Motor

In fact, if we normalize the last 5 years of earnings, we get an annual net income of US$3.6b, which would reflect a historical P/E of 17.5x - If is what investors can expect from profits, than this P/E is much closer to market level pricing, and does not indicate that the stock is underpriced.

For a stable, mature company such as Ford, it makes sense to take the last 5 instead of 3 years when normalizing data, since profits will be additionally skewed by 2020 and 2021 circumstances.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ford Motor.

Does Growth Match The P/E?

The company had a revenue slump in the first half of 2020, and is very slowly recovering. It seems that management is placing some strong hopes in the EV landscape, but must show investors that they can surpass previous historical earnings, not just replace them - otherwise the stock is trading around a fair price and not creating additional value for shareholders.

While the top line grew about 7.2% in the last 12 months, Ford did manage to scale well and revenue growth was 5.5% higher than the growth of COGS (cost of goods sold).

For an automobile company, COGS is a meaningful factor, because they (and many like them) have a gross margin of 12.1% - This means that small improvements in the cost structure, will be noticed by investors. Perhaps Ford management should focus on explaining the EV cost structure and possible savings, instead of growth and CapEx.

The Final Word

Ford is further moving towards EVs in Europe. While the company posts big plans, it may take more convincing for investors.

If we look at a traditional valuation metric such as the P/E we might find that the company is underpriced. However, it may make more sense to normalize earnings across 5 years, in which case we get a P/E of 17.5x - much closer to market level pricing.

Ford, may actually have a chance to create value for investors if it finds a way to adopt efficient production strategies and optimize the cost structure of COGS. A small move in the gross margin can open some air for investors.

There are also other vital risk factors to consider, and we've discovered 5 warning signs for Ford Motor (2 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)