- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

Discovering US Undiscovered Gems in October 2025

Reviewed by Simply Wall St

In October 2025, the U.S. stock market has been marked by volatility, with major indices like the S&P 500 and Nasdaq recently hitting new highs before pulling back slightly. Amidst this backdrop of fluctuating economic indicators and shifting investor sentiment, identifying undiscovered gems in the small-cap sector can offer unique opportunities for growth as these companies often fly under the radar while possessing strong fundamentals or innovative potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

GBank Financial Holdings (GBFH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GBank Financial Holdings Inc. is a bank holding company for GBank, offering banking services to commercial and consumer clients in Nevada, with a market cap of $585.04 million.

Operations: GBank Financial Holdings generates revenue primarily through its banking segment, which reported $65.05 million.

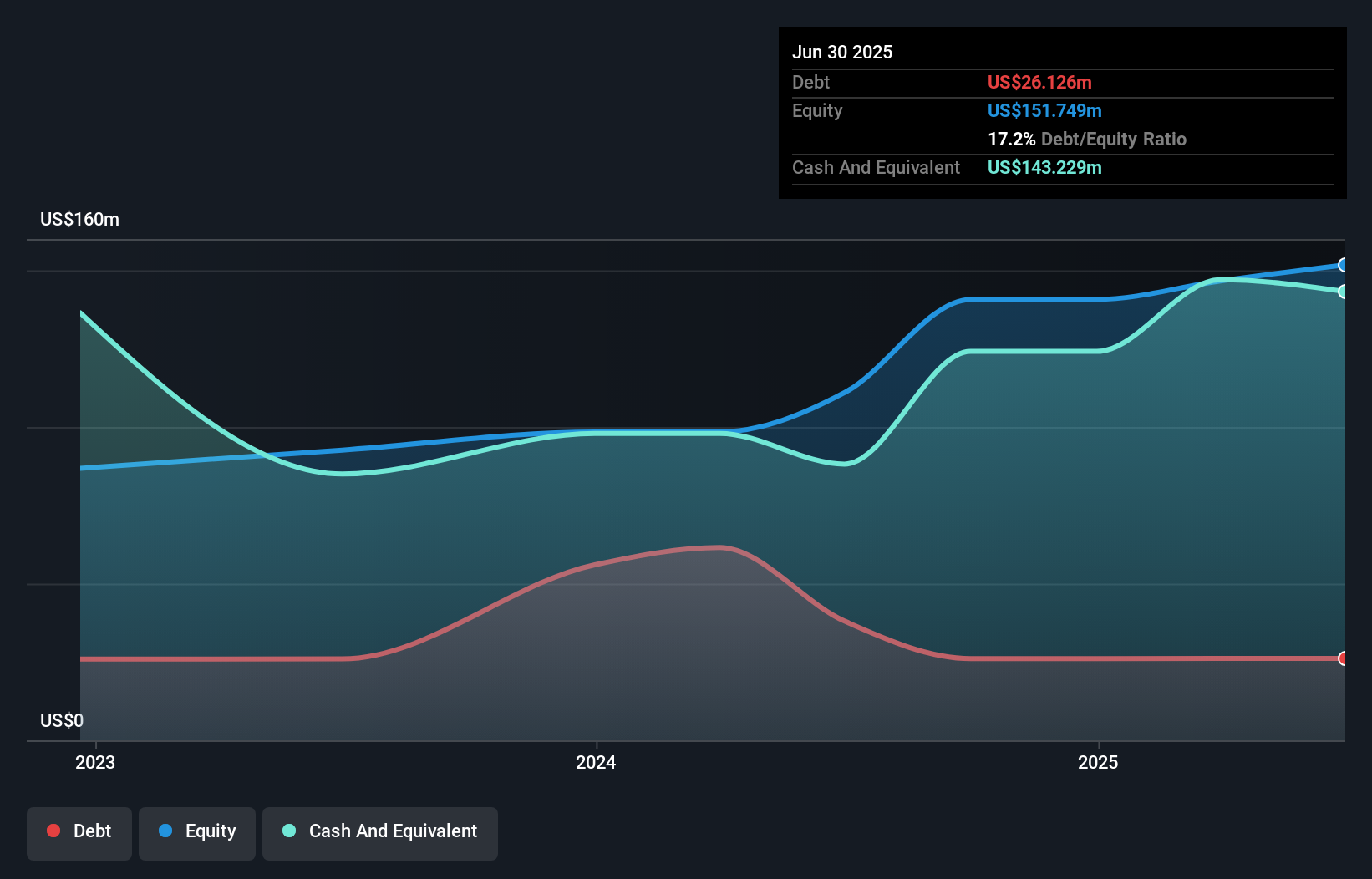

GBank Financial Holdings, with total assets of US$1.2 billion and equity of US$151.7 million, is gaining attention due to its strong growth trajectory and recent inclusion in the S&P Global BMI Index. The company has a robust deposit base of US$1 billion, which constitutes 96% low-risk funding sources. Despite a high level of bad loans at 2.1%, earnings have surged by 42% over the past year, outpacing industry averages significantly. Recent management shifts aim to capitalize on digital banking opportunities, with Ed Nigro stepping in as CEO to guide this transition effectively amidst ongoing executive changes.

- Delve into the full analysis health report here for a deeper understanding of GBank Financial Holdings.

Understand GBank Financial Holdings' track record by examining our Past report.

XPEL (XPEL)

Simply Wall St Value Rating: ★★★★★★

Overview: XPEL, Inc. is involved in the manufacturing, installation, sales, and distribution of protective films and coatings with a market capitalization of approximately $928.70 million.

Operations: XPEL generates revenue primarily from its Auto Parts & Accessories segment, which accounts for $448.90 million. The company has a market capitalization of approximately $928.70 million, reflecting its position in the protective films and coatings industry.

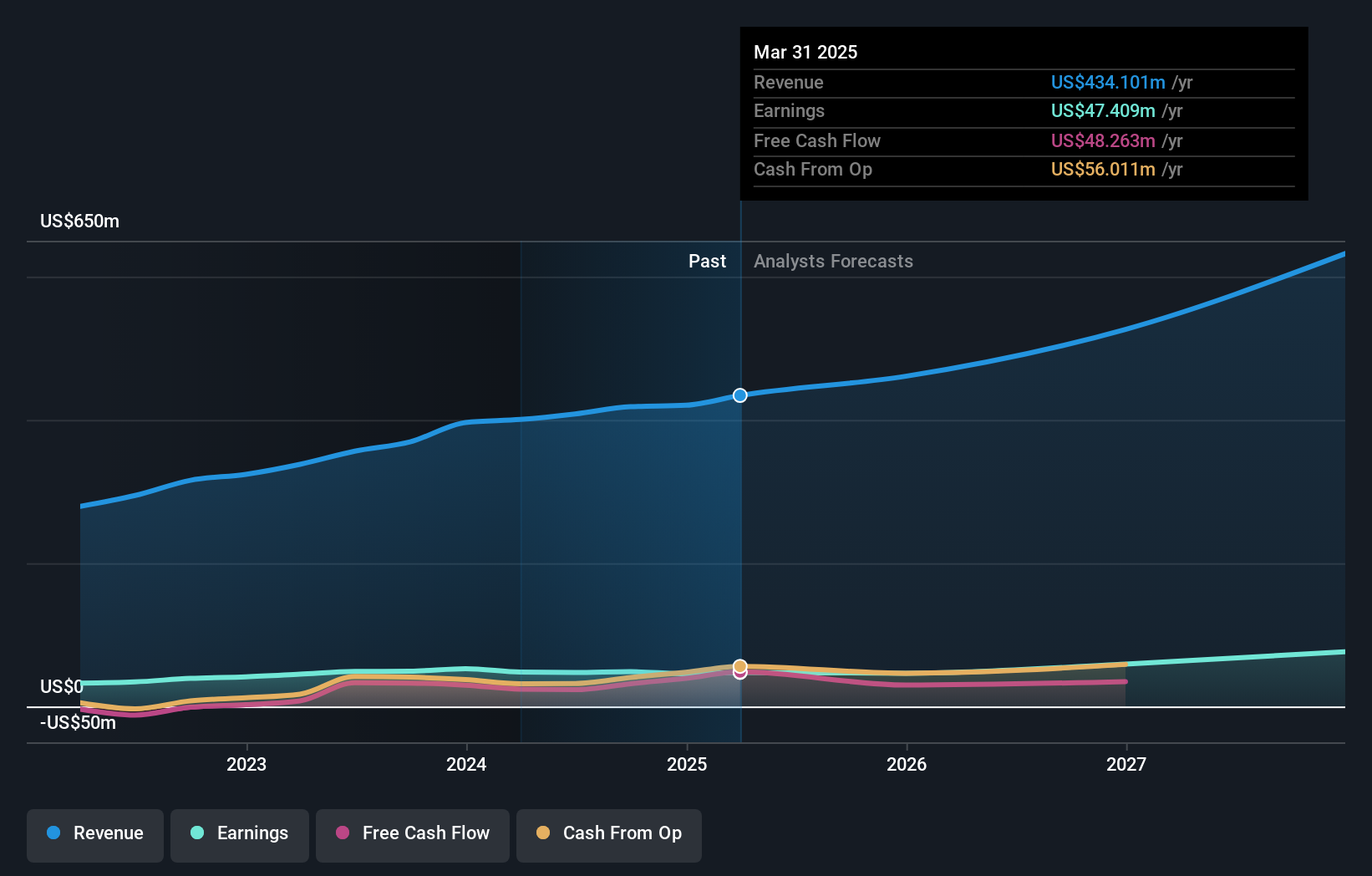

XPEL, a dynamic player in the automotive protection industry, is making waves with its innovative COLOR Paint Protection Film (PPF), offering a durable and vibrant alternative to traditional vehicle wraps. This small-cap company has seen its earnings grow by 2.8% over the past year, outpacing industry averages. Its debt-to-equity ratio impressively dropped from 18.7% to just 0.08% over five years, while maintaining high-quality earnings and positive free cash flow. Trading at 46% below estimated fair value suggests potential for investors seeking undervalued opportunities in an expanding market segment with robust growth prospects projected at nearly 25%.

Third Coast Bancshares (TCBX)

Simply Wall St Value Rating: ★★★★★★

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, offering a range of commercial banking solutions to small and medium-sized businesses and professionals in the United States, with a market cap of $532.96 million.

Operations: Third Coast Bancshares generates revenue primarily from its community banking segment, amounting to $182.32 million. The company's market capitalization stands at approximately $532.96 million.

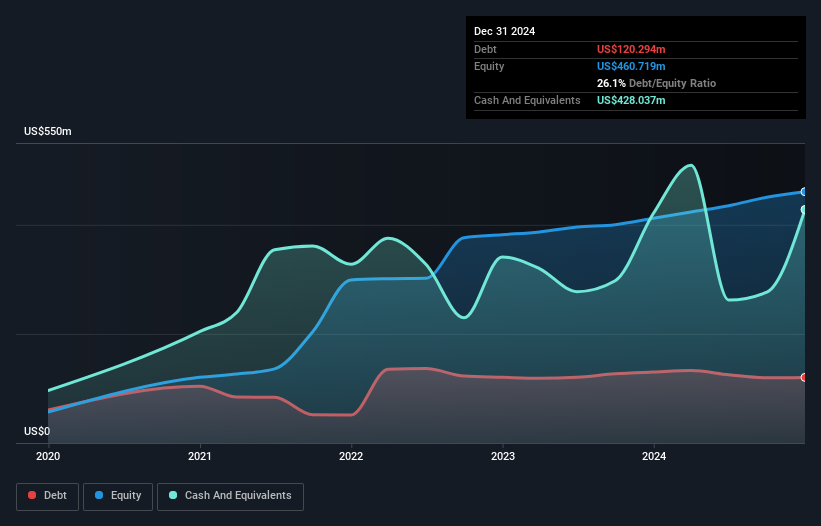

Third Coast Bancshares, with total assets of US$4.9 billion and equity of US$496.1 million, is making waves with impressive earnings growth of 64.4% over the past year, outpacing the industry average. The bank boasts a robust allowance for bad loans at 199%, ensuring stability against potential defaults while maintaining low-risk funding through customer deposits, which account for 96% of liabilities. Despite its removal from the NASDAQ Composite Index recently, TCBX continues to demonstrate high-quality earnings and prudent lending practices amidst Texas's competitive banking landscape, positioning it well for future strategic acquisitions and expansion opportunities in the region.

Turning Ideas Into Actions

- Investigate our full lineup of 288 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)