- United States

- /

- Food and Staples Retail

- /

- NYSE:NGVC

Discovering November 2024's Undiscovered Gems in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing by 2.2% over the past week with every sector experiencing gains, and achieving a remarkable 32% increase over the last year. In this thriving environment, identifying stocks that exhibit strong growth potential and align well with anticipated earnings growth can uncover promising opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Montauk Renewables (NasdaqCM:MNTK)

Simply Wall St Value Rating: ★★★★★★

Overview: Montauk Renewables, Inc. is a renewable energy company focused on the recovery and processing of biogas from landfills and other non-fossil fuel sources, with a market cap of $636.18 million.

Operations: Montauk Renewables generates revenue primarily from Renewable Natural Gas (RNG) at $176.70 million and Renewable Electricity Generation (REG) at $18.15 million.

Montauk Renewables, a player in the renewable energy sector, shows promise with its focus on biogas recovery from landfills. Recent earnings for Q3 2024 revealed sales of US$65.92 million and net income of US$17.05 million, both up from the previous year. The company's debt management is robust with a net debt to equity ratio at 0.8%, while interest payments are well covered by EBIT at 5.5 times coverage. Despite challenges like weather impacts and market price shifts, Montauk's strategic projects and partnerships could bolster future growth prospects significantly within this dynamic industry landscape.

XPEL (NasdaqCM:XPEL)

Simply Wall St Value Rating: ★★★★★★

Overview: XPEL, Inc. is a company that specializes in selling, distributing, and installing protective films and coatings globally, with a market capitalization of approximately $1.26 billion.

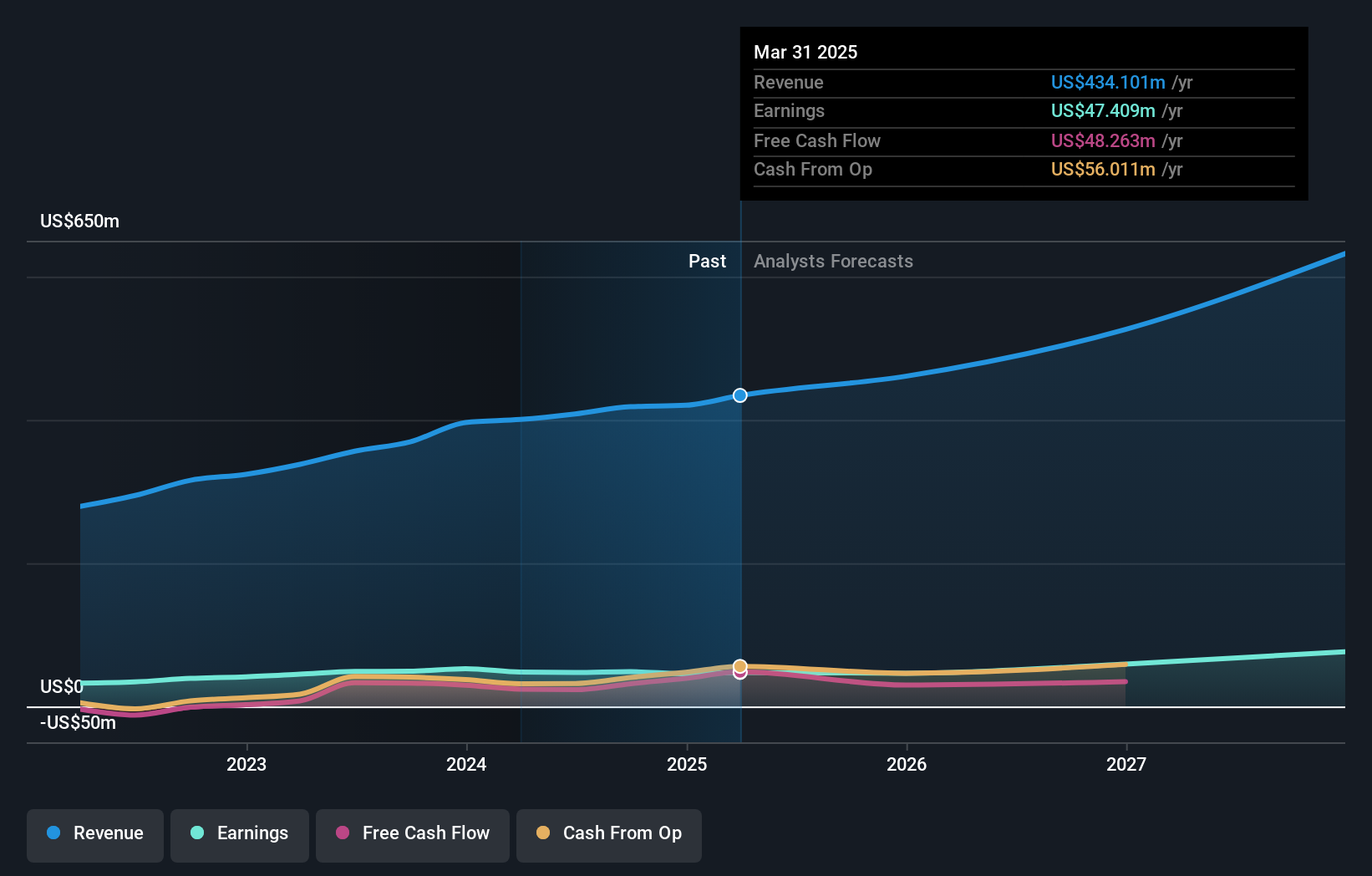

Operations: XPEL generates revenue primarily from its Auto Parts & Accessories segment, which contributed $418.41 million. The company's financial performance is highlighted by a focus on this core segment, impacting overall profitability and growth strategies.

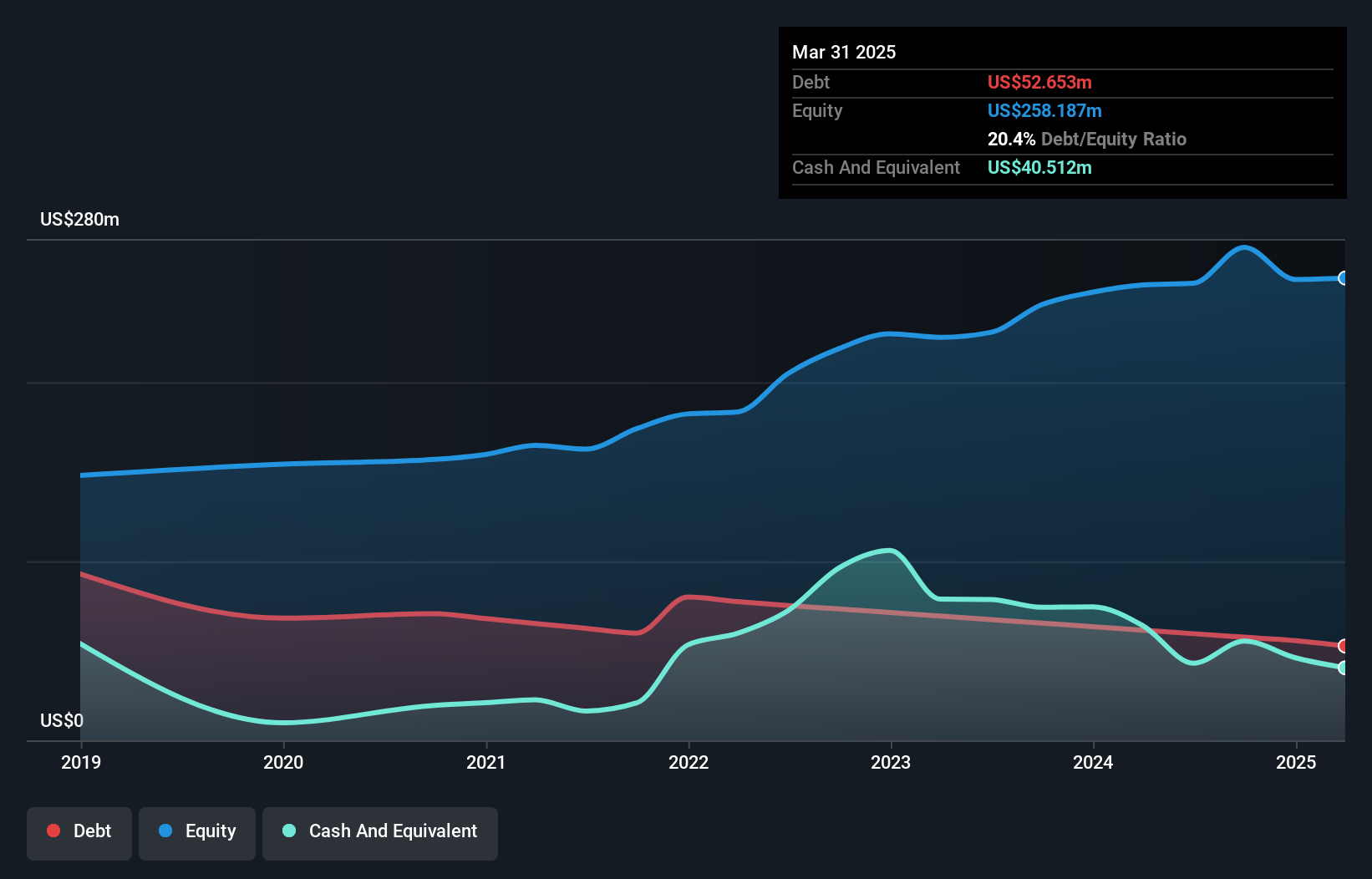

XPEL, a nimble player in the auto components sector, is navigating its path with strategic expansions and product innovations. Despite facing a slight earnings dip of 1.3% last year against the industry’s 5.3% growth, XPEL's financial health remains robust with more cash than debt and an impressive EBIT coverage of interest payments at 48 times. The company's recent collaboration with Rivian to offer customized paint protection films underscores its innovative edge and market adaptability. With earnings expected to grow annually by over 15%, XPEL seems well-positioned for future opportunities despite current challenges in key markets like Europe and China.

Natural Grocers by Vitamin Cottage (NYSE:NGVC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Natural Grocers by Vitamin Cottage, Inc. operates as a retailer of natural and organic groceries and dietary supplements in the United States, with a market cap of approximately $1.04 billion.

Operations: Natural Grocers generates revenue primarily through its natural and organic retail stores, amounting to $1.24 billion.

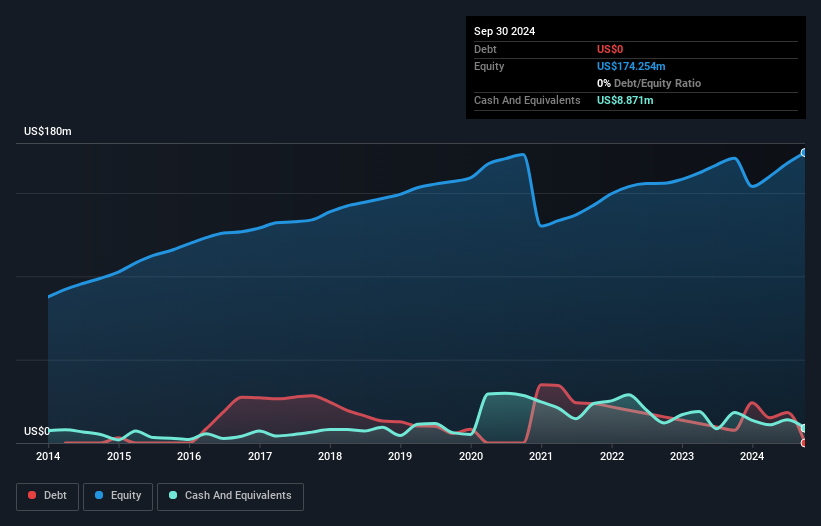

Natural Grocers, a compact player in the retail sector, showcases robust financial health with zero debt and an impressive earnings growth of 46% over the past year. The company reported net income of US$33.94 million for the fiscal year ending September 2024, up from US$23.24 million the previous year, reflecting its strong performance against industry norms. Trading at 24% below estimated fair value suggests potential undervaluation. Recent expansions include relocating stores and plans to open new locations in fiscal 2025 while enhancing customer experience through sustainable practices and community-focused initiatives like nutritional health coaching.

Summing It All Up

- Get an in-depth perspective on all 228 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natural Grocers by Vitamin Cottage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVC

Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc., together with its subsidiaries, retails natural and organic groceries, and dietary supplements in the United States.

Solid track record with adequate balance sheet.