- United States

- /

- Communications

- /

- NasdaqGS:CRNT

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market looks to extend its gains during the Santa Claus rally, investors are paying close attention to opportunities that might emerge amid fluctuating indices and economic signals. Penny stocks, a term often associated with speculative trading, continue to hold potential for those willing to explore smaller or newer companies with solid financial foundations. In this article, we highlight several penny stocks that demonstrate financial strength and could offer long-term value for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $103.25M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8849 | $6.43M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2399 | $8.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.855 | $49.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.27 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8502 | $76.47M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.64 | $388.67M | ★★★★☆☆ |

Click here to see the full list of 739 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Real Brokerage (NasdaqCM:REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $946.31 million.

Operations: The company generates revenue primarily from its North American Brokerage segment, which accounts for $1.09 billion.

Market Cap: $946.31M

Real Brokerage, with a market cap of US$946.31 million, is currently unprofitable but maintains over three years of cash runway due to positive free cash flow. Despite trading at 55.3% below estimated fair value and lacking long-term liabilities, it has seen shareholder dilution and significant insider selling recently. The company reported sales of US$372.49 million for Q3 2024 but incurred a net loss of US$2.59 million, reflecting ongoing financial challenges despite revenue growth forecasts of 23.51% annually. Recent strategic moves include expanding its agent base with ROVI Homes and launching innovative tools like Real Wallet and Leo CoPilot to enhance agent operations.

- Take a closer look at Real Brokerage's potential here in our financial health report.

- Evaluate Real Brokerage's prospects by accessing our earnings growth report.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across multiple regions, with a market cap of $404.45 million.

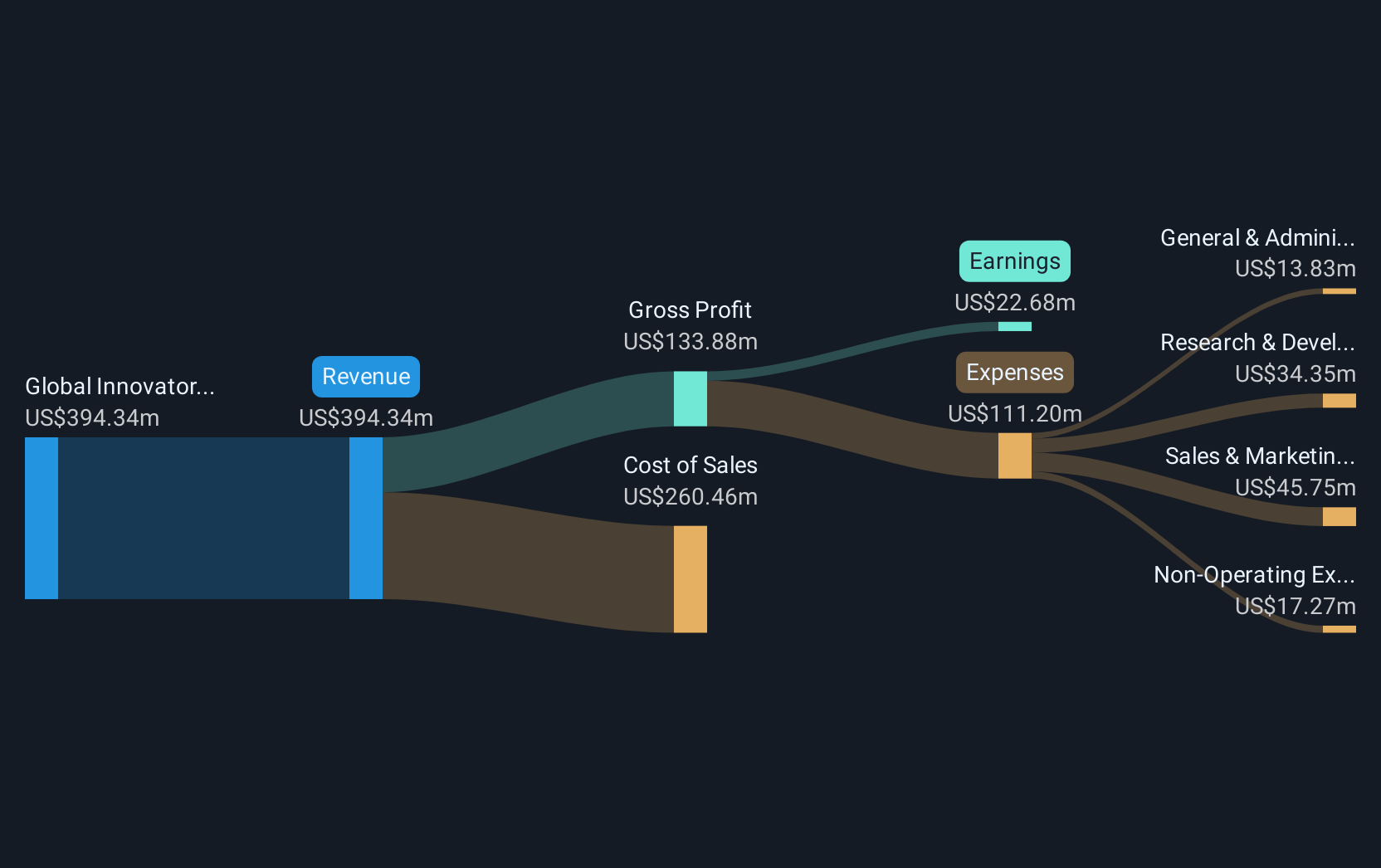

Operations: The company generates $377.62 million in revenue from its role as a global innovator and leading solutions provider of wireless transport.

Market Cap: $404.45M

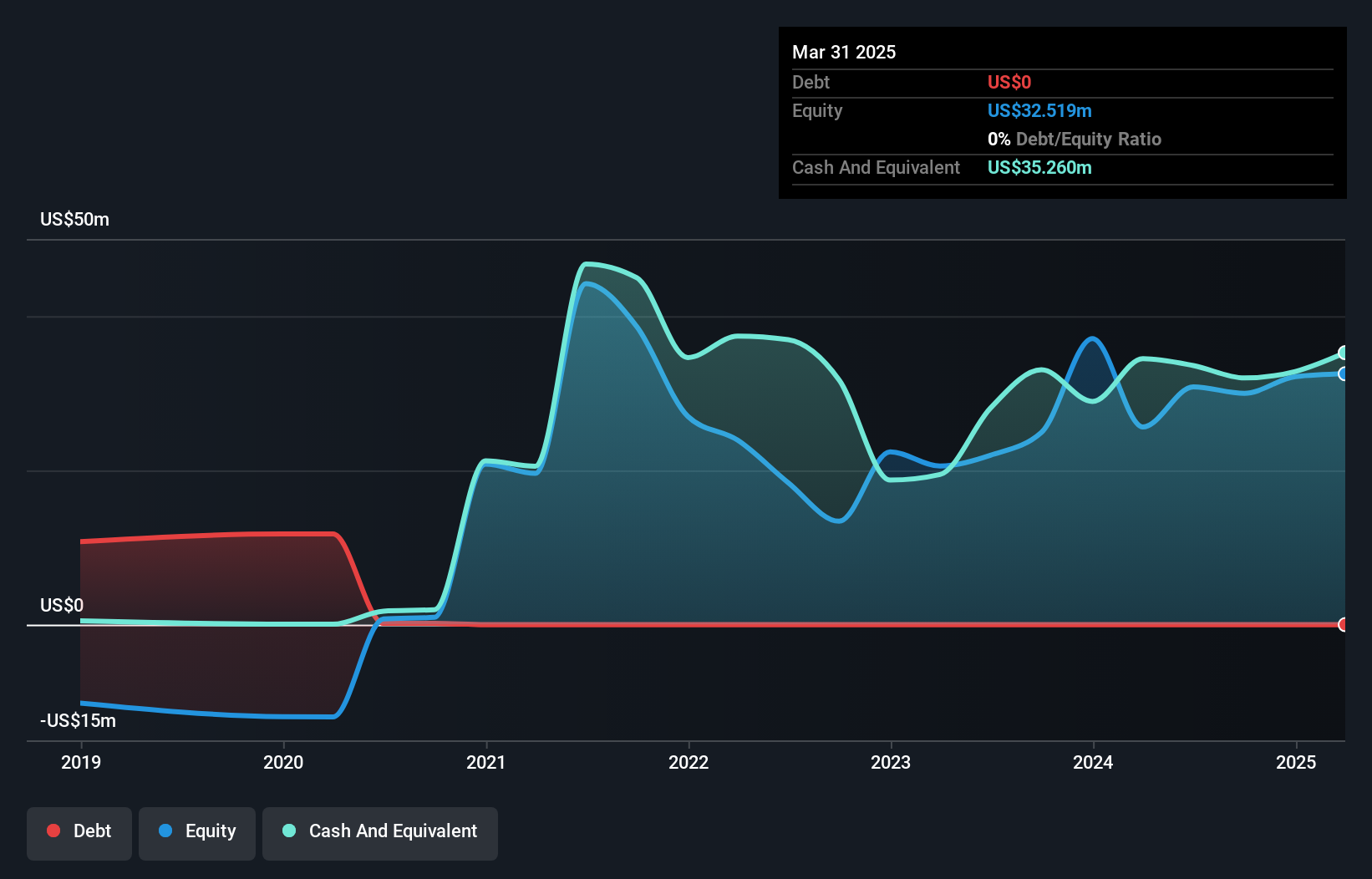

Ceragon Networks, with a market cap of US$404.45 million, has shown substantial growth in the past year, reporting Q3 2024 sales of US$102.67 million and net income of US$12.22 million, up significantly from the previous year. The company has become profitable recently and maintains strong financial health with short-term assets exceeding both long-term and short-term liabilities. Its debt is well covered by operating cash flow, and it trades at a good value relative to peers despite low return on equity. Ceragon's earnings guidance for 2024 anticipates revenue growth between 12% to 15%, bolstered by its acquisition of Siklu.

- Dive into the specifics of Ceragon Networks here with our thorough balance sheet health report.

- Learn about Ceragon Networks' future growth trajectory here.

Butterfly Network (NYSE:BFLY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Butterfly Network, Inc. develops, manufactures, and commercializes ultrasound imaging solutions globally and has a market cap of $662.62 million.

Operations: The company's revenue is primarily generated from providing an AI-enhanced personal ultrasound solution, totaling $76.22 million.

Market Cap: $662.62M

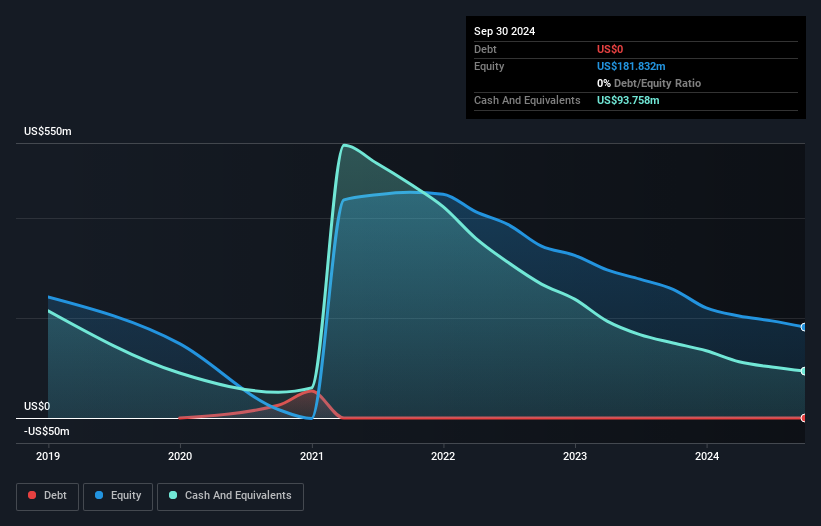

Butterfly Network, with a market cap of US$662.62 million, has been gaining attention after being added to the S&P Healthcare Equipment Select Industry Index. Despite reporting revenue growth with Q3 2024 figures at US$20.56 million, the company remains unprofitable and is not expected to achieve profitability in the near term. However, it maintains a strong balance sheet with short-term assets of US$199.5 million covering both short-term and long-term liabilities and is debt-free. Recent partnerships like the HeartFocus Education app highlight its innovative approach in ultrasound solutions despite shareholder dilution concerns over the past year.

- Unlock comprehensive insights into our analysis of Butterfly Network stock in this financial health report.

- Gain insights into Butterfly Network's future direction by reviewing our growth report.

Next Steps

- Get an in-depth perspective on all 739 US Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNT

Ceragon Networks

Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives