Narratives are currently in beta

Key Takeaways

- Expansion in India and Japan via distributor acquisition aims to boost growth through a direct sales model in underperforming markets.

- New product introductions and OEM partnerships, especially in Asia, could drive revenue by expanding channels and engaging new customers.

- Transitioning to direct distribution poses execution risks, while economic challenges in key regions and rising costs may pressure XPEL's revenue and earnings.

Catalysts

About XPEL- Sells, distributes, and installs protective films and coatings worldwide.

- The acquisition of distributors in India and Japan provides XPEL with the opportunity to transition to a more direct sales model, potentially increasing revenue growth in these emerging and underperforming markets.

- Streamlining processes and strategic shifts in China, including SKU optimization and supply chain improvements, are expected to stabilize revenue and contribute to predictable growth, improving earnings consistency.

- The introduction of new products, such as the Windshield Protection Film, opens up additional revenue streams by targeting consumers who are currently not engaged with XPEL's existing product lines.

- Expansion of OEM partnerships and dealership services, particularly in Asia, could enhance revenue through increased penetration of XPEL's products in new vehicle sales channels.

- A strategic focus on optimizing cash flow, managing inventory, and improving capital allocation could enhance net margins and support future investments in growth initiatives, potentially increasing earnings.

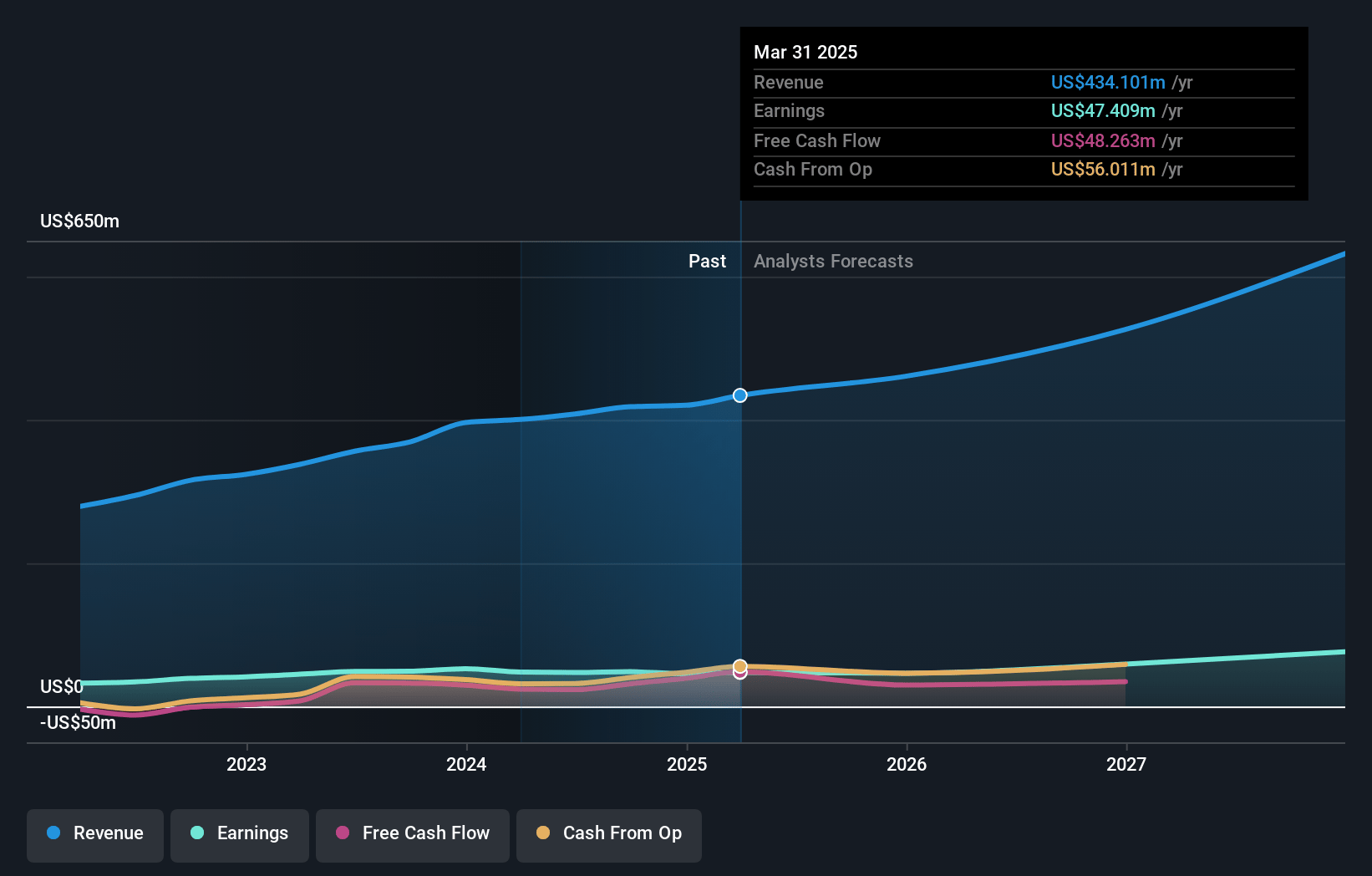

XPEL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming XPEL's revenue will grow by 17.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.6% today to 16.2% in 3 years time.

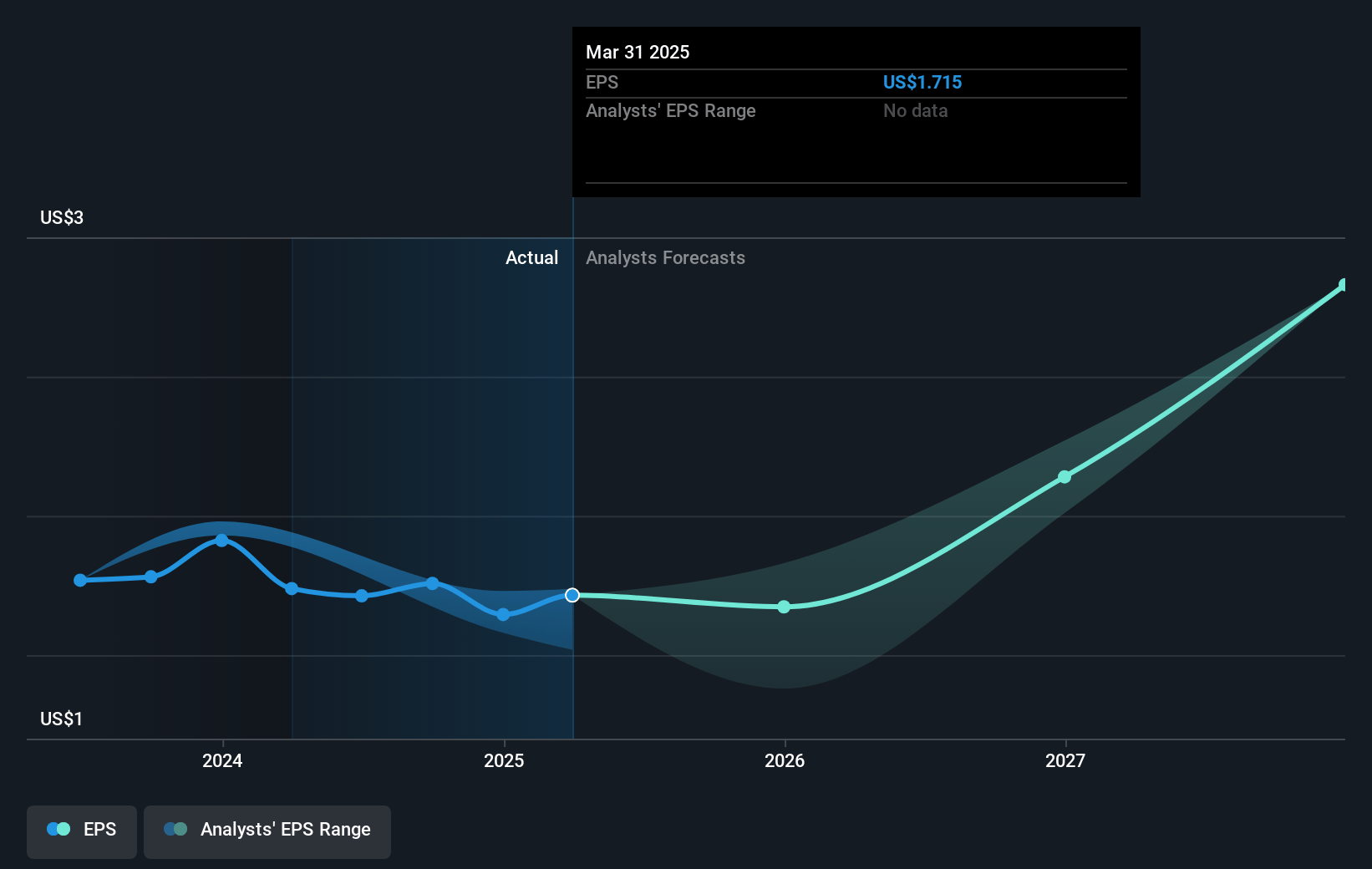

- Analysts expect earnings to reach $109.2 million (and earnings per share of $3.94) by about November 2027, up from $48.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2027 earnings, down from 25.6x today. This future PE is lower than the current PE for the US Auto Components industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

XPEL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on indirect distribution channels in less mature markets could impact revenue stability as it transitions to a direct model internationally, presenting execution risks and transitional challenges.

- Slower growth in Europe and the U.K. due to macroeconomic headwinds might reflect broader economic challenges that could suppress revenue growth in these regions if not addressed.

- Fluctuating revenues from China, with a reported decline and forecasted year-over-year drop in Q4, expose the company to regional economic volatility that could negatively impact earnings.

- Rising SG&A expenses, which increased by 23.6% over the previous year, could pressure net margins if revenue growth does not adequately cover these increased costs.

- The new windshield protection film product and ongoing strategic initiatives, while promising future revenue, may not contribute significantly to revenue or earnings in the immediate term, posing short-term financial risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.33 for XPEL based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $673.5 million, earnings will come to $109.2 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $44.93, the analyst's price target of $55.33 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives