Narratives are currently in beta

Key Takeaways

- The new Apex RNG facility and Blue Granite project are expected to drive future revenue once operational, despite commissioning delays.

- Regulatory approvals and strategic contracts could stabilize margins and enhance earnings from environmental attribute sales and RNG project efficiencies.

- Potential production and revenue impacts stem from weather events, regulatory delays, market price fluctuations, and infrastructure challenges in renewable natural gas operations.

Catalysts

About Montauk Renewables- A renewable energy company, engages in recovery and processing of biogas from landfills and other non-fossil fuel sources.

- The construction of Montauk Renewables' second Apex RNG facility, driven by increased landfill waste intake and gas feedstock availability, is expected to provide excess processing capacity and contribute to revenue growth upon its scheduled commissioning in 2025.

- Delays in utility upgrades for the Blue Granite RNG project, due to Hurricane Helene's remediation efforts, shift its commissioning expectation to 2027, which, once operational, is anticipated to impact long-term revenue positively.

- Montauk Ag Renewables' project in Turkey, North Carolina, gained regulatory approval to sell electricity generated from swine waste, which could enhance revenue from environmental attribute sales under the Renewable Fuel Standard and the California Low Carbon Fuel Standard.

- Current trends impacting landfill hosts' infrastructure installations could delay projected production increases. Montauk is considering fixed-price contracts to mitigate the impact of higher environmental attribute sharing percentage increases, potentially stabilizing revenue and net margins.

- The company’s engagement with various regulatory agencies for the development and optimization of RNG projects signifies potential future expansions and improved efficiency, potentially leading to enhanced earnings through increased environmental attribute generation and sales.

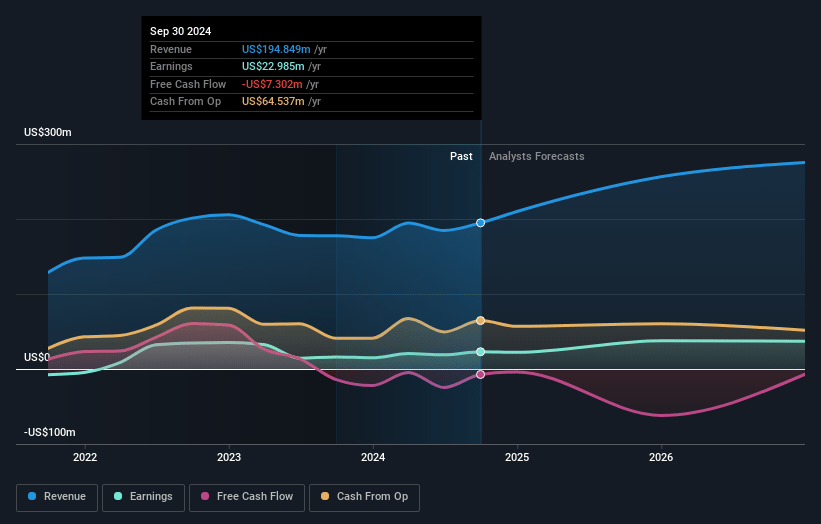

Montauk Renewables Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Montauk Renewables's revenue will grow by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.8% today to 8.0% in 3 years time.

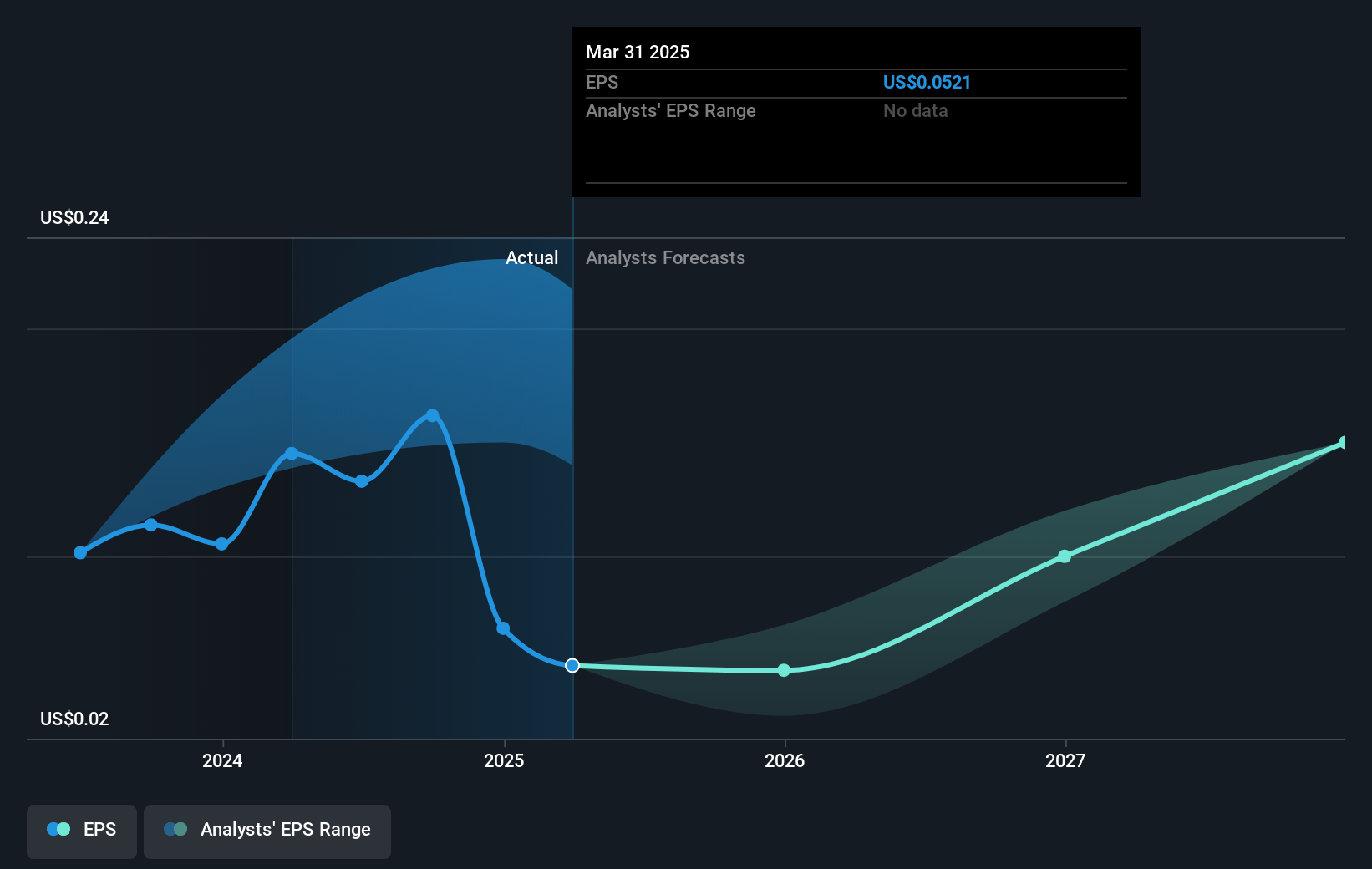

- Analysts expect earnings to reach $24.9 million (and earnings per share of $0.18) by about December 2027, up from $23.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $58.2 million in earnings, and the most bearish expecting $16.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.9x on those 2027 earnings, up from 23.4x today. This future PE is greater than the current PE for the US Renewable Energy industry at 22.1x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Montauk Renewables Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Severe weather events and utility power outages in Houston facilities, which contribute to over half of Montauk’s RNG production, could impact overall production levels and revenue.

- Delays in utility upgrades and interconnection for projects like Blue Granite and potential impacts of regulatory changes at Frank R. Bowerman Landfill may lead to project commissioning delays, affecting future earnings and project timelines.

- Increases in pathway renewal percentages for environmental attributes without corresponding revenue increases could pressure profit margins and reduce net earnings.

- Fluctuations in the market price for environmental attributes like RINs and reliance on self-marketing these attributes pose revenue uncertainty and may impact net margins.

- Landfill-driven delays in installing wellfield infrastructure might impact gas feedstock supply and consequently production volumes, potentially limiting revenue growth in the renewable natural gas segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.94 for Montauk Renewables based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $313.1 million, earnings will come to $24.9 million, and it would be trading on a PE ratio of 39.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of $3.77, the analyst's price target of $5.94 is 36.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives