- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Updates Bylaws and Welcomes New Board Member Jack Hartung

Reviewed by Simply Wall St

Tesla (NasdaqGS:TSLA) recently amended its bylaws and announced the appointment of Jack Hartung to its board, sparking interest in enhanced governance and strategic insights. Meanwhile, the market showed a 5% rise in the past week, yet Tesla's remarkable 45% price increase over the past month significantly outpaced this growth. Events such as improved access to Tesla's Supercharger network for Kia EV owners, despite the company's legal challenges and declining earnings, might have presented mixed influences. Overall, Tesla's price movement far exceeded broader trends, suggesting strong investor confidence in the company's recent strategic adjustments.

You should learn about the 2 risks we've spotted with Tesla.

The recent bylaw amendments and board appointment at Tesla (NasdaqGS:TSLA) align with the company's goals of enhancing governance and strategic insights. Over five years, Tesla's total shareholder return, encompassing stock price appreciation and dividends, was a very large 542.65%, underscoring strong performance despite facing fluctuating market conditions and legal challenges. When comparing the last year's performance, Tesla exceeded the US Auto industry, reflecting a resilient market position amidst diverse economic influences.

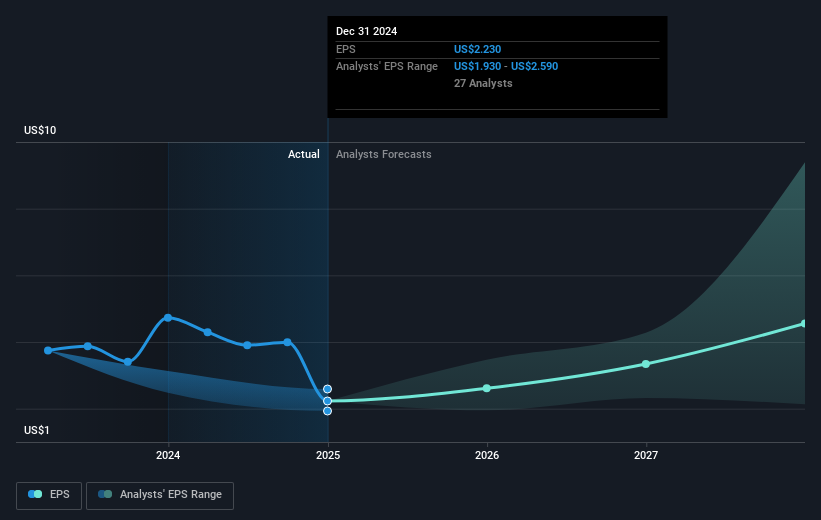

This governance update may bolster investor confidence, potentially affecting revenue and earnings forecasts by supporting strategic ventures like autonomous vehicles and energy expansion. The introduction of features such as improved access to its Supercharger network could influence future revenue streams positively, although ongoing geopolitical uncertainties and execution risks may pose challenges.

With Tesla's current share price at US$275.35, a modest 4.9% discount exists relative to the consensus analyst price target of US$289.44. This suggests a perception of Tesla's fair market value, implying limited upside potential according to current forecasts. Investors must weigh these factors with the implications of recent initiatives and governance enhancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tesla, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives