- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Quick Takes: Tesla, Twitter, Carvana & More

Reviewed by Michael Paige

Tesla Investors not impressed with Musk going ahead with Twitter purchase

Tesla's ( Nasdaq: TSLA ) share price fell again after Elon Musk 'proposed' moving ahead with his purchase of Twitter (NYSE: TWTR). The concern is that Musk may have to sell more Tesla stock to finance the deal.

Our Take: Whether or not Musk does have to sell more Tesla shares, long-term investors might also become concerned with how much time he can devote to Tesla with yet another company in his portfolio. As it stands he already owns or controls Tesla, SpaceX, Neuralink, and the Boring Company.

We recently looked at why the bears might be wrong about Tesla , but longer term Musk's attention span is something to keep an eye on.

Constellation Brands takes a big hit on Canopy Growth investment

Constellation Brands ( NYSE: STZ ) reported its Q2 2023 results on Thursday. The company comfortably beat consensus estimates on the top and bottom lines, but the stock price opened lower. One of the lowlights of the results was a $1.06 billion impairment charge on Constellation's investment in Canopy Growth ( Nasdaq: CGC ).

Starting in 2017 Constellation invested over $4 billion in Canopy Growth at an average price well above $20. Five years later Canopy's share price is hovering around $3.

Our Take: The Canopy investment has been weighing on Constellation’s value for a long time, and it’s probably a good thing that it’s now out of the way. However, we would still be a little wary of Constellation's valuation.

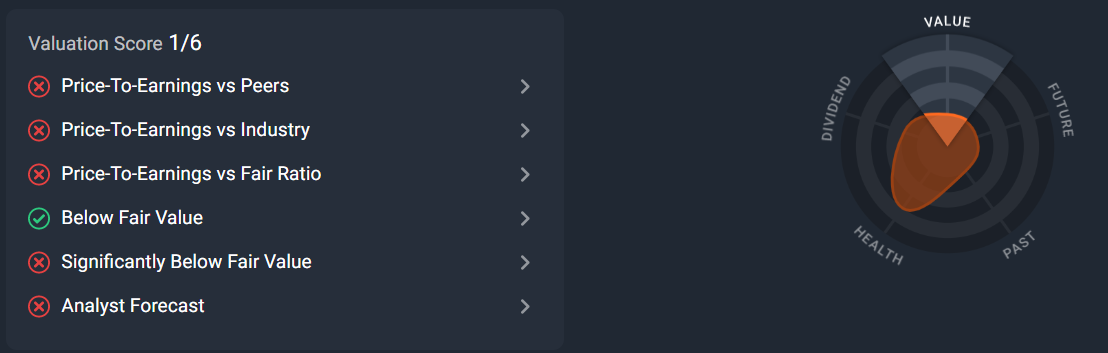

The Simply Wall St analysis page shows Constellation brands as being potentially overvalued on five out of six metrics. The one metric suggesting the stock may be undervalued, the discount to our fair value estimate, shows a very modest 11% discount. The other five metrics suggest the stocks may be overvalued, but not by a lot.

Carvana is Primed for Big Moves in Both Directions

Carvana Co’s ( Nasdaq: CVNA ) share price has now completed a 175% roundtrip over the last 10 weeks, rising from $21 to $58 and then giving back all those gains. Prior to that, the share price fell 94% from its all-time high of $376.83.

The catalyst for the latest decline was CarMax ( NYSE: KMX ) reporting a drop in unit sales during the last quarter.

Analysts are widely divided on Carvana's prospects as an investment. Some believe it is ' grossly undervalued' , while others believe bankruptcy is on the horizon .

Theoretically, the company has a good business model, and earnings should normalize in time. On the other hand, used car prices have risen so much that they are now unaffordable for many people - and Carvana is sitting on inventory it bought at very high prices. The company also has a lot of debt maturing in 2025 which will need to be rolled forward, and probably at a much higher interest rate than it currently carries.

Our Take: The conflicting opinions about the stock have made it a favorite amongst hedge funds that have both long and short positions. It's not often we see 9.6% of a stock float in the hands of hedge funds. The short float (percent of the total share count that has been sold short) is also sky-high at 30%.

The combination of divergent views, debt, hedge fund involvement, and high short interest is a recipe for extreme volatility regardless of the investment case for the stock.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives