Summary:

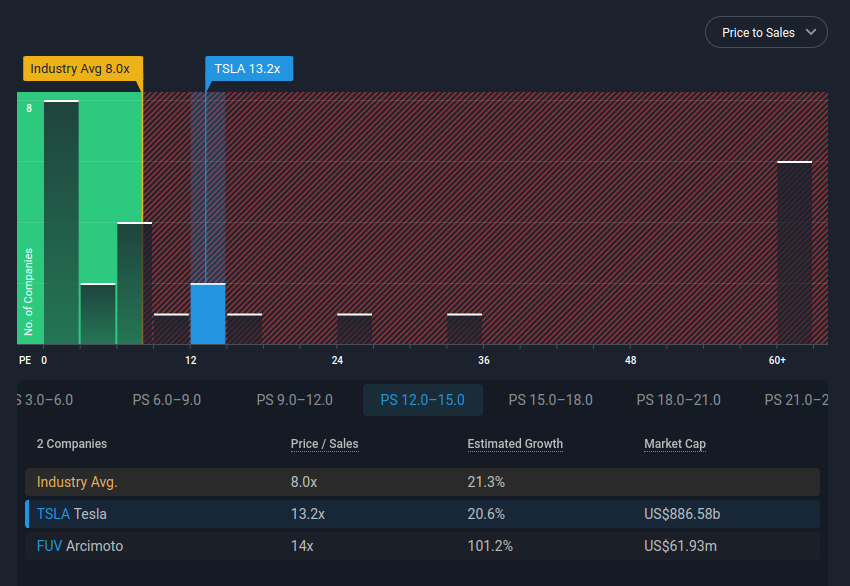

- Tesla is trading at a 13.2x P/S ratio which may not seem too high for some investors.

- Expected to continue growing revenues at 20.3% annually and 27% in FY2022.

- Besides the fundamentals, investors willing to short will need to estimate if retail enthusiasm will decline for the stock.

In this analysis, we will look at some of the aspects the market may have adapted when pricing Tesla, Inc. ( NASDAQ:TSLA ) and explore why the stock may retain current levels. Even though the fundamentals may not reflect the current valuation.

Traditionally, we look for the cash flows attributable to investors when assessing the value of a company. However, when companies are in a high growth phase, investors may be caught up on the top line, rather than profits. The rationale for this is that we don't really know when growth will decelerate, so going down the income structure may not make sense at that time. Thus, investors may monitor the price to sales ratio, instead of price to earnings.

The Price to Sales Ratio is not That Unreasonable

Here we arrive at our first main point. The price to sales ratio for Tesla isn't too bad. The company is trading at a 13.2x vs its historical 2x to 8x ratio since 2016. However, analysts still expect a 20.3% sales growth for the next few years. This means that it would take some 3 years for the P/S to move closer to the industry average 8x ratio. This three years premium is likely something that enthusiastic investors may be willing to stick with, unless the economic shake-up is so severe to change their investment approaches.

We can see that Tesla is not too far off from the industry's distribution in the chart below:

Check out our latest analysis for Tesla

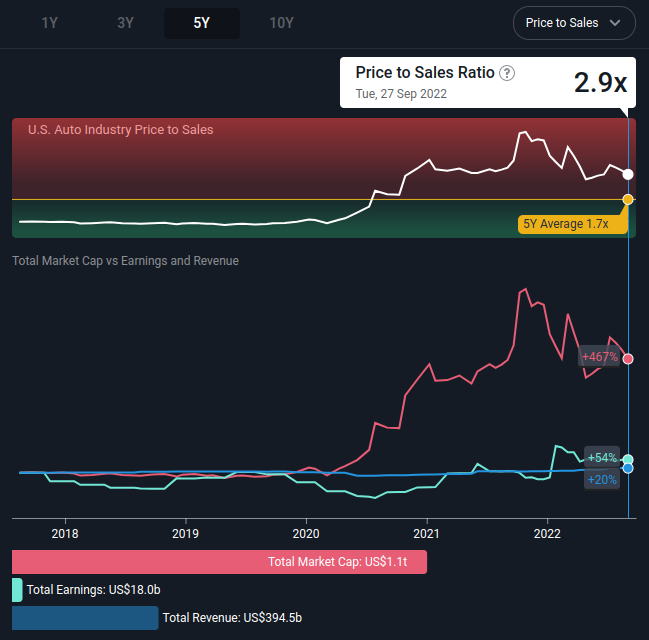

U.S. Auto Industry is Sustaining Investor Enthusiasm

In the last 5 years, the average price to sales for the U.S. Auto industry was 1.7x. However, things changed in 2020, and the P/S ratio climbed to 3x, 4x in 2021 and finally reverting to 3x. Investors may use the historical rates as an argument that the ratio will go back to historical levels, however that should be taken in conjunction with the changes to the auto industry. Specifically, many governments are passing legislation that incentivizes electrical vehicles, and some investors are betting on the software and hardware innovation capacity of the industry. While we may be headed for an economic slump, there is a good possibility that the west will continue to support EVs in the future and Tesla, along with its competitors, will be the beneficiaries of tax credits and other subsidies. Additionally, many investors have adopted the notion that the market is close to fairly valued (has bottomed), implying an expectation of a recovery in the future - While this may be wrong, it makes shorting the stock a more difficult process.

Looking at a bird's perspective, here is how the industry changed on a price to sales basis. Note that the previous chart depicted the global industry, while this one focuses on the U.S.:

While this may look like a "bubble" for some investors, it is important to keep in mind that the trend may not recede when investors think it should. In fact, bubbles have a way of disappointing the prevailing narrative - which currently seems to be that "Tesla is a short". While this may look like a contrarian position, it may be the consensus.

The Current Assumption is the Tesla Will Continue to Grow

Since we are analyzing Tesla, it makes sense to look at its fundamentals through the perspective of someone who has a vested interest in the company. We are not trying to be objective, instead we are assessing the reasons why investors may be willing to hold on to, or buy more of the stock in a downturn.

A Dedicated Investor Base

The first thing to keep in mind, is that leadership is great at managing investor's expectations and buying the company more time. A breakdown of Tesla's ownership structure reveals a factor for the stock's resilience. It seems that 16.4% of the shares are held by insiders, while 37.1% are held by retail investors. In typical companies, a large portion held by retail investors may signal that institutions have abandoned a company. However, in the case of Tesla, it is more likely that shareholders are still enthusiastic and possibly keep buying the stock.

Who Would Sell A Growing and Profitable Company

As long as the company keeps executing, it seems unlikely that investors would abandon it. It is quite possible that Tesla hits a profitability and growth wall, but who can say when will that happen? Next quarter, a year from now, in the next 5 years? Investors that believe they know when the company will decelerate, may be in a good position to make a short prediction, but hoping that it does may not be enough.

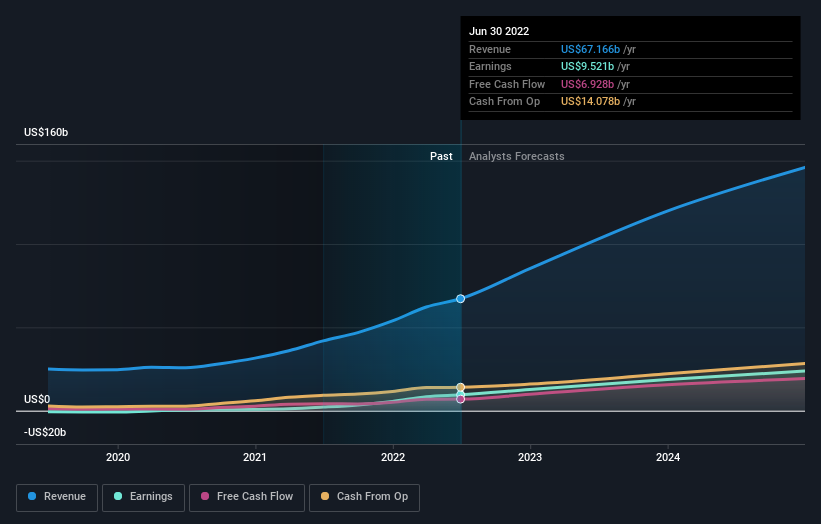

In the last 12 months, revenues were $67.17b, about what the analysts expected. Tesla surprised by delivering a (statutory) profit of $3.18 per share. In the previous earnings calls, Musk gave forward guidance that the company is expected to grow around 50% for the next few years. Analysts are not completely on board, but seem to be expecting an overall 20.6% growth per year.

In the chart below, we can see how analysts expect the company to perform in the future:

Statutory earnings per share are also predicted to shoot up 22% to $3.69. We can see that the company is expected to continue growing, and stay at par with some of the highest U.S. market cap stocks.

We should also note, that analysts reconfirmed their price target of US$309, which has been relatively stable for Tesla in the past year, and is holding up current levels despite the disruption in some of the production facilities. You can get our price target history for Tesla in order to better understand why the company has sustained current levels.

Conclusion

Markets have a mind of their own, and in order for a stock to decline, investors need to change their perspective. While the fundamentals can inform them in the process, they may not matter in the short term.

In this analysis, we explored the bullish perspective of Tesla's analysts and investors. While the fundamentals likely don't reflect the current market valuation, it seems that there are a number of reasons why investors are willing to pay the forward premium for the stock, and bearish investors will need to be right on the slowing down of future fundamentals as well as on a changed perspective on the company from investors who are willing to buy the stock on a downturn.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)