- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Insider-Owned Growth Stocks To Watch In July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown an impressive 11% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business and may align well with anticipated earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Victory Capital Holdings (VCTR) | 10.1% | 32.5% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 48.2% |

| Credo Technology Group Holding (CRDO) | 11.8% | 47% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Here we highlight a subset of our preferred stocks from the screener.

Futu Holdings (FUTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Futu Holdings Limited operates as a digitalized securities brokerage and wealth management product distributor in Hong Kong and internationally, with a market cap of approximately $20.88 billion.

Operations: The company generates revenue primarily from its online brokerage services and margin financing services, which amounted to HK$13.92 billion.

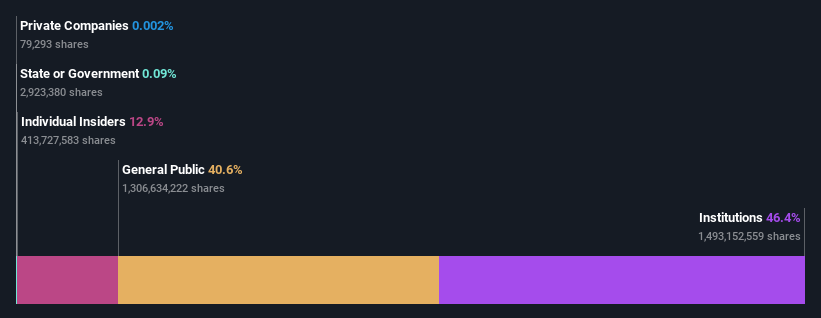

Insider Ownership: 36.3%

Earnings Growth Forecast: 16.5% p.a.

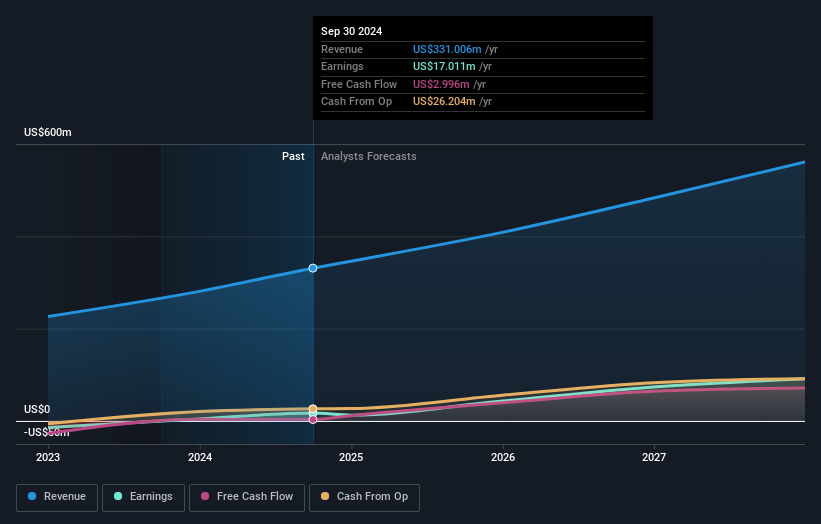

Futu Holdings has demonstrated robust financial performance, with a significant increase in revenue and net income for Q1 2025. The company's earnings grew by 58.7% over the past year, and future earnings are projected to grow faster than the US market at 16.5% annually. Despite no recent insider trading activity, Futu is trading at a good value relative to its peers, with a Price-To-Earnings ratio of 25x below the industry average of 27.7x.

- Unlock comprehensive insights into our analysis of Futu Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Futu Holdings shares in the market.

Tesla (TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tesla, Inc. is involved in the design, development, manufacturing, leasing, and sale of electric vehicles and energy generation and storage systems globally with a market cap of approximately $1.01 trillion.

Operations: Tesla's revenue is primarily derived from its automotive segment, generating $84.54 billion, and its energy generation and storage segment, contributing $11.18 billion.

Insider Ownership: 12.9%

Earnings Growth Forecast: 28.0% p.a.

Tesla's growth trajectory is underscored by substantial insider buying, indicating confidence in its future prospects. The company's earnings are projected to grow significantly faster than the US market at 28% annually, despite a forecasted low return on equity of 10.9%. Recent expansions into India highlight Tesla's strategic push for growth amid challenges in Europe and China. However, declining profit margins and ongoing legal issues regarding its Full Self-Driving technology pose potential risks.

- Take a closer look at Tesla's potential here in our earnings growth report.

- According our valuation report, there's an indication that Tesla's share price might be on the expensive side.

Karman Holdings (KRMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Karman Holdings Inc., with a market cap of $6.44 billion, operates in the United States through its subsidiary, focusing on the design, testing, manufacturing, and sale of mission-critical systems.

Operations: KRMN's revenue primarily comes from the Space and Defense Industry, generating $362.37 million.

Insider Ownership: 14.7%

Earnings Growth Forecast: 59.2% p.a.

Karman Holdings is poised for notable growth, with earnings expected to increase significantly at 59.2% annually, outpacing the US market. Despite a recent decline in profit margins and interest payments not being well-covered by earnings, the company has been added to multiple indices like Russell 3000 Growth, enhancing its visibility. Additionally, Karman's new facility in Decatur supports expansion into defense and space sectors while boosting local employment and economic development.

- Click here and access our complete growth analysis report to understand the dynamics of Karman Holdings.

- In light of our recent valuation report, it seems possible that Karman Holdings is trading beyond its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 195 Fast Growing US Companies With High Insider Ownership here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives