- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Volkswagen Partnership and Delivery Cut Could Be a Game Changer for Rivian Automotive (RIVN)

Reviewed by Sasha Jovanovic

- Earlier this week, Rivian Automotive announced it expects lower vehicle deliveries in 2025 compared to 2024, citing economic headwinds, tariffs, and softer demand, while also revealing a US$5.8 billion joint venture with Volkswagen and plans to raise US$1.25 billion through a private bond sale.

- A unique aspect of the announcement is Rivian's intent to cut material costs by 45% with its next-generation platform and accelerate its push into the mass-market EV segment with the upcoming R2 midsize SUV.

- Now, we'll explore how Rivian's revised delivery guidance and Volkswagen partnership reshape the company's investment case and long-term outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Rivian Automotive Investment Narrative Recap

To see Rivian as an investment opportunity, shareholders need to believe the company’s push to scale production, reduce costs, and capture market share in the mass-market EV segment will translate into sustainable revenue and long-term profitability. While the lowered 2025 delivery guidance highlights nearer-term challenges, from economic conditions, tariffs, and softer demand, it does not fundamentally change that the mass-market launch of the R2 midsize SUV remains the key short-term catalyst, while liquidity and ongoing cash burn persist as the biggest risks driving the outlook.

Of the recent developments, the US$5.8 billion Volkswagen joint venture stands out, as it should enhance Rivian’s ability to expand capacity and invest in technology, potentially supporting its capital base for new models. In the context of current financial losses, such partnerships align directly with the need to fund R2 scale-up without overburdening Rivian’s balance sheet or diluting existing shareholders, at least for now.

Yet, for investors, it is equally important to recognize that despite these strategic moves, continued high cash burn and mounting capital requirements mean ...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's outlook anticipates $15.7 billion in revenue and $788.9 million in earnings by 2028. This scenario assumes a 44.9% annual increase in revenue and a $4.3 billion improvement in earnings from current levels of -$3.5 billion.

Uncover how Rivian Automotive's forecasts yield a $14.26 fair value, a 6% upside to its current price.

Exploring Other Perspectives

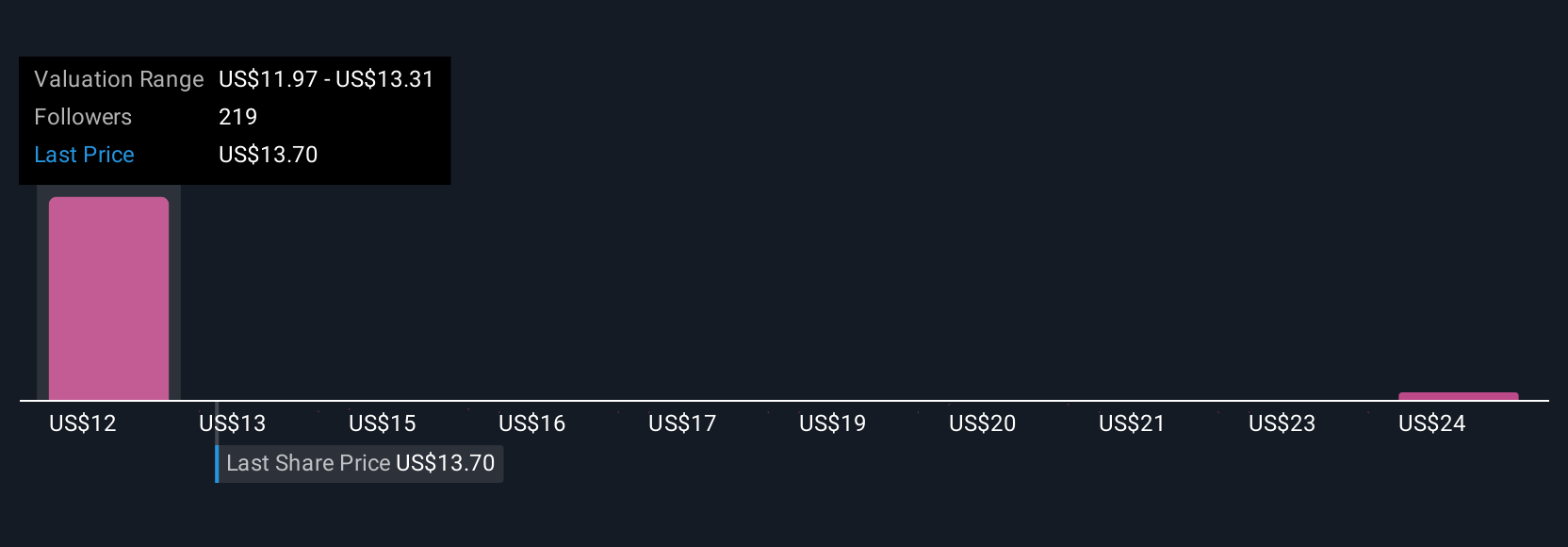

Fair value estimates from 17 Simply Wall St Community members for Rivian range widely from US$8.25 to US$25.41 per share. With major capital demands still ahead and risks to liquidity prominent, you may want to explore several perspectives before taking a position.

Explore 17 other fair value estimates on Rivian Automotive - why the stock might be worth as much as 89% more than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.