- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (NasdaqGS:RIVN) Reports Revenue Rise to US$1,240 Million in Q1 Earnings

Reviewed by Simply Wall St

Rivian Automotive (NasdaqGS:RIVN) recently reported its first-quarter earnings, showing improvements with revenue increasing to $1,240 million and a significant reduction in net loss. This financial performance was accompanied by a revision in the company's 2025 production guidance, forecasting deliveries of 40,000 to 46,000 vehicles. These developments come as the market experiences a positive trend, with major indices like the Dow Jones, S&P 500, and Nasdaq Composite extending their recent gains. Rivian's 23% share price increase over the last month aligns with this broader market uplift, with the company's earnings and guidance adding strength to this upward movement.

The recent financial improvements reported by Rivian Automotive, alongside the company's revised 2025 production guidance, could potentially boost investor confidence in its long-term growth prospects. Despite the impressive 23% increase last month, Rivian's shares exhibited a total return of 45.29% over the last year, indicating positive momentum. However, compared to the broader auto industry, which returned 76.3% over the same period, Rivian's performance has lagged somewhat, perhaps reflecting the challenges of ramping up production and achieving profitability amidst market complexities.

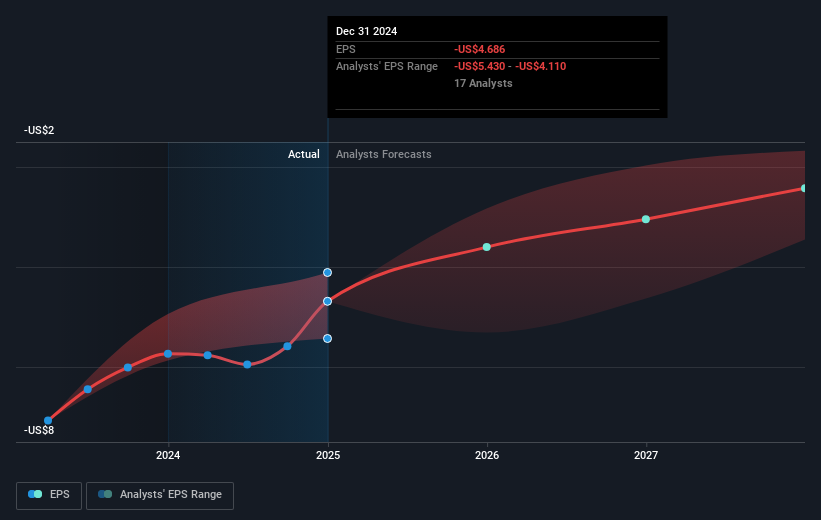

The developments related to the R2 platform and manufacturing expansions in Georgia are expected to enhance production efficiency, translating into potential revenue growth and improved margins. However, it's crucial to factor in ongoing risks, such as supply chain constraints and tariff complications which could pressure costs. Despite these hurdles, analysts see a bright future with revenue growth expected at 30.7% annually over the next three years. Earnings, however, are not forecasted to turn positive within this timeframe. The current share price of US$13.50 represents a 5.1% discount to the consensus price target of US$14.23, signaling a cautious optimism in the market about Rivian's ability to meet its projections and enhance shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives