- United States

- /

- Auto

- /

- NasdaqGS:RIVN

How Rivian’s R2 SUV Launch and Georgia Factory Plans May Influence RIVN Investors

Reviewed by Simply Wall St

- Rivian Automotive announced its plans to begin production of the more affordable R2 mid-size SUV in 2026, while also preparing to break ground on a US$5 billion Georgia factory that will be key for manufacturing and scaling the new model beginning in 2028.

- This expansion comes amid workforce reductions and mounting cost pressures from regulatory changes and tariffs, posing near-term challenges as the company seeks to extend its market reach and operational efficiency.

- We'll examine how Rivian's decision to launch the R2 SUV and invest in new factory expansion may influence its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Rivian Automotive Investment Narrative Recap

To own Rivian shares, you need to be confident that the company can successfully scale production of the more affordable R2 SUV and accelerate electric vehicle adoption, despite growing near-term pressures. While excitement around the R2 launch remains the key potential catalyst for Rivian, the latest news of deepening losses and demand headwinds re-emphasizes that execution and timing risks are front and center; however, these developments don't significantly alter the current short-term narrative or catalyst. The most immediate risk to watch is mounting cost challenges, regulatory rollbacks, expiring credits, and higher tariffs, which continue to threaten gross margin and profitability timelines.

Of recent announcements, the planned US$5 billion Georgia factory stands out as highly relevant, supporting Rivian’s ambitions to ramp up R2 production and fulfill delivery projections from 2028. This investment aligns with the central catalyst for Rivian: achieving substantial cost efficiencies and capturing scale, which will be critical as the company seeks to offset margin pressures from the current cost environment.

On the flip side, investors should be mindful of the risk posed by the removal of key incentives and...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's outlook anticipates $15.6 billion in revenue and $788.5 million in earnings by 2028. This projection is based on an annual revenue growth rate of 44.6% and an earnings increase of $4.3 billion from the current earnings of -$3.5 billion.

Uncover how Rivian Automotive's forecasts yield a $13.94 fair value, in line with its current price.

Exploring Other Perspectives

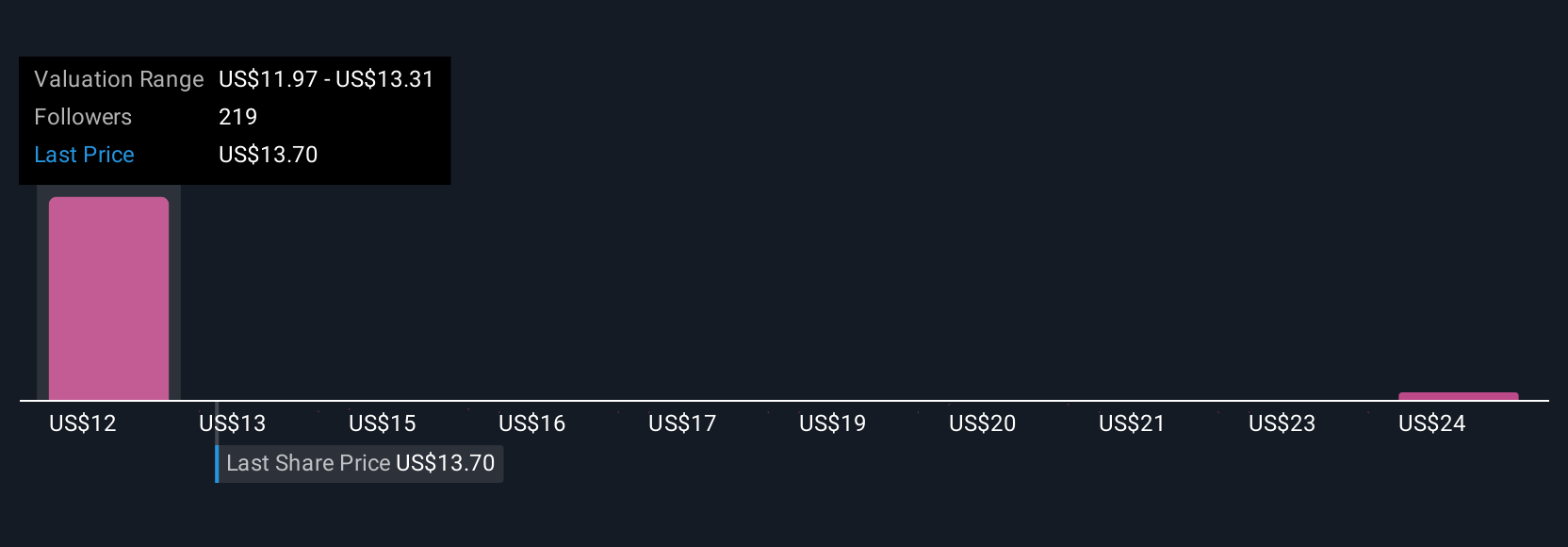

Sixteen members of the Simply Wall St Community estimate Rivian’s fair value anywhere from US$8.25 to US$25.41 per share. With rising cost pressures threatening margins, you may want to compare how these different views reflect varied expectations on future profitability and risk.

Explore 16 other fair value estimates on Rivian Automotive - why the stock might be worth as much as 79% more than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives