- United States

- /

- Auto

- /

- NasdaqGS:LI

Reassessing Li Auto (NasdaqGS:LI) Valuation After a Steep Multi‑Month Share Price Decline

Reviewed by Simply Wall St

Li Auto (NasdaqGS:LI) has been sliding lately, with the stock down about 15% over the past month and nearly 30% in the past 3 months, despite solid double digit revenue and earnings growth.

See our latest analysis for Li Auto.

Stepping back, the roughly 28% year to date share price decline and 24.6% one year total shareholder return slump suggest momentum has clearly faded, as investors reassess execution risks despite ongoing top line growth.

If Li Auto’s recent pullback has you rethinking your exposure to carmakers, it may be worth scanning other auto manufacturers that could offer a different balance of growth and risk.

With Li Auto trading well below analyst targets yet still delivering robust revenue and profit growth, the key question now is whether the recent slide signals an undervalued opportunity or a market that is bracing for slower future gains.

Most Popular Narrative Narrative: 29.5% Undervalued

With Li Auto’s fair value in the mid twenties versus a last close of $17.21, the most followed narrative argues the market is heavily discounting the company’s long term potential.

The company's ongoing transition from extended-range vehicles (EREVs) to pure battery electric vehicles (BEVs), including successful launches of the Li MEGA and Li i8, and the upcoming Li i6, positions Li Auto to capture expanding market share as Chinese middle class consumers upgrade and EV adoption accelerates, directly supporting long term revenue growth and total addressable market expansion.

Curious how shifting product mix, fatter margins, and a richer earnings multiple combine into that higher fair value? Want to see the full playbook behind those projections?

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cash burn, along with fiercer EV competition and policy shifts in China, could quickly erode margins and derail that upbeat valuation path.

Find out about the key risks to this Li Auto narrative.

Another Angle on Valuation

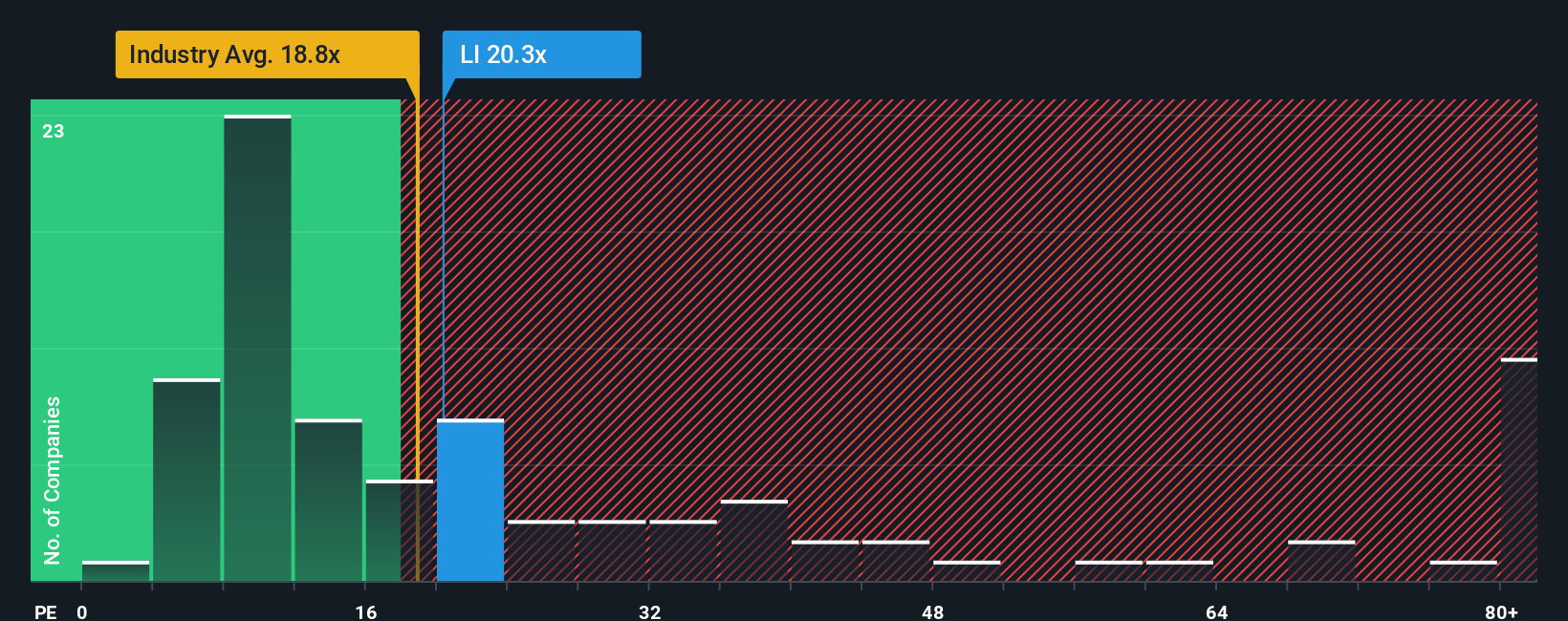

On earnings, Li Auto screens less like a bargain. Its 26.4x price to earnings ratio sits above both the global auto average of 18.5x and peers at 23x, though still below a 28.9x fair ratio. This leaves investors to weigh upside potential against clear multiple compression risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Li Auto Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A great starting point for your Li Auto research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research momentum to work by scanning fresh opportunities on Simply Wall Street’s powerful screener, so you are not leaving potential returns on the table.

- Capture potential bargains early by reviewing these 908 undervalued stocks based on cash flows, which screens for companies trading below their estimated intrinsic value based on future cash flows.

- Target powerful structural trends by checking these 26 AI penny stocks, focused on businesses building real-world products and services around artificial intelligence.

- Boost your income potential by using these 12 dividend stocks with yields > 3% to hunt for companies offering attractive yields supported by solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026