- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (LCID) Debuts Gravity SUV In Europe With Prices From CHF 125,900

Reviewed by Simply Wall St

Lucid Group (LCID) recently launched its all-new Lucid SUV at IAA Mobility in Munich, marking its entrance into the European market. Despite this significant product announcement, the company's share price dropped by 7.02% over the past week. The unveiling showcased a focus on advanced features like DreamDrive 2, yet broader market dynamics, such as anticipation around interest rate cuts, predominantly influenced larger indices. The market remained largely flat, as the NASDAQ hit new highs. Lucid's developments, amid a generally buoyant tech sector, seemed to counterbalance prevailing market sentiments with a differing trajectory.

The launch of Lucid's new SUV at IAA Mobility in Munich could potentially bolster its positioning in the European market, enhancing its revenue prospects by expanding its customer base. However, despite this product introduction, Lucid's shares suffered a 7.02% decline in the past week. Over the past year, Lucid's total shareholder return, including share price and dividends, was a substantial 46.79% decline, indicating a challenging period for the company in terms of investor confidence and market performance.

In terms of its sector relevance, Lucid underperformed compared to the broader US Auto industry, which achieved a significant 55.9% return over the same period. As such, relative performance metrics suggest Lucid faces ongoing competitive pressure and challenges in establishing a robust market standing.

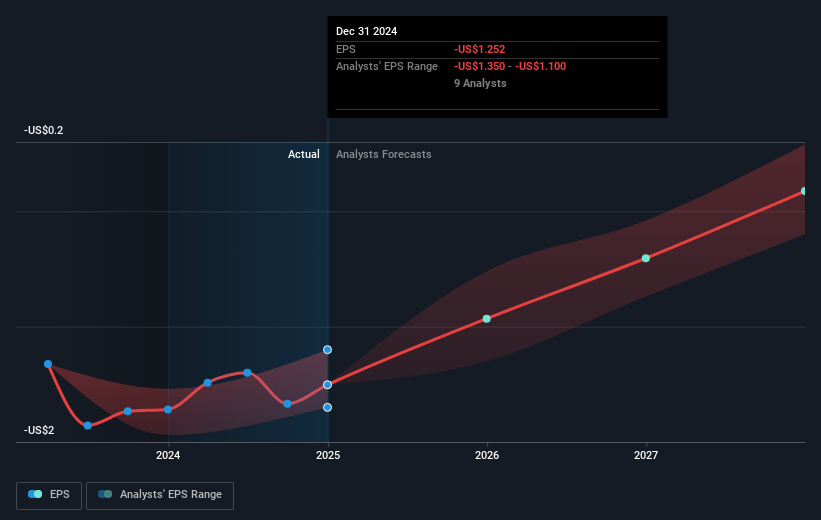

The SUV launch could serve as a catalyst for improving future revenue and earnings forecasts by leveraging potential technology licensing deals and fleet sales, such as the Uber and Nuro partnership. However, current earnings remain deeply negative at US$3.06 billion, highlighting substantial challenges in reversing its financial trajectory. Analysts' consensus places Lucid's share price target at US$23.25, representing a 26.27% discount from its current US$18.41 price, indicating room for potential growth if financial and operational metrics improve as anticipated.

Gain insights into Lucid Group's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)