- Taiwan

- /

- Semiconductors

- /

- TPEX:4971

Should You Use IntelliEPI (Cayman)'s (GTSM:4971) Statutory Earnings To Analyse It?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding IntelliEPI (Cayman) (GTSM:4971).

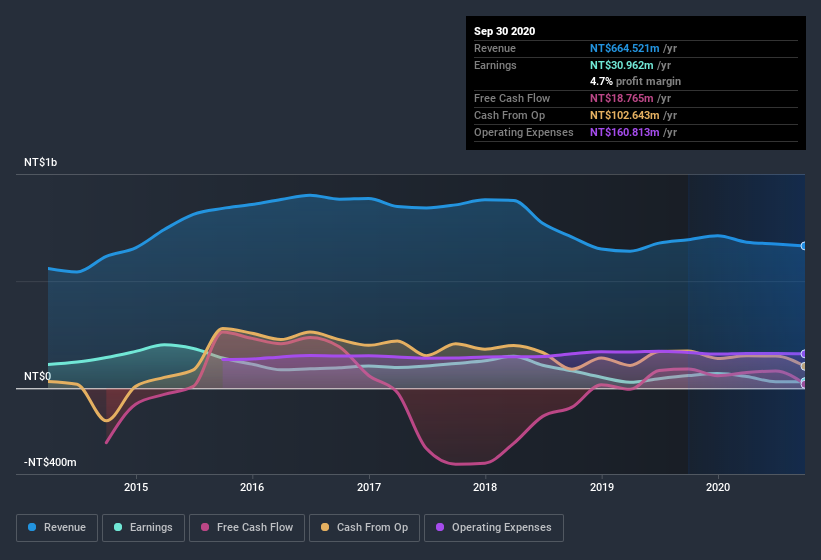

While IntelliEPI (Cayman) was able to generate revenue of NT$664.5m in the last twelve months, we think its profit result of NT$31.0m was more important. The chart below shows that both revenue and profit have declined over the last three years.

See our latest analysis for IntelliEPI (Cayman)

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced IntelliEPI (Cayman)'s statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of IntelliEPI (Cayman).

The Impact Of Unusual Items On Profit

To properly understand IntelliEPI (Cayman)'s profit results, we need to consider the NT$2.6m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If IntelliEPI (Cayman) doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that IntelliEPI (Cayman) received a tax benefit of NT$8.7m. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On IntelliEPI (Cayman)'s Profit Performance

In its last report IntelliEPI (Cayman) received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Having considered these factors, we don't think IntelliEPI (Cayman)'s statutory profits give an overly harsh view of the business. So while earnings quality is important, it's equally important to consider the risks facing IntelliEPI (Cayman) at this point in time. For example, we've found that IntelliEPI (Cayman) has 3 warning signs (1 is a bit unpleasant!) that deserve your attention before going any further with your analysis.

Our examination of IntelliEPI (Cayman) has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade IntelliEPI (Cayman), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4971

IntelliEPI (Cayman)

Produces and sells epitaxy wafers of compound semiconductor for use in wireless communications, data transmission and national defense in the United States, Germany, Korea, Japan, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026