- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

European Growth Companies With High Insider Ownership In April 2025

Reviewed by Simply Wall St

In April 2025, the European markets have shown resilience, with the pan-European STOXX Europe 600 Index rebounding by nearly 4% in response to the European Central Bank's rate cuts and improved investor sentiment amid trade policy uncertainties. As these economic dynamics unfold, companies with strong growth potential and high insider ownership can be particularly appealing to investors seeking stability and alignment of interests during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Bonesupport Holding (OM:BONEX) | 10.1% | 47.8% |

| Elicera Therapeutics (OM:ELIC) | 20.5% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

Here's a peek at a few of the choices from the screener.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK10.80 billion.

Operations: The company's revenue is primarily derived from its operations in Sweden (SEK6.68 billion), Norway (SEK2.47 billion), and other markets (SEK2.39 billion).

Insider Ownership: 11.3%

Rusta is experiencing robust growth, with earnings expected to increase significantly at 24.4% annually, outpacing the Swedish market. Recent expansions include new store openings in Sweden and Norway, aligning with an upwardly revised forecast of 50-80 new stores over three years. The company reported a rise in quarterly sales to SEK 3.48 billion and net income to SEK 257 million. Despite trading below estimated fair value, analysts anticipate a stock price increase of 21.8%.

- Take a closer look at Rusta's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Rusta's current price could be quite moderate.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of approximately SEK7.45 billion.

Operations: The company's revenue is primarily derived from its streaming services, generating SEK3.38 billion, and its publishing segment, contributing SEK1.13 billion.

Insider Ownership: 13.3%

Storytel's revenue is forecast to grow at 9.9% annually, outpacing the Swedish market's 2.7%, while earnings are expected to rise significantly at 32.9% per year. The company recently became profitable, reporting SEK 196.71 million in net income for 2024 compared to a loss the previous year. Insider activity shows more buying than selling over three months, and Storytel trades at a substantial discount below its estimated fair value of SEK 77 million in dividends proposed for its anniversary celebration.

- Delve into the full analysis future growth report here for a deeper understanding of Storytel.

- Our valuation report unveils the possibility Storytel's shares may be trading at a premium.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops, operates, and markets technology platforms for the financial services, property, and insurance industries in Germany with a market cap of €1.27 billion.

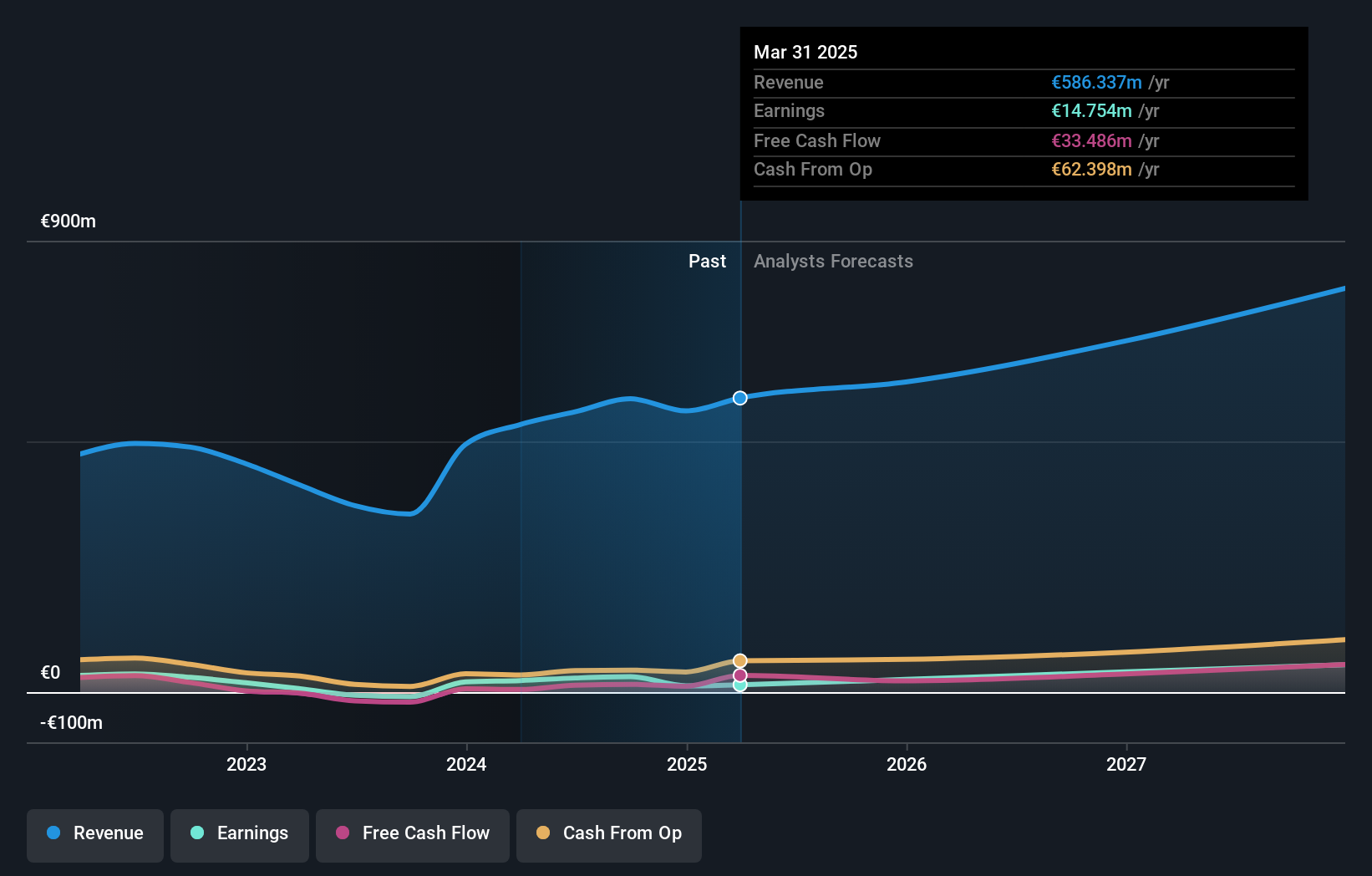

Operations: The company's revenue is primarily derived from its Real Estate & Mortgage Platforms (€420.74 million), Financing Platforms (€75.40 million), and Insurance Platforms (€66.97 million).

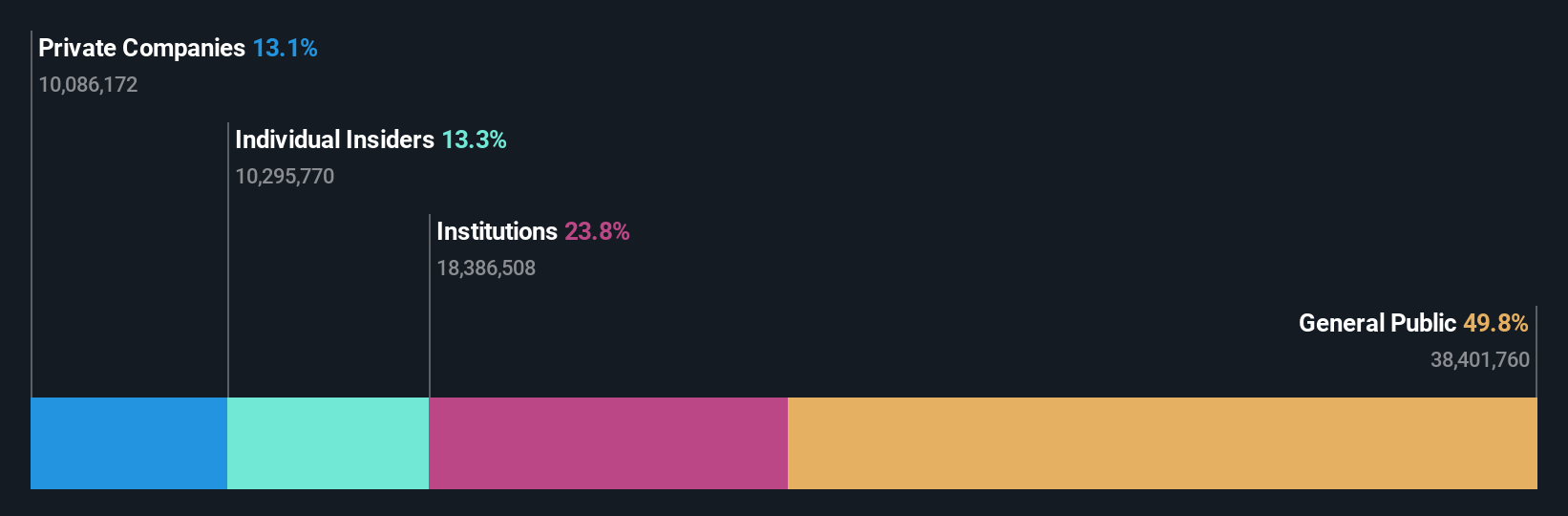

Insider Ownership: 33.3%

Hypoport's earnings are projected to grow significantly at 43.3% annually, surpassing the German market's growth rate of 15.8%, although revenue growth is slower at 9.9% per year. Despite a decline in net income from €20.47 million to €12.41 million for 2024, the company anticipates double-digit revenue growth in 2025, targeting a minimum of €640 million and EBIT between €30 million and €36 million. Recently added to the SDAX Index, Hypoport faces challenges with reduced profit margins and low forecasted return on equity (10.9%).

- Navigate through the intricacies of Hypoport with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Hypoport's share price might be too optimistic.

Seize The Opportunity

- Investigate our full lineup of 218 Fast Growing European Companies With High Insider Ownership right here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives