- Sweden

- /

- Paper and Forestry Products

- /

- OM:RROS

This Just In: Analysts Are Boosting Their Rottneros AB (publ) (STO:RROS) Outlook for This Year

Rottneros AB (publ) (STO:RROS) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The market may be pricing in some blue sky too, with the share price gaining 11% to kr15.12 in the last 7 days. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

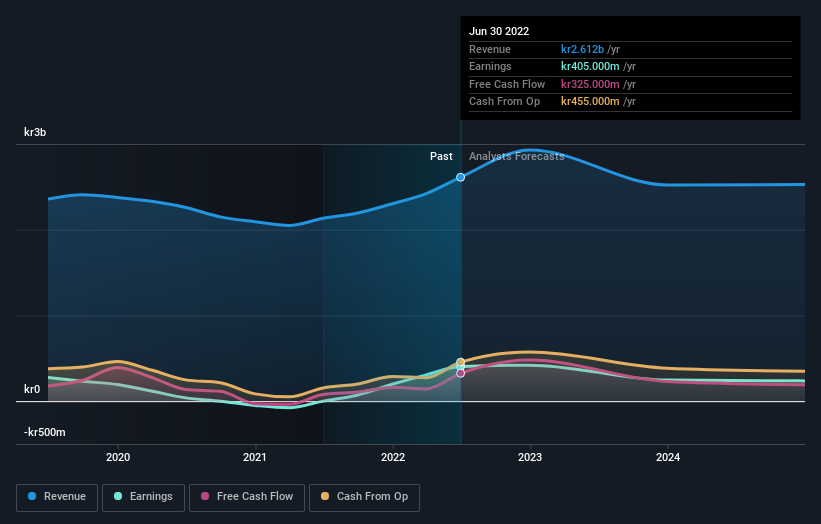

After this upgrade, Rottneros' twin analysts are now forecasting revenues of kr2.9b in 2022. This would be a solid 12% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to increase 3.6% to kr2.75. Prior to this update, the analysts had been forecasting revenues of kr2.6b and earnings per share (EPS) of kr2.03 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Rottneros

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Rottneros' past performance and to peers in the same industry. It's clear from the latest estimates that Rottneros' rate of growth is expected to accelerate meaningfully, with the forecast 26% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 3.4% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 0.3% annually. It seems obvious that as part of the brighter growth outlook, Rottneros is expected to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, they also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The clear improvement in sentiment should be enough to get most shareholders feeling more optimistic about Rottneros' future.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Rottneros going out as far as 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RROS

Rottneros

Develops and produces chemical and mechanical market pulp worldwide.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)