Will HEXPOL's (OM:HPOL B) M&A Focus Offset Weak Q3 Results and Reframe Its Investment Story?

Reviewed by Sasha Jovanovic

- HEXPOL AB (publ) reported third quarter 2025 results showing sales of SEK 4,692 million and net income of SEK 465 million, both lower than a year earlier, and confirmed continued focus on M&A and sustainability targets during its investor presentation.

- The company emphasized that despite near-term geopolitical uncertainty affecting M&A activity, it maintains strong financial resources and remains confident in delivering its 75% CO2 reduction target by year-end.

- Given the earnings decline and continued M&A ambition, we'll examine how these updates might shift HEXPOL's investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

HEXPOL Investment Narrative Recap

To be a shareholder in HEXPOL today, you need to believe in the company’s ability to navigate pressured earnings, leverage its strong balance sheet for growth through acquisitions, and deliver on ambitious sustainability targets. The recent Q3 results confirmed ongoing sales and earnings weakness but had no material impact on the short-term catalyst: whether HEXPOL can accelerate value-accretive M&A even as geopolitical uncertainty slows deal flow. The key risk remains that margin and revenue pressures, especially in core segments, may persist if organic top-line growth does not recover. Among the latest announcements, CEO Klas Dahlberg’s reaffirmation during the third quarter presentation of HEXPOL’s commitment to pursue acquisitions despite a more cautious market directly relates to the growth catalyst investors are watching. The CEO’s comments highlight that available financial resources could enable the company to act quickly on the right deals, although actual M&A activity may ebb and flow with external uncertainty. This underscores the importance of strong execution in a challenging demand environment. On the flip side, investors should be aware that if HEXPOL’s margin recovery stalls in the face of muted sales, the company’s medium-term earnings outlook could shift dramatically...

Read the full narrative on HEXPOL (it's free!)

HEXPOL is projected to reach SEK21.0 billion in revenue and SEK2.6 billion in earnings by 2028. This outlook hinges on a 1.6% annual revenue growth rate and a SEK0.5 billion earnings increase from the current SEK2.1 billion.

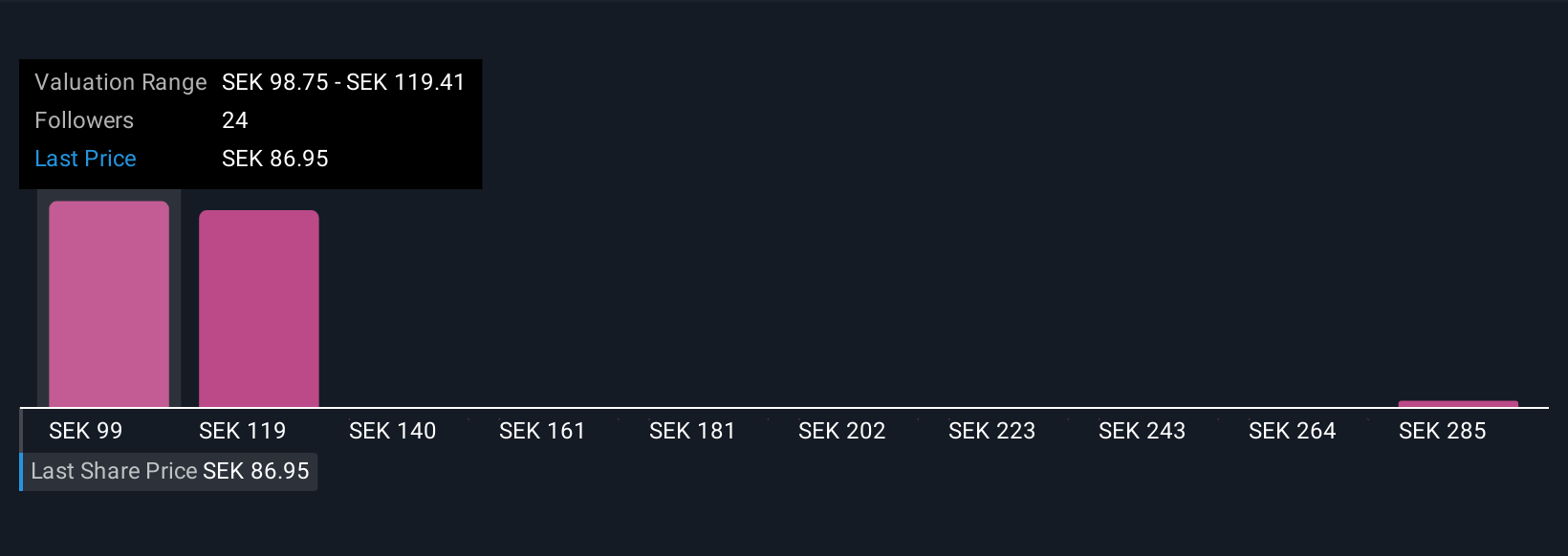

Uncover how HEXPOL's forecasts yield a SEK100.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced 5 fair value estimates for HEXPOL, ranging from SEK 100.50 to SEK 144.55 per share, showing markedly broad opinions. With margin pressures highlighted in recent results, these contrasting perspectives invite you to consider several angles on HEXPOL’s future performance.

Explore 5 other fair value estimates on HEXPOL - why the stock might be worth just SEK100.50!

Build Your Own HEXPOL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HEXPOL research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free HEXPOL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HEXPOL's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)