Middle East Hidden Gems Featuring Saudi Steel Pipes And Two Promising Small Caps

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced gains, buoyed by easing trade tensions following U.S. tariff exemptions, which have positively influenced global shares and bolstered investor confidence across the Gulf region. In this context of rising indices and renewed market optimism, identifying promising small-cap stocks becomes crucial for investors seeking to capitalize on growth opportunities; such stocks often exhibit strong fundamentals and potential for expansion in a dynamic economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Amir Marketing and Investments in Agriculture | 13.05% | 5.82% | 3.78% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 23.69% | 28.47% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Y.D. More Investments | 72.96% | 29.63% | 29.48% | ★★★★★☆ |

| Polyram Plastic Industries | 41.71% | 10.42% | 9.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★☆

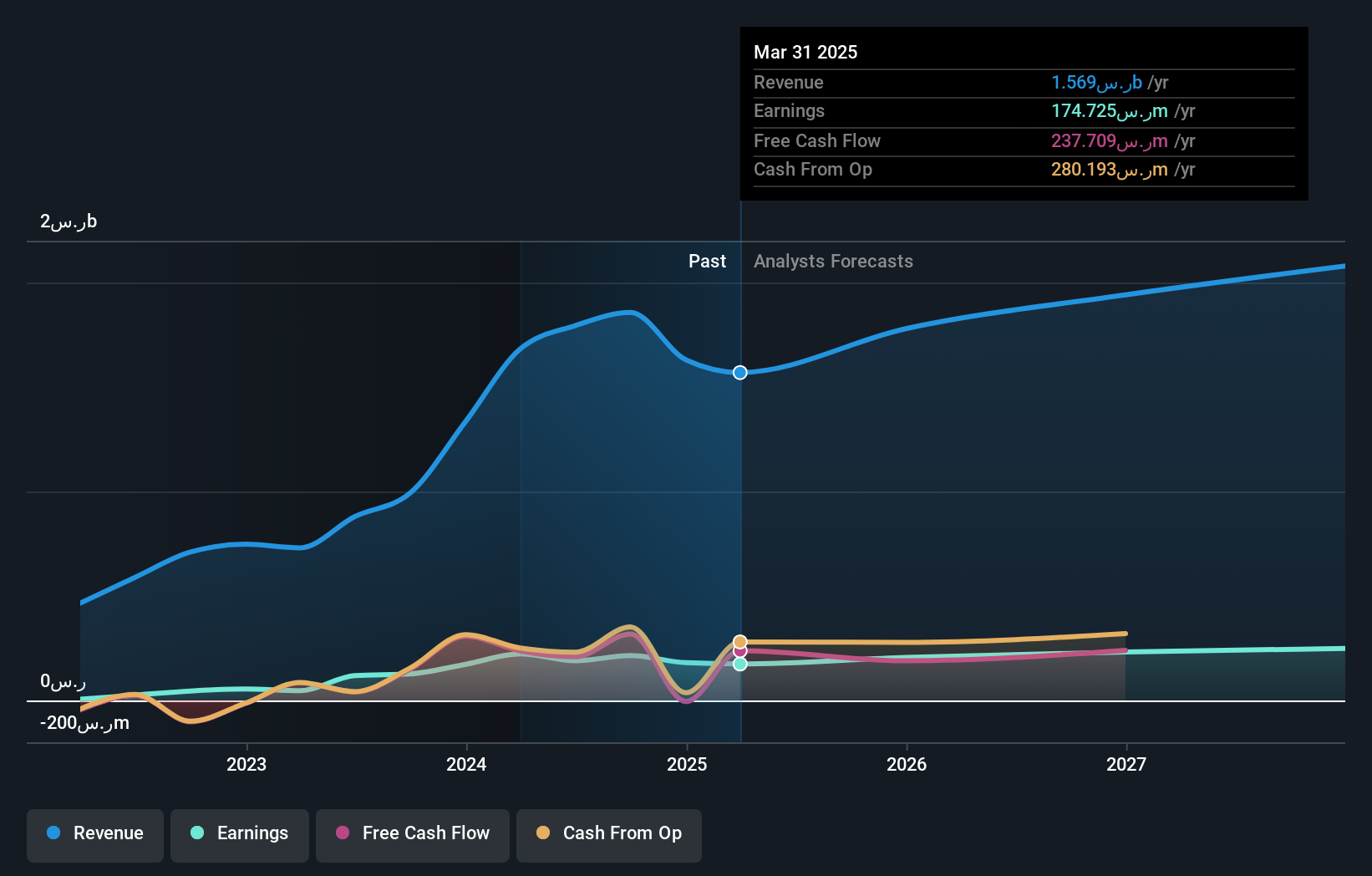

Overview: Saudi Steel Pipes Company specializes in the manufacture and distribution of steel pipes both within Saudi Arabia and internationally, with a market capitalization of SAR2.82 billion.

Operations: The primary revenue stream for Saudi Steel Pipes Company is from its steel pipes segment, which generated SAR1.63 billion.

Saudi Steel Pipes, a nimble player in the industry, has seen its earnings swell by 72.3% annually over the past five years. Despite not outpacing the broader Metals and Mining sector's recent growth, it trades at a good value compared to peers. The company's net debt to equity ratio stands at a satisfactory 32.9%, showing prudent financial management as it decreased from 54.4% over five years. With EBIT covering interest payments nearly ten times over, financial stability seems robust. Recent results show sales of SAR 1,630 million and net income of SAR 180 million for the year ending December 2024.

- Delve into the full analysis health report here for a deeper understanding of Saudi Steel Pipes.

Explore historical data to track Saudi Steel Pipes' performance over time in our Past section.

Nice One Beauty Digital Marketing (SASE:4193)

Simply Wall St Value Rating: ★★★★☆☆

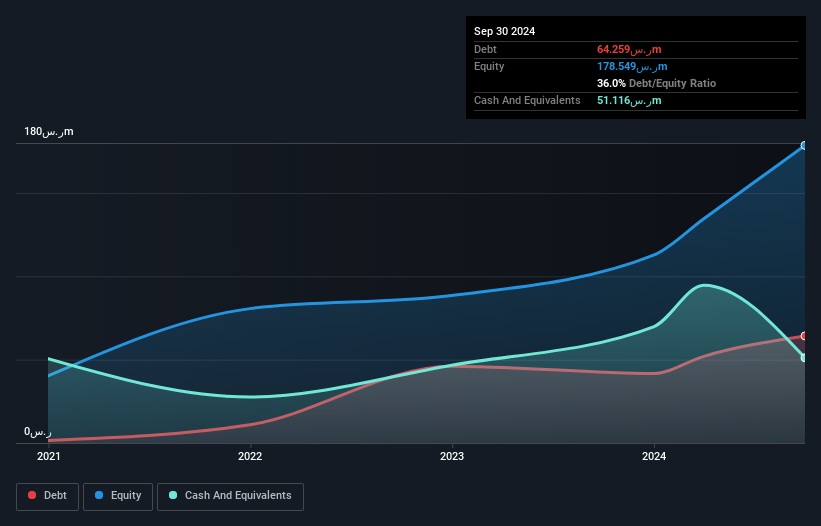

Overview: Nice One Beauty Digital Marketing Company operates an e-commerce platform offering beauty and personal care products in Saudi Arabia, with a market capitalization of SAR4.16 billion.

Operations: The company generates revenue primarily from its retail specialty segment, amounting to SAR1 billion.

Nice One Beauty Digital Marketing, a relatively small player in the Middle East's beauty sector, is trading 14.9% below its estimated fair value, suggesting potential undervaluation. The company boasts a strong earnings growth of 119.9% over the past year and has high-quality non-cash earnings. Its net debt to equity ratio stands at a satisfactory 14.4%, indicating manageable leverage levels. However, free cash flow remains negative despite profitability not being an immediate concern due to well-covered interest payments with EBIT at 17.3 times coverage, pointing towards solid financial health amidst industry volatility and promising future growth projections of 52.68% annually.

Matrix IT (TASE:MTRX)

Simply Wall St Value Rating: ★★★★★★

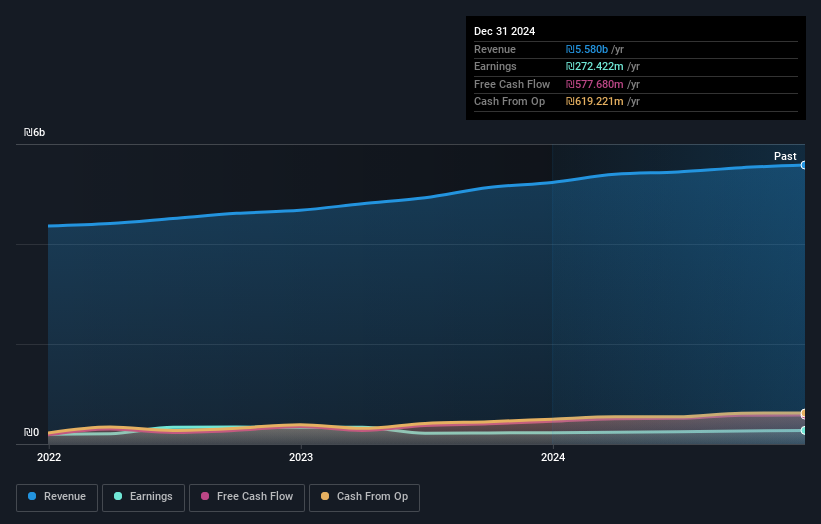

Overview: Matrix IT Ltd., along with its subsidiaries, offers information technology solutions and services across Israel, the United States, Europe, and other international markets with a market cap of ₪5.55 billion.

Operations: Matrix IT generates revenue primarily from Information Technology Solutions and Services, Consulting, and Management in Israel (₪3.34 billion), followed by Cloud and Computing Infrastructure (₪1.52 billion), Marketing and Support of Software Products (₪456.77 million), and IT Solutions in the United States (₪460.94 million).

Matrix IT, a standout in the Middle East's tech scene, shows promising financial health with its interest payments well covered by EBIT at 12.2x. Trading at nearly 45% below fair value suggests potential upside for investors. Over five years, earnings have grown annually by 10%, while the debt-to-equity ratio improved from 117% to 69%. The company boasts high-quality earnings and maintains a satisfactory net debt-to-equity ratio of just over 10%. Recent results highlight a rise in annual sales to ILS 5.58 billion and net income reaching ILS 272 million, reflecting robust operational performance despite not outpacing industry growth rates.

- Take a closer look at Matrix IT's potential here in our health report.

Assess Matrix IT's past performance with our detailed historical performance reports.

Where To Now?

- Explore the 244 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTRX

Matrix IT

Provides information technology (IT) solutions and services in Israel, the United States, and Europe.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026